Beneficiary Life Form

What is the Beneficiary Life

The term "beneficiary life" refers to the individual or entity designated to receive the benefits from a life insurance policy upon the death of the insured. This designation is crucial, as it determines who will receive the financial support intended by the policyholder. Beneficiaries can be relatives, friends, or even organizations, and it's important to clearly specify them in the life insurance beneficiary form to avoid any disputes or confusion later on.

Steps to complete the Beneficiary Life

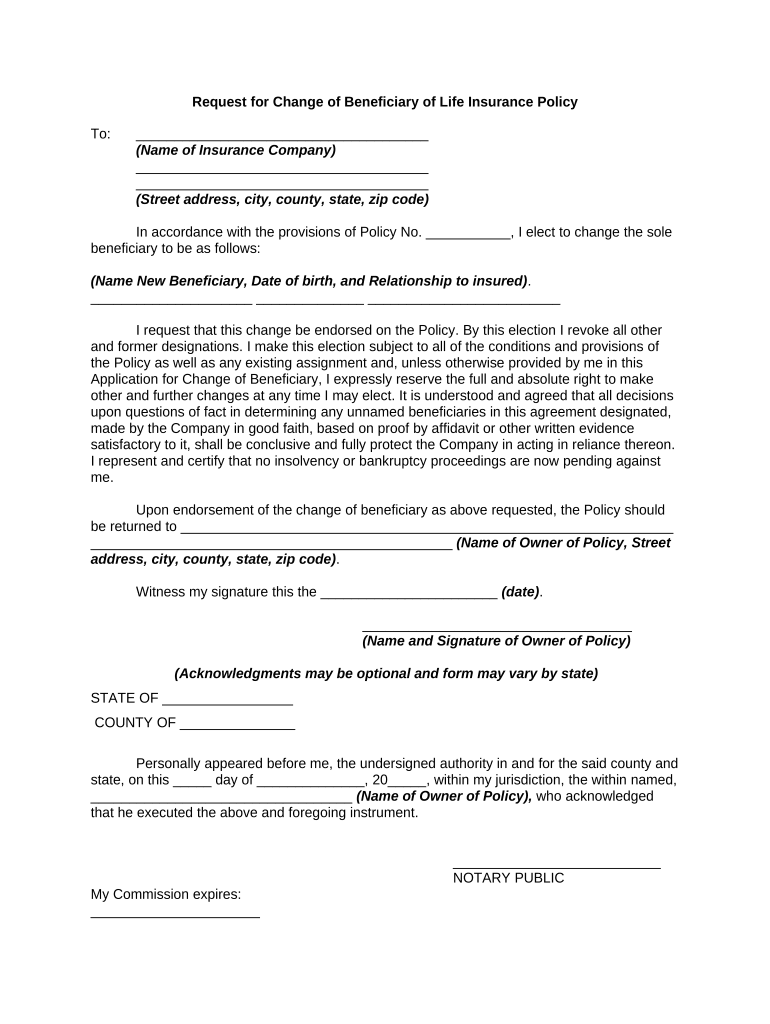

Completing the beneficiary designation on a life insurance policy involves several important steps:

- Review your life insurance policy to understand the current beneficiary designations.

- Decide who you want to name as your beneficiary, considering both primary and contingent beneficiaries.

- Obtain the appropriate beneficiary life form from your insurance provider.

- Fill out the form accurately, including the full name, relationship, and contact information of the beneficiary.

- Sign and date the form, ensuring that any required witnesses or notarization is completed if necessary.

- Submit the form to your insurance company, either online, by mail, or in person, as per their guidelines.

Legal use of the Beneficiary Life

The legal use of a beneficiary designation is governed by state laws and the specific terms of the life insurance policy. It is essential to ensure that the beneficiary designation is valid and complies with legal requirements. This includes understanding the implications of naming a non-relative as a beneficiary, which may involve additional documentation or considerations. Consulting with a legal professional can help clarify any complexities regarding beneficiary designations.

State-specific rules for the Beneficiary Life

Each state in the U.S. has its own regulations regarding beneficiary designations. Factors such as marital status, divorce, and the age of beneficiaries can influence how a beneficiary designation is treated legally. Some states may require specific forms or processes to change a beneficiary, especially if the beneficiary is not a relative. It's advisable to check with your state’s insurance department or legal resources to ensure compliance with local laws.

Required Documents

When designating a beneficiary, certain documents may be required to ensure the process is legally binding. These typically include:

- The completed beneficiary life form.

- Proof of identity for both the policyholder and the beneficiary.

- Any legal documents that may support the designation, such as divorce decrees or court orders, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Submitting the beneficiary designation form can be done through various methods, depending on the insurance provider's policies. Common submission methods include:

- Online submission through the insurance company’s website or mobile app.

- Mailing the completed form to the designated address provided by the insurer.

- Delivering the form in person to a local insurance office or agent.

Examples of using the Beneficiary Life

Understanding how to use the beneficiary life designation can be illustrated through examples. For instance, if a policyholder names a close friend as a beneficiary, it is essential to ensure that the friend is aware of this designation and has provided their consent. In another scenario, if a policyholder wishes to change the beneficiary after a divorce, they must complete a new beneficiary form to reflect this change legally. Such examples highlight the importance of clear communication and proper documentation in beneficiary designations.

Quick guide on how to complete beneficiary life

Complete Beneficiary Life seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Beneficiary Life on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Beneficiary Life effortlessly

- Locate Beneficiary Life and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Beneficiary Life and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the american general life insurance beneficiary form 3596?

The american general life insurance beneficiary form 3596 is a document used to designate a beneficiary for your life insurance policy. By filling out this form, policyholders can ensure that their benefits are distributed according to their wishes. It's essential to keep this form updated to reflect any changes in your life circumstances.

-

How do I fill out the american general life insurance beneficiary form 3596?

Filling out the american general life insurance beneficiary form 3596 typically requires you to provide personal information about yourself and the intended beneficiary. Be sure to follow the instructions carefully and double-check all entered information for accuracy. If you have any doubts, consider consulting a financial advisor for guidance.

-

Can I change my beneficiary using the american general life insurance beneficiary form 3596?

Yes, you can change your beneficiary by completing a new american general life insurance beneficiary form 3596. It's advisable to submit this updated form to keep your records current and ensure that your new wishes are honored. Always check with your insurance provider for any specific requirements when making changes.

-

What happens if I don't fill out the american general life insurance beneficiary form 3596?

If you do not fill out the american general life insurance beneficiary form 3596, the life insurance benefits will typically be paid to your estate upon your passing. This can lead to delays in distribution and potential probate complications. To avoid this, it's recommended to complete and submit the form to clearly designate your beneficiary.

-

Is there a fee for using the american general life insurance beneficiary form 3596?

There is no fee associated with filling out or submitting the american general life insurance beneficiary form 3596. It is a standard procedure provided by life insurance companies for policyholders at no additional cost. However, always check with your insurance provider for any potential fees related to your policy.

-

How can I submit the american general life insurance beneficiary form 3596?

You can submit the american general life insurance beneficiary form 3596 either online or by mailing a physical copy to your insurance provider. Be sure to follow the submission guidelines provided by your insurer to ensure your form is processed efficiently. Always keep a copy of the submitted form for your records.

-

What information do I need to provide on the american general life insurance beneficiary form 3596?

On the american general life insurance beneficiary form 3596, you need to provide personal information such as your full name, policy number, and details about your chosen beneficiary. This usually includes the beneficiary's name, contact information, and relationship to you. Providing accurate information is crucial to avoid complications in the future.

Get more for Beneficiary Life

- Alabama recad form

- Mill hill school pta standing rules form

- Residency completion and teaching certificates residency form

- Membership application boys amp girls club of hartford form

- Crec food service program information capitol region

- Frontier lifeline application form

- Dog license danbury form

- Dcps application to use facilities does dc form

Find out other Beneficiary Life

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy