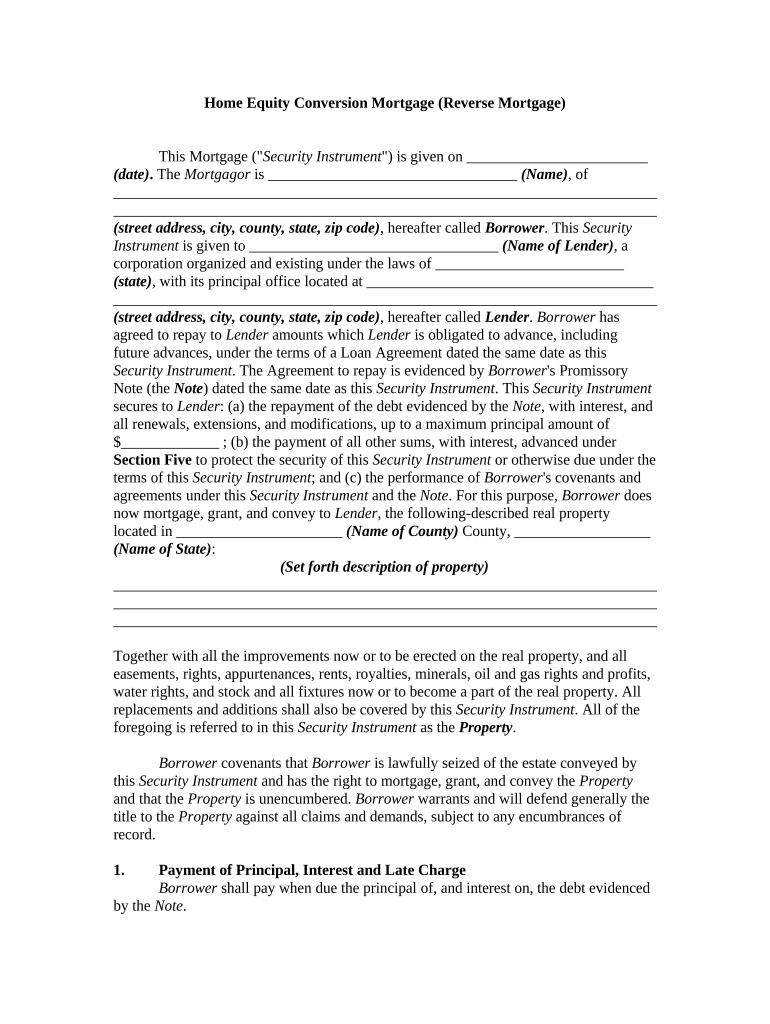

Home Equity Conversion Mortgage Reverse Mortgage Form

What is the Home Equity Conversion Mortgage Reverse Mortgage

The Home Equity Conversion Mortgage (HECM), commonly known as a reverse mortgage, is a federal program designed to help seniors aged sixty-two and older access the equity in their homes. This type of mortgage allows homeowners to convert part of their home equity into cash, which can be used for various purposes, such as supplementing retirement income, covering healthcare costs, or making home improvements. Unlike traditional mortgages, borrowers do not need to make monthly payments; instead, the loan is repaid when the homeowner sells the home, moves out, or passes away. The amount borrowed, plus interest and fees, is then deducted from the sale proceeds.

How to use the Home Equity Conversion Mortgage Reverse Mortgage

Steps to complete the Home Equity Conversion Mortgage Reverse Mortgage

Completing the Home Equity Conversion Mortgage process involves several key steps:

- Determine Eligibility: Confirm that you meet the age, residency, and property requirements.

- Consult a Housing Counselor: Engage with a HUD-approved counselor to discuss your options and understand the terms.

- Choose a Lender: Research and select a lender who specializes in reverse mortgages.

- Submit Your Application: Provide the necessary documentation, including income verification and property details.

- Receive Approval: Once approved, review the loan terms and conditions carefully.

- Access Funds: Decide how you want to receive your funds, whether as a lump sum, monthly payments, or a line of credit.

Eligibility Criteria

To qualify for a Home Equity Conversion Mortgage, applicants must meet specific criteria. The primary requirements include:

- Age: Borrowers must be at least sixty-two years old.

- Home Ownership: The home must be owned outright or have a low mortgage balance that can be paid off with the reverse mortgage proceeds.

- Primary Residence: The property must be the borrower's primary residence.

- Financial Assessment: Borrowers must demonstrate the ability to pay property taxes, homeowners insurance, and maintenance costs.

Required Documents

When applying for a Home Equity Conversion Mortgage, several documents are typically required. These may include:

- Proof of age (e.g., birth certificate or driver's license).

- Income verification (e.g., pay stubs, tax returns, or Social Security statements).

- Homeownership documentation (e.g., deed or mortgage statement).

- Property tax statements and homeowners insurance information.

- Any existing mortgage details if applicable.

Legal use of the Home Equity Conversion Mortgage Reverse Mortgage

The Home Equity Conversion Mortgage is governed by federal regulations, ensuring its legal use. Borrowers must adhere to the terms outlined in the loan agreement, including maintaining the property as their primary residence and keeping up with property taxes and insurance. Failure to comply with these terms can lead to foreclosure. Additionally, lenders must follow strict guidelines to ensure that borrowers are fully informed of their rights and responsibilities. This legal framework protects both the lender and the borrower throughout the mortgage process.

Quick guide on how to complete home equity conversion mortgage reverse mortgage

Complete Home Equity Conversion Mortgage Reverse Mortgage effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Home Equity Conversion Mortgage Reverse Mortgage on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Home Equity Conversion Mortgage Reverse Mortgage with ease

- Obtain Home Equity Conversion Mortgage Reverse Mortgage and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Home Equity Conversion Mortgage Reverse Mortgage and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Home Equity Conversion Mortgage Reverse Mortgage?

A Home Equity Conversion Mortgage Reverse Mortgage is a government-insured financial product that allows seniors to convert part of their home equity into cash. This type of mortgage does not require monthly payments, making it an attractive option for retirees looking to supplement their income.

-

What are the main benefits of a Home Equity Conversion Mortgage Reverse Mortgage?

The primary benefits of a Home Equity Conversion Mortgage Reverse Mortgage include increased cash flow, the ability to stay in your home longer, and no monthly mortgage payments. This financial tool can be crucial for seniors who wish to maintain their lifestyle without depleting their savings.

-

How is a Home Equity Conversion Mortgage Reverse Mortgage different from a traditional mortgage?

A Home Equity Conversion Mortgage Reverse Mortgage differs from a traditional mortgage in that it does not require monthly payments from the homeowner. Instead, the loan balance increases over time, which the borrower repays when they sell the home or pass away, making it a unique option for seniors.

-

What costs are associated with a Home Equity Conversion Mortgage Reverse Mortgage?

Costs for a Home Equity Conversion Mortgage Reverse Mortgage can include upfront mortgage insurance premiums, closing costs, and potential servicing fees. It's important to review these costs carefully, as they can affect the overall financial benefits of the mortgage.

-

Can I use a Home Equity Conversion Mortgage Reverse Mortgage to pay off existing debts?

Yes, a Home Equity Conversion Mortgage Reverse Mortgage can be used to pay off existing debts, including traditional mortgages and other loans. This can provide financial relief and improve cash flow for seniors who may be struggling to keep up with payments.

-

Are there any age requirements for obtaining a Home Equity Conversion Mortgage Reverse Mortgage?

Yes, to qualify for a Home Equity Conversion Mortgage Reverse Mortgage, borrowers must be at least 62 years old. This age requirement ensures that the product is tailored for seniors who can benefit from accessing their home equity.

-

What happens to the Home Equity Conversion Mortgage Reverse Mortgage if I move out of my home?

If you move out of your home or sell it, the Home Equity Conversion Mortgage Reverse Mortgage becomes due. The proceeds from the sale of the home will be used to pay off the mortgage, and any remaining equity will go to the homeowner or their estate.

Get more for Home Equity Conversion Mortgage Reverse Mortgage

Find out other Home Equity Conversion Mortgage Reverse Mortgage

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation