Trust Will Form

What is the Trust Will

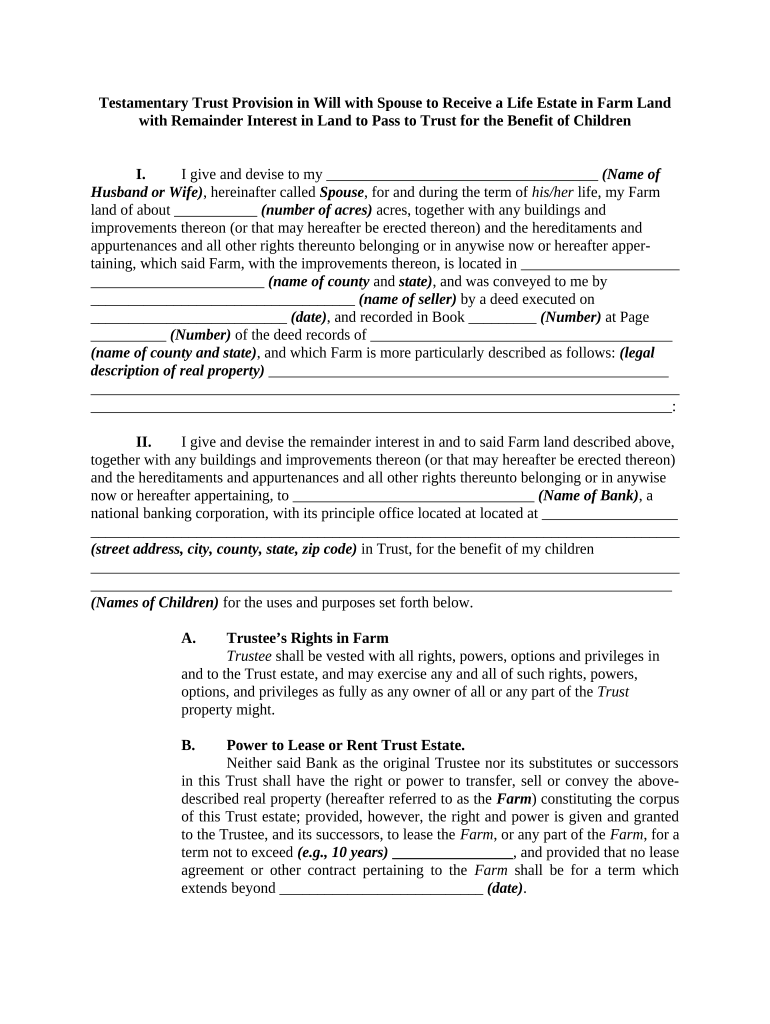

A trust will, often referred to as a testamentary trust, is a legal document that outlines how an individual's assets will be managed and distributed after their death. This type of will establishes a trust that comes into effect upon the death of the individual, allowing for specific instructions regarding the management of assets for beneficiaries, such as children or other dependents. It is particularly useful in situations where the beneficiaries may not be of legal age or may require assistance in managing their inheritance.

How to use the Trust Will

Using a trust will involves several key steps. First, the individual must clearly define their wishes regarding asset distribution and the management of those assets. This includes naming a trustee who will be responsible for administering the trust. The trust will must then be properly executed according to state laws, ensuring that it is signed and witnessed as required. Once established, the trust will should be kept in a safe place, and the appointed trustee should be informed of its existence and contents.

Steps to complete the Trust Will

Completing a trust will involves a series of important steps:

- Identify the assets to be included in the trust.

- Choose a reliable trustee who will manage the trust.

- Draft the trust will, clearly outlining the terms and conditions.

- Sign the document in the presence of witnesses, as required by Michigan law.

- Store the trust will in a secure location, and inform relevant parties of its existence.

Legal use of the Trust Will

The legal use of a trust will is governed by state laws, which dictate how the document must be executed and enforced. In Michigan, a trust will must meet specific requirements, including proper witnessing and notarization, to be considered valid. Additionally, it is essential to ensure that the trust will complies with relevant laws regarding estate planning and asset distribution to avoid potential legal disputes among beneficiaries.

State-specific rules for the Trust Will

Each state has its own regulations regarding trust wills. In Michigan, for example, the trust will must be signed by the testator in the presence of at least two witnesses who are not beneficiaries. These witnesses must also sign the document, affirming that they witnessed the testator's signature. Understanding these state-specific rules is crucial to ensure the trust will is legally binding and enforceable.

Key elements of the Trust Will

Key elements of a trust will include:

- The identification of the testator and their intent to create a trust.

- A detailed description of the assets to be placed in the trust.

- The appointment of a trustee to manage the trust.

- Specific instructions on how the assets should be distributed to beneficiaries.

- Provisions for the management of the trust until the beneficiaries reach a certain age or meet other conditions.

Quick guide on how to complete trust will

Effortlessly prepare Trust Will on any device

Online document handling has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Manage Trust Will on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Trust Will effortlessly

- Obtain Trust Will and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes a matter of seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Trust Will and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is trust and will online Michigan?

Trust and will online Michigan refers to the ability to create and manage your estate planning documents digitally through an online platform. This service provides a convenient and efficient way for Michigan residents to establish their trusts and wills without the need for complex legal procedures. With airSlate SignNow, you can easily navigate the process and secure your family's future.

-

How much does trust and will online Michigan cost?

The pricing for trust and will online Michigan varies based on your specific needs and the features you choose. airSlate SignNow offers competitive pricing, providing users with a cost-effective solution for estate planning. By opting for our online services, you can save signNowly on legal fees while ensuring your documents are properly drafted.

-

What features are included in trust and will online Michigan?

Our trust and will online Michigan service includes a variety of features designed to simplify the estate planning process. Users have access to customizable templates, step-by-step guidance, and the ability to securely store and share documents. Additionally, you can eSign documents easily, ensuring that your wills and trusts are legally binding.

-

What are the benefits of using trust and will online Michigan?

Using trust and will online Michigan offers numerous benefits, including convenience, affordability, and control over your estate planning documents. With airSlate SignNow, you can complete your estate planning from the comfort of your home, ensuring that your wishes are documented and executed correctly. This solution also reduces the complexities typically associated with traditional estate planning.

-

Can I customize my trust and will online Michigan documents?

Yes, you can fully customize your trust and will online Michigan documents through our platform. airSlate SignNow allows you to tailor your estate planning documents to fit your specific needs and preferences. Our intuitive interface makes it easy to add or modify information, ensuring that your wishes are clearly reflected.

-

Is my information secure when using trust and will online Michigan?

Absolutely! airSlate SignNow prioritizes the security of your information. When using our trust and will online Michigan service, all data is encrypted, and we adhere to strict privacy standards to protect your sensitive information. You can trust that your estate planning documents are kept safe and confidential.

-

What integrations are available with trust and will online Michigan?

airSlate SignNow offers various integrations with popular applications to enhance your trust and will online Michigan experience. You can easily connect with tools such as Google Drive, Dropbox, and other document management systems. These integrations streamline your workflow and make it even easier to manage your estate planning documents efficiently.

Get more for Trust Will

- Equipment request form coleysolutionscom

- Coe dat participant application form 2018 nato

- Benevolence form new covenant ministries cogic ncmcogic

- Dte planning and design form

- Contrato de servicio movistar en casa tarifa plana zonal form

- 9v9 soccer formations pdf

- This is your medical insurance card form

- Verification statement of aenor for telefnica on the form

Find out other Trust Will

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast