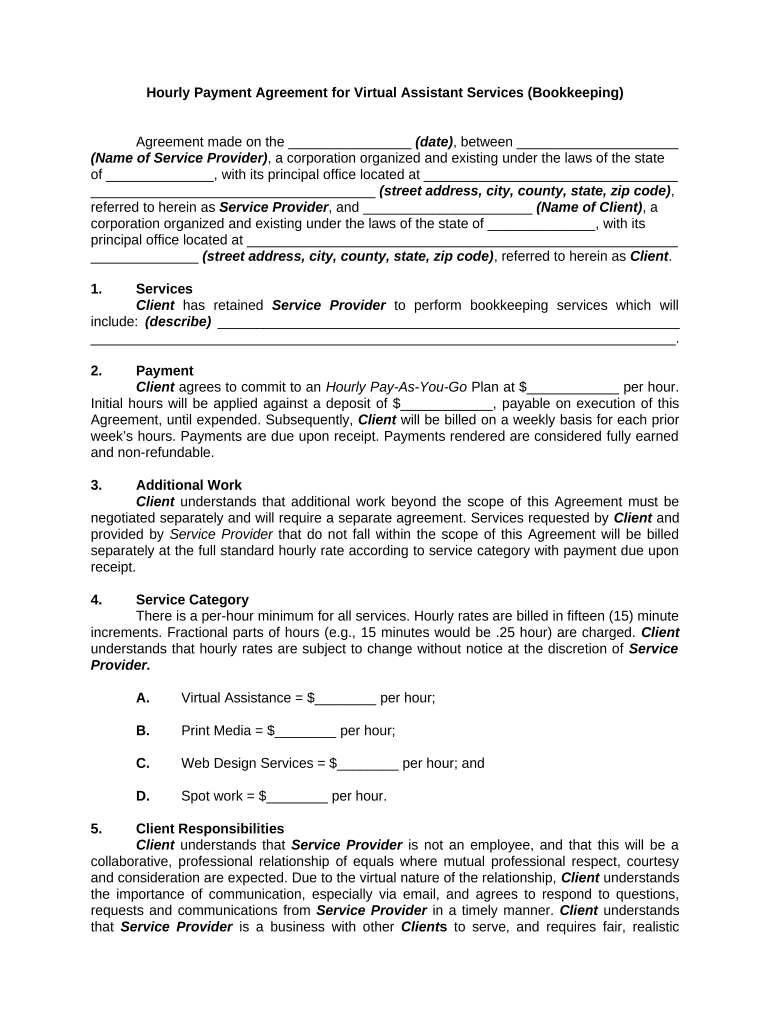

Services Bookkeeping Form

What is the Services Bookkeeping

The Services Bookkeeping refers to a structured method of recording and managing financial transactions related to hourly services provided by businesses or freelancers. This system helps track income, expenses, and other financial activities, ensuring that all transactions are documented accurately. By utilizing a services bookkeeping approach, businesses can maintain clear financial records, which is essential for tax reporting and financial analysis.

Key elements of the Services Bookkeeping

Understanding the key elements of services bookkeeping is crucial for effective financial management. These elements include:

- Transaction Records: Accurate documentation of all financial transactions, including invoices and receipts.

- Income Tracking: Monitoring all income generated from hourly services to ensure proper reporting.

- Expense Management: Recording all business-related expenses to assess profitability and manage budgets.

- Compliance: Ensuring adherence to relevant financial regulations and tax laws.

- Reporting: Generating financial reports that provide insights into the business's financial health.

Steps to complete the Services Bookkeeping

Completing services bookkeeping involves several systematic steps to ensure accuracy and compliance. Here are the essential steps:

- Gather Financial Documents: Collect all relevant documents, including invoices, receipts, and bank statements.

- Record Transactions: Enter all financial transactions into a bookkeeping system or software, categorizing them appropriately.

- Reconcile Accounts: Regularly compare recorded transactions with bank statements to identify discrepancies.

- Generate Reports: Create financial reports to analyze income, expenses, and overall financial performance.

- Review for Compliance: Ensure that all records meet regulatory requirements and are ready for potential audits.

Legal use of the Services Bookkeeping

The legal use of services bookkeeping is vital for maintaining compliance with tax laws and regulations. Accurate bookkeeping ensures that businesses can substantiate their income and expenses during audits. Compliance with the Internal Revenue Service (IRS) guidelines is essential, as improper record-keeping can lead to penalties. Businesses should also be aware of state-specific regulations that may impact their bookkeeping practices.

Examples of using the Services Bookkeeping

Services bookkeeping can be applied in various scenarios to enhance financial management. Examples include:

- Freelancers: Independent contractors can use bookkeeping to track income from multiple clients and manage expenses related to their services.

- Small Businesses: Owners of small businesses can maintain records of hourly services provided, ensuring accurate invoicing and tax reporting.

- Consultants: Professionals offering consulting services can document billable hours and related expenses to provide transparent billing to clients.

IRS Guidelines

Adhering to IRS guidelines is critical for businesses using services bookkeeping. The IRS requires accurate reporting of income and expenses, and businesses must keep detailed records to support their tax filings. This includes maintaining receipts, invoices, and any other documentation that verifies financial transactions. Understanding these guidelines helps businesses avoid potential issues with tax compliance and ensures that they are prepared for audits.

Quick guide on how to complete services bookkeeping

Effortlessly Prepare Services Bookkeeping on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate template and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Services Bookkeeping on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and Electronically Sign Services Bookkeeping with Ease

- Obtain Services Bookkeeping and click on Get Form to begin.

- Make use of the tools we provide to fill out your template.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method of sending your template, whether by email, SMS, or invitation link; or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Services Bookkeeping and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an hourly agreement in the context of airSlate SignNow?

An hourly agreement is a contract formatted to pay individuals based on the hours worked rather than a fixed salary. With airSlate SignNow, you can easily create, send, and eSign hourly agreements that streamline the process of documenting work terms regardless of your industry.

-

How does airSlate SignNow help with managing hourly agreements?

airSlate SignNow offers templates specifically designed for hourly agreements, making it easy to customize and manage your agreements. The platform also allows you to track the status of your agreements in real-time, ensuring that all parties are aware of their obligations.

-

What are the benefits of using airSlate SignNow for hourly agreements?

Using airSlate SignNow for hourly agreements provides several benefits, including enhanced efficiency and compliance. The electronic signature feature ensures that agreements are legally valid, while the integration capabilities streamline workflows, making it easier to manage your contracts.

-

Can I integrate airSlate SignNow with other tools for hourly agreements?

Yes, airSlate SignNow integrates seamlessly with various tools like Google Drive, Dropbox, and Salesforce, enhancing your ability to manage hourly agreements. These integrations allow for efficient document sharing and collaboration, simplifying your workflow.

-

What is the pricing structure for hourly agreements using airSlate SignNow?

The pricing for using airSlate SignNow to manage hourly agreements is competitive and varies based on your needs and features required. You can choose from different plans, ensuring you only pay for the functionality that enhances your document management.

-

Is it secure to eSign hourly agreements using airSlate SignNow?

Absolutely! airSlate SignNow employs robust encryption and security protocols to ensure that your hourly agreements remain protected. This commitment to security means that all signatures are legally binding and your data is safe from unauthorized access.

-

How does airSlate SignNow improve the workflow for creating hourly agreements?

airSlate SignNow automates the process of creating hourly agreements, signNowly reducing the time spent on paperwork. With customizable templates and easy eSigning, your team can focus on their work rather than administrative tasks.

Get more for Services Bookkeeping

- 2019 form irs 990 or 990 ez schedule l fill online

- 2020 schedule d form 1065 capital gains and losses

- 2020 form 8404 interest charge on disc related deferred tax liability

- 2021 instructions for forms 1099 a and 1099 c instructions for forms 1099 a and 1099 c acquisition or abandonment of secured

- Dor sales tax forms

- State form 7878 r9 3 20

- Internal revenue service instructions for forms page 1 of

- Go to wwwirsgovform990 for the latest information inspection

Find out other Services Bookkeeping

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation