Owner Foreign Form

What is the Owner Foreign

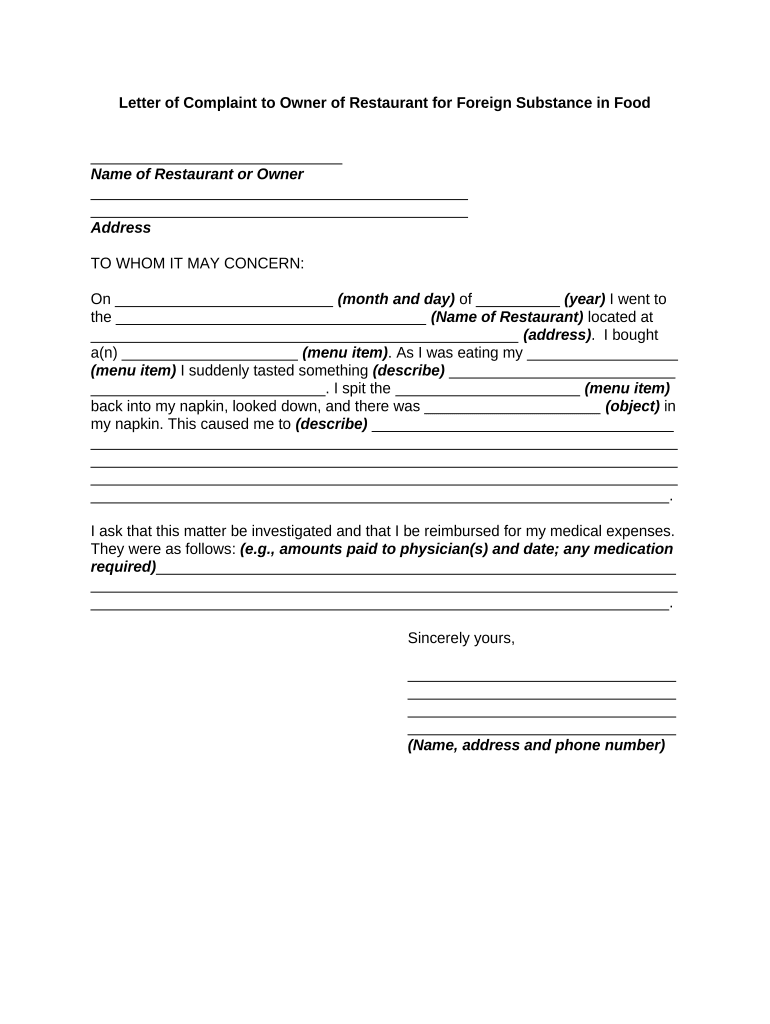

The owner foreign form is a crucial document for individuals or entities that own property or assets in the United States but are not U.S. citizens or residents. This form serves to report ownership and ensure compliance with tax regulations. It is essential for foreign owners to provide accurate information regarding their holdings to avoid potential legal issues and penalties. Understanding the purpose and requirements of this form is vital for maintaining compliance with U.S. tax laws.

How to use the Owner Foreign

Using the owner foreign form involves several steps to ensure proper completion and submission. First, gather all necessary information about the property or assets owned, including location, value, and type. Next, accurately fill out the form, ensuring all details are correct and complete. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements set by the IRS. It is important to keep a copy of the submitted form for your records.

Steps to complete the Owner Foreign

Completing the owner foreign form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation, including property deeds and financial statements.

- Fill out the form with accurate information regarding ownership and asset details.

- Review the form for completeness and accuracy to prevent delays.

- Submit the form through the appropriate channel, either online or by mail.

- Retain a copy of the completed form for your records.

Legal use of the Owner Foreign

The legal use of the owner foreign form is governed by U.S. tax laws, which require foreign owners to report their holdings. This form helps ensure compliance with regulations set forth by the IRS, preventing potential legal ramifications. Proper use of the form is essential for foreign owners to avoid penalties and ensure that their ownership is recognized under U.S. law.

Required Documents

When completing the owner foreign form, certain documents are necessary to support the information provided. These may include:

- Proof of ownership, such as property deeds or titles.

- Financial statements detailing the value of the assets.

- Identification documents for the foreign owner, such as a passport.

Having these documents readily available can streamline the completion process and ensure compliance with legal requirements.

Penalties for Non-Compliance

Failure to properly complete and submit the owner foreign form can result in significant penalties. The IRS imposes fines for late submissions, inaccuracies, or failure to report ownership. These penalties can vary based on the severity of the non-compliance and may include monetary fines or legal action. Understanding these risks emphasizes the importance of timely and accurate form submission.

Quick guide on how to complete owner foreign

Complete Owner Foreign effortlessly on any device

Online document management has become increasingly popular with organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed forms, allowing you to find the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Owner Foreign on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Owner Foreign with ease

- Find Owner Foreign and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Owner Foreign and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of an owner foreign in document signing?

An owner foreign refers to an individual or entity holding ownership rights, often needing to sign documents electronically for validity. airSlate SignNow ensures that owner foreign signers can easily eSign documents, streamlining the signing process while maintaining legal compliance.

-

How does airSlate SignNow help facilitate the needs of an owner foreign?

airSlate SignNow provides an intuitive platform where an owner foreign can securely eSign documents from anywhere in the world. With features like multi-language support and mobile accessibility, it caters to the unique needs of foreign owners, ensuring a seamless signing experience.

-

What pricing plans are available for an owner foreign using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business sizes, making it accessible for an owner foreign looking to manage document signing efficiently. Subscription options include monthly and annual plans, ensuring you'll find a fitting solution for your signing needs.

-

Can an owner foreign integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows an owner foreign to seamlessly connect their document signing processes with existing workflows, enhancing productivity and ease of use.

-

What security features does airSlate SignNow provide for an owner foreign?

Security is a top priority for airSlate SignNow, particularly for an owner foreign who may deal with sensitive documents. The platform offers bank-level encryption, secure cloud storage, and robust authentication options to ensure that all signed documents are safe and compliant with regulations.

-

Is it easy for an owner foreign to get started with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing an owner foreign to set up an account and start eSigning within minutes. With comprehensive support resources and tutorials, new users can quickly adapt to the platform's functionalities.

-

What are the key benefits of using airSlate SignNow for an owner foreign?

Using airSlate SignNow, an owner foreign can enjoy benefits such as reduced turnaround time for document signing, cost savings on printing and mailing, and increased environmental sustainability. The convenience of eSigning helps enhance business efficiency and improve overall productivity.

Get more for Owner Foreign

Find out other Owner Foreign

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT