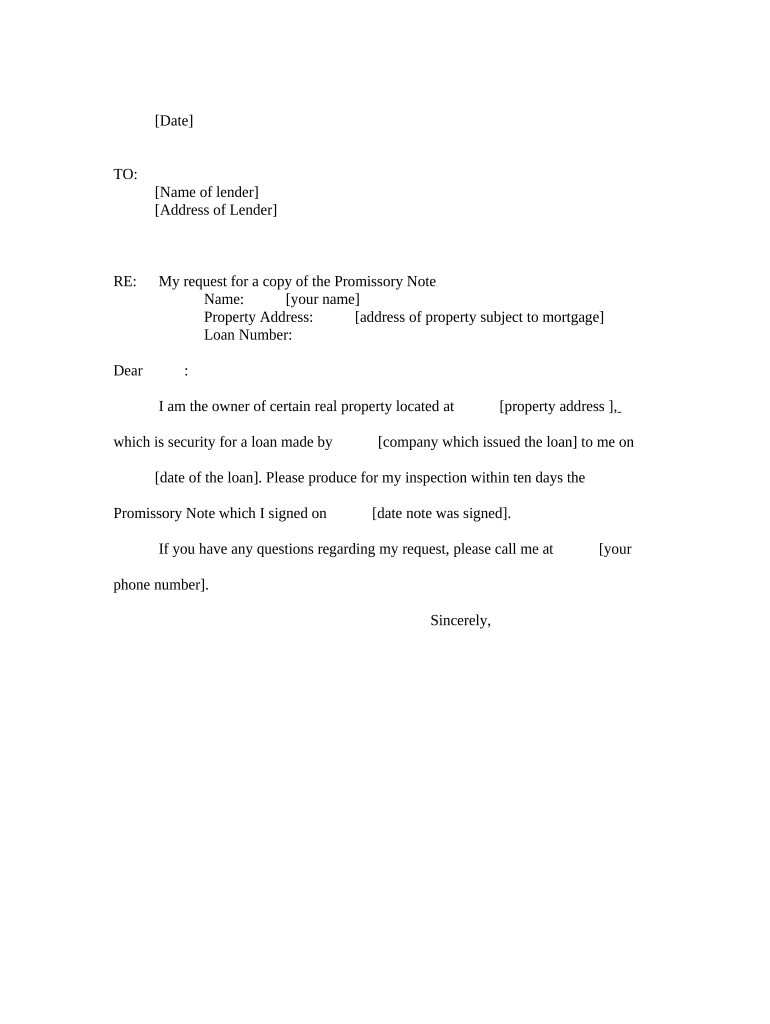

Produce Note Form

What is the lender note?

A lender note is a financial document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as a written acknowledgment of the debt and specifies the repayment terms, including interest rates, payment schedule, and any collateral involved. This document is crucial for both parties as it provides legal protection and clarity regarding the obligations of each party. In the context of real estate, a lender note often accompanies a mortgage, detailing the borrower's promise to repay the borrowed amount under agreed-upon conditions.

How to use the lender note

Using a lender note involves several key steps to ensure that both the borrower and lender understand their rights and responsibilities. First, the borrower should review the terms outlined in the note, ensuring they are clear and acceptable. Next, both parties must sign the document, which can now be done electronically for convenience and security. Once signed, the lender retains the original note, while the borrower should keep a copy for their records. This note can be used in future transactions or legal matters to verify the terms of the loan.

Steps to complete the lender note

Completing a lender note requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including borrower and lender details, loan amount, and repayment terms.

- Clearly outline the interest rate, payment schedule, and any fees associated with the loan.

- Include any collateral details if applicable, specifying what the lender can claim in case of default.

- Review the document for accuracy, ensuring all terms are clearly stated and understood.

- Both parties should sign the document, either in person or electronically, to validate the agreement.

Legal use of the lender note

The lender note is legally binding once it is signed by both parties. To ensure its enforceability, it must comply with applicable state laws and regulations. This includes adhering to interest rate limits and disclosure requirements. In the event of a dispute, the lender note can serve as evidence in court, demonstrating the agreed-upon terms of the loan. It is advisable for both parties to retain copies of the signed note to protect their interests.

Key elements of the lender note

Several key elements must be included in a lender note to ensure it serves its purpose effectively:

- Borrower and lender information: Names and addresses of both parties.

- Loan amount: The total amount of money being borrowed.

- Interest rate: The percentage charged on the loan amount.

- Repayment terms: Schedule of payments, including due dates and amounts.

- Default terms: Conditions under which the lender can take action if the borrower fails to repay.

Examples of using the lender note

Lender notes are commonly used in various scenarios, including:

- Real estate transactions, where a buyer borrows money to purchase a home.

- Personal loans, where individuals borrow funds for personal expenses.

- Business loans, where companies secure financing for operational needs or expansion.

In each case, the lender note serves as a critical document that outlines the terms of the loan and protects the interests of both parties involved.

Quick guide on how to complete produce note

Manage Produce Note effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Produce Note on any gadget using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Produce Note with ease

- Locate Produce Note and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your delivery method for the form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searching, or errors that require new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Modify and eSign Produce Note while ensuring smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lender note and how does it work?

A lender note is a financial document that outlines the terms of a loan agreement between a borrower and a lender. Typically, it details the loan amount, interest rates, repayment schedule, and any collateral involved. AirSlate SignNow simplifies the creation and management of lender notes by allowing users to easily draft, send, and eSign these important documents.

-

How can airSlate SignNow help in creating lender notes?

AirSlate SignNow provides a user-friendly platform to create lender notes efficiently. With customizable templates, users can quickly generate accurate documents that meet their specific needs. Moreover, the eSigning feature ensures that all parties can review and sign documents securely and conveniently, streamlining the process.

-

What are the key features of airSlate SignNow for managing lender notes?

Key features of airSlate SignNow for managing lender notes include customizable templates, document tracking, and secure eSigning. Users can collaborate in real-time, ensuring all stakeholders are on the same page. Additionally, the platform offers secure storage and easy access to all signed lender notes for future reference.

-

Is airSlate SignNow cost-effective for users dealing with lender notes?

Yes, airSlate SignNow offers a cost-effective solution for users managing lender notes. Its pricing plans are designed to fit businesses of all sizes, providing essential features without breaking the bank. This affordability allows companies to streamline their document management processes while saving on traditional paper and printing costs.

-

What integrations does airSlate SignNow offer for lender note management?

AirSlate SignNow integrates seamlessly with numerous applications and platforms, enhancing the lender note management experience. Whether you use CRM systems, cloud storage services, or project management tools, airSlate SignNow can connect with them to streamline your workflow. These integrations ensure that your lender notes are easily accessible and manageable across all your business processes.

-

How secure is airSlate SignNow when dealing with lender notes?

AirSlate SignNow prioritizes security, especially when handling sensitive lender notes. The platform employs industry-standard encryption and secure storage solutions to protect your documents. Additionally, audit trails and authentication features ensure that only authorized individuals can view and sign important lender notes.

-

Can I track the status of my lender notes with airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking for your lender notes so you can see when they are sent, viewed, and signed. This feature adds transparency to the document management process, allowing you to follow up with parties involved if necessary. Keeping track of your lender notes has never been easier!

Get more for Produce Note

Find out other Produce Note

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement