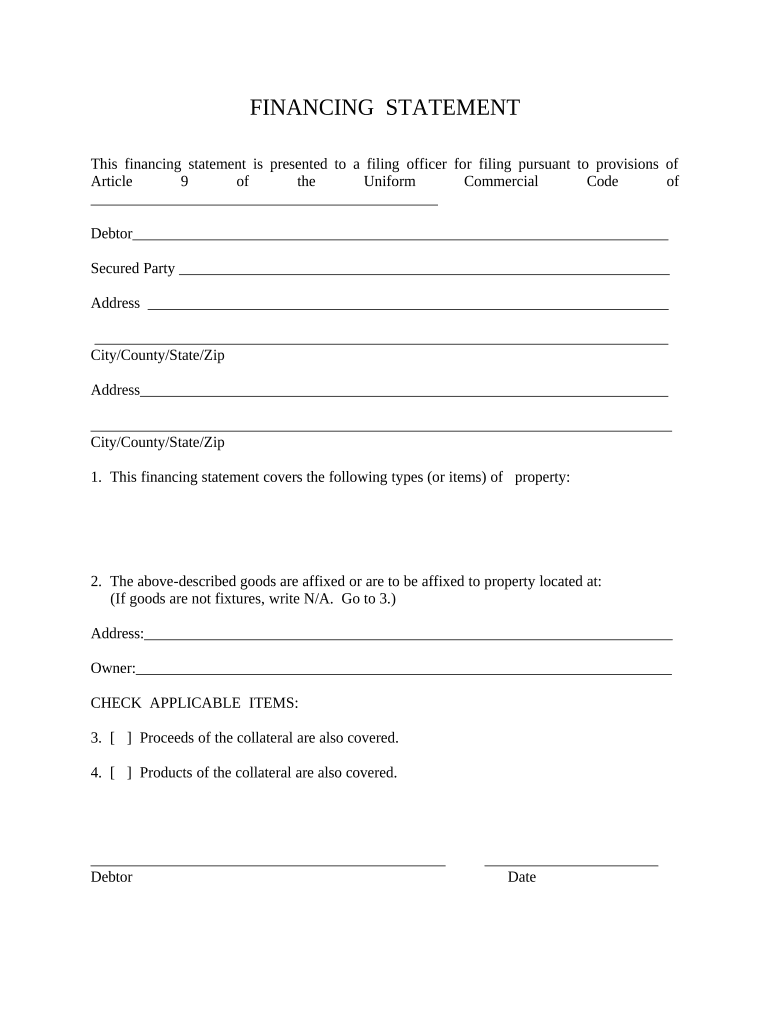

Financing Statement Form

What is the Financing Statement

A financing statement is a legal document used to secure a creditor's interest in a debtor's collateral. It serves as a public notice of the creditor's claim and is commonly filed in connection with secured transactions. This document is crucial in establishing the priority of claims against the collateral in the event of default. In the United States, financing statements are typically governed by the Uniform Commercial Code (UCC), which provides a standardized framework for these transactions across states.

How to use the Financing Statement

The financing statement is used primarily by creditors to perfect their security interests in collateral. To utilize this form effectively, a creditor must accurately complete the statement by including essential details such as the names and addresses of both the debtor and creditor, a description of the collateral, and any relevant filing fees. Once completed, the document must be filed with the appropriate state authority, usually the Secretary of State's office, to ensure it is publicly accessible and enforceable.

Steps to complete the Financing Statement

Completing a financing statement involves several key steps:

- Gather necessary information, including the debtor's legal name, address, and a detailed description of the collateral.

- Obtain the appropriate form, which can typically be found on the website of your state’s Secretary of State.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness, as errors may lead to complications in enforcing the security interest.

- Submit the financing statement along with any required filing fees to the designated state office.

Legal use of the Financing Statement

The legal use of a financing statement is critical for establishing a secured party's rights in collateral. To be legally binding, the statement must comply with UCC requirements, including proper execution and filing. This document serves as a notice to other creditors and parties that a security interest exists, thus protecting the secured party's claim in case of bankruptcy or liquidation. Failure to file or improper filing can result in the loss of priority over other creditors.

Key elements of the Financing Statement

Several key elements must be included in a financing statement for it to be valid:

- Debtor Information: The legal name and address of the debtor must be accurately stated.

- Secured Party Information: The name and address of the creditor or secured party must be included.

- Description of Collateral: A clear and specific description of the collateral being secured is essential.

- Filing Details: Information regarding the filing date and any applicable fees should be noted.

State-specific rules for the Financing Statement

Each state in the U.S. may have specific rules and requirements regarding the financing statement. These can include variations in the form itself, differing filing fees, and unique deadlines for submission. It is important for creditors to consult their state’s regulations to ensure compliance and avoid any potential issues with the validity of the financing statement. Understanding these state-specific rules can help secure interests effectively and maintain legal protections.

Quick guide on how to complete financing statement

Effortlessly Prepare Financing Statement on Any Device

Web-based document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Financing Statement on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Financing Statement with Ease

- Locate Financing Statement and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred delivery method, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Financing Statement to ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Financing Statement and how is it used?

A Financing Statement is a legal document that provides public notice about a secured party's interest in a debtor’s collateral. In the context of airSlate SignNow, it enables businesses to safeguard their financing agreements and ensure compliance. By using our platform, you can create and sign financing statements quickly and efficiently.

-

How can airSlate SignNow simplify the financing statement process?

airSlate SignNow streamlines the financing statement process through an intuitive eSigning platform that allows for easy document management. You can create, send, and eSign financing statements without any hassle. This reduces paperwork and saves time for your business.

-

Are there any costs associated with using airSlate SignNow for financing statements?

Yes, while airSlate SignNow offers flexible pricing plans based on your business needs, the costs are generally very competitive. You receive a comprehensive tool for managing financing statements along with other document management features. Consider reviewing our pricing page for detailed information on options that suit you best.

-

What features does airSlate SignNow offer for financing statements?

airSlate SignNow provides features like customizable templates, secure storage, and real-time tracking for financing statements. With our user-friendly interface, you can easily edit and fill out your financing statements, allowing for swift completion. Additionally, you can access your documents anytime, anywhere on our platform.

-

Is airSlate SignNow compliant with legal requirements for financing statements?

Absolutely, airSlate SignNow is designed to comply with legal requirements for financing statements. Our platform ensures that the documents you create meet regulatory standards, giving you confidence in their validity. This allows you to focus on your business without worrying about compliance issues.

-

Can I integrate airSlate SignNow with other applications for managing financing statements?

Yes, airSlate SignNow supports integration with numerous applications, making it easier to manage your financing statements. You can connect with various CRM and cloud storage solutions to streamline your workflow. This enhances your efficiency, allowing for a more connected and productive working environment.

-

What are the benefits of using airSlate SignNow for financing statements?

Using airSlate SignNow for financing statements provides multiple benefits, including faster processing times, enhanced security, and reduced paper usage. The electronic signing feature eliminates the delays associated with traditional methods. This results in a more organized approach to document management, ultimately benefiting your business operations.

Get more for Financing Statement

Find out other Financing Statement

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form