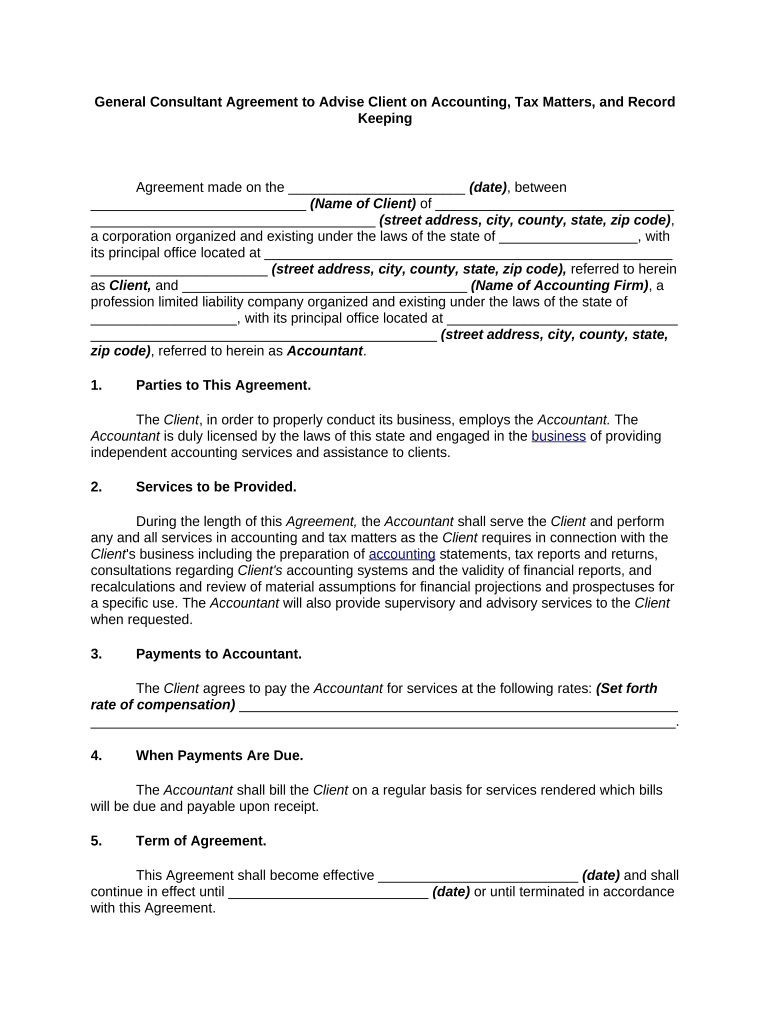

Consultant Accounting Form

Understanding the Consultant Tax

The consultant tax refers to the specific tax obligations that independent consultants must adhere to when filing their taxes. Unlike traditional employees, consultants are typically considered self-employed, which means they are responsible for reporting their income and paying taxes directly to the IRS. This includes both income tax and self-employment tax, which covers Social Security and Medicare contributions. Understanding these obligations is crucial for maintaining compliance and avoiding penalties.

Steps to Complete the Consultant Tax Form

Completing the consultant tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements, receipts for business expenses, and any previous tax returns. Next, accurately report your total income from consulting work. Deduct any eligible business expenses to determine your taxable income. Finally, fill out the appropriate tax form, typically the IRS Form 1040 along with Schedule C for self-employment income, and submit it by the deadline.

Legal Use of the Consultant Tax Form

The legal use of the consultant tax form is governed by IRS regulations. To be valid, the form must be completed accurately and submitted on time. It is essential to keep thorough records of income and expenses, as these may be required in case of an audit. Additionally, using digital tools for filing can enhance the security and efficiency of the process, ensuring that all legal requirements are met.

Filing Deadlines and Important Dates

Consultants must be aware of key filing deadlines to avoid penalties. The typical deadline for filing individual tax returns is April 15 each year. If additional time is needed, consultants can file for an extension, which typically provides an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for Consultant Tax Filing

When preparing to file your consultant tax, several documents are essential. These include:

- Form 1040: The standard individual income tax return.

- Schedule C: Used to report income or loss from a business.

- 1099 forms: Issued by clients to report payments made to you.

- Receipts for business expenses: To substantiate deductions.

- Previous tax returns: Useful for reference and consistency.

IRS Guidelines for Consultants

The IRS provides specific guidelines for consultants regarding income reporting and deductions. Consultants must report all income received, regardless of whether they receive a 1099 form. Additionally, they can deduct ordinary and necessary business expenses, such as office supplies, travel expenses, and home office deductions, provided they meet IRS criteria. Familiarity with these guidelines helps ensure compliance and maximizes allowable deductions.

Quick guide on how to complete consultant accounting

Effortlessly Prepare Consultant Accounting on Any Device

Managing documents online has become increasingly favored by companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle Consultant Accounting on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Consultant Accounting with minimal effort

- Locate Consultant Accounting and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Consultant Accounting and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a consultant tax and how can it affect my business?

A consultant tax is a fee that may be considered when hiring independent consultants for various projects. It's essential to understand how this tax can impact your budgeting and expenses. Utilizing effective eSignature solutions like airSlate SignNow can streamline contracts and reduce the administrative burden related to consultant tax.

-

How much does airSlate SignNow cost for managing consultant tax documentation?

The pricing for airSlate SignNow starts at a competitive rate that caters to businesses of all sizes. By opting for our service, you can simplify the management of consultant tax documentation while ensuring compliance and accuracy. Visit our pricing page to explore different plans that best suit your business needs.

-

What features does airSlate SignNow offer to help with consultant tax management?

airSlate SignNow provides features such as customizable templates, document tracking, and audit trails specifically designed for consultant tax management. These tools help you organize and securely store all related documents. This ensures that your consultant tax documentation is easily accessible and compliance-ready.

-

How can airSlate SignNow benefit my company in relation to consultant tax?

By using airSlate SignNow, your company can efficiently manage the documentation process associated with consultant tax. This not only saves time but also minimizes the risk of errors in contract preparation. Our intuitive platform enhances collaboration, allowing you to focus on what matters most in your business.

-

Does airSlate SignNow integrate with other financial software that tracks consultant tax?

Yes, airSlate SignNow offers various integrations with popular financial software to support the tracking and reporting of consultant tax. This ensures a seamless workflow, allowing you to manage your consultant tax documentation and finances in one place. Check our integrations page for a comprehensive list of supported applications.

-

Can airSlate SignNow help with compliance related to consultant tax?

Absolutely! airSlate SignNow is designed to help you stay compliant with all regulations concerning consultant tax. With features like audit trails and secure document storage, you can ensure that all your consultant-related documents are accurately maintained and accessible for any compliance checks.

-

Is there a trial period available to test airSlate SignNow for consultant tax solutions?

Yes, we offer a trial period for businesses looking to test airSlate SignNow's capabilities related to consultant tax. This allows you to explore the platform's features without any commitment. Sign up today to discover how our eSignature solution can enhance your consultant tax management process.

Get more for Consultant Accounting

Find out other Consultant Accounting

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT