Nys1 Form

What is the NYC1 Form?

The NYC1 form is a crucial document used for reporting and filing business taxes in New York City. It is specifically designed for businesses operating within the city to comply with local tax regulations. This form captures essential information about the business, including its income, expenses, and tax liabilities. Understanding the NYC1 form is vital for ensuring accurate reporting and compliance with city tax laws.

How to Use the NYC1 Form

Using the NYC1 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise details regarding your business operations. It is important to review the form for accuracy before submission to avoid any potential penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to Complete the NYC1 Form

Completing the NYC1 form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Provide basic information about your business, such as name, address, and tax identification number.

- Report your total income and any applicable deductions.

- Calculate your tax liability based on the information provided.

- Review the completed form for accuracy.

- Submit the form by the specified deadline.

Legal Use of the NYC1 Form

The NYC1 form serves as a legally binding document when submitted correctly. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Compliance with local tax laws is critical, and the NYC1 form must be filed in accordance with the guidelines set forth by the New York City Department of Finance.

Filing Deadlines / Important Dates

Timely filing of the NYC1 form is crucial to avoid penalties. The filing deadlines may vary based on the type of business and the specific tax year. Typically, businesses must submit their NYC1 forms by the end of the fiscal year. It is advisable to check the official guidelines for any updates regarding deadlines to ensure compliance.

Required Documents

To complete the NYC1 form, certain documents are necessary. These may include:

- Financial statements, including profit and loss statements.

- Tax identification number.

- Records of all business income and expenses.

- Any relevant receipts or invoices supporting deductions.

Form Submission Methods

The NYC1 form can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission via the New York City Department of Finance website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated city tax offices.

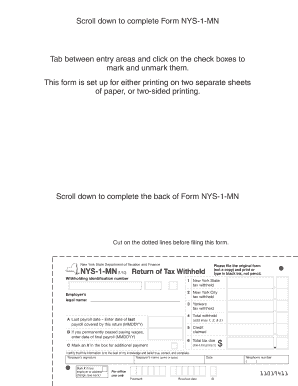

Quick guide on how to complete nys1

Effortlessly prepare Nys1 on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Nys1 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Nys1 with ease

- Obtain Nys1 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Nys1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nyc1 form and how is it used?

The nyc1 form is a document utilized for various business and legal purposes in New York City. It serves to streamline processes such as contract signing and information sharing. Understanding its proper use can enhance transaction efficiency within organizations.

-

How does airSlate SignNow help with the nyc1 form?

airSlate SignNow simplifies the process of managing the nyc1 form by providing easy-to-use eSigning features. Users can upload, edit, and send the nyc1 form seamlessly. This integration helps reduce turnaround times and ensures documents are signed securely.

-

Is there a cost associated with using airSlate SignNow for the nyc1 form?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs for managing the nyc1 form. Plans vary based on features and the number of users, making it flexible for companies of all sizes. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for the nyc1 form?

Absolutely! airSlate SignNow provides a range of integrations with popular applications like Google Drive, Salesforce, and more to manage the nyc1 form efficiently. These integrations enhance workflow and allow users to utilize their existing tools while handling the nyc1 form.

-

What benefits does airSlate SignNow offer for managing the nyc1 form?

Using airSlate SignNow for the nyc1 form offers benefits such as increased efficiency, reduced paper usage, and enhanced security. Electronic signatures help to expedite the signing process while ensuring compliance with legal standards. This solution ultimately saves time and resources for businesses.

-

How secure is the process of signing the nyc1 form with airSlate SignNow?

The security of the nyc1 form signing process with airSlate SignNow is robust. The platform employs advanced encryption and authentication measures to protect sensitive information. Businesses can trust that their documents and signatures are secure throughout the signing process.

-

What types of businesses can benefit from using the nyc1 form with airSlate SignNow?

Any business that requires efficient document management and signing can benefit from using the nyc1 form with airSlate SignNow. This includes small businesses, corporations, non-profits, and more, all of which can enhance operations by streamlining document workflows and reducing delays.

Get more for Nys1

Find out other Nys1

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT