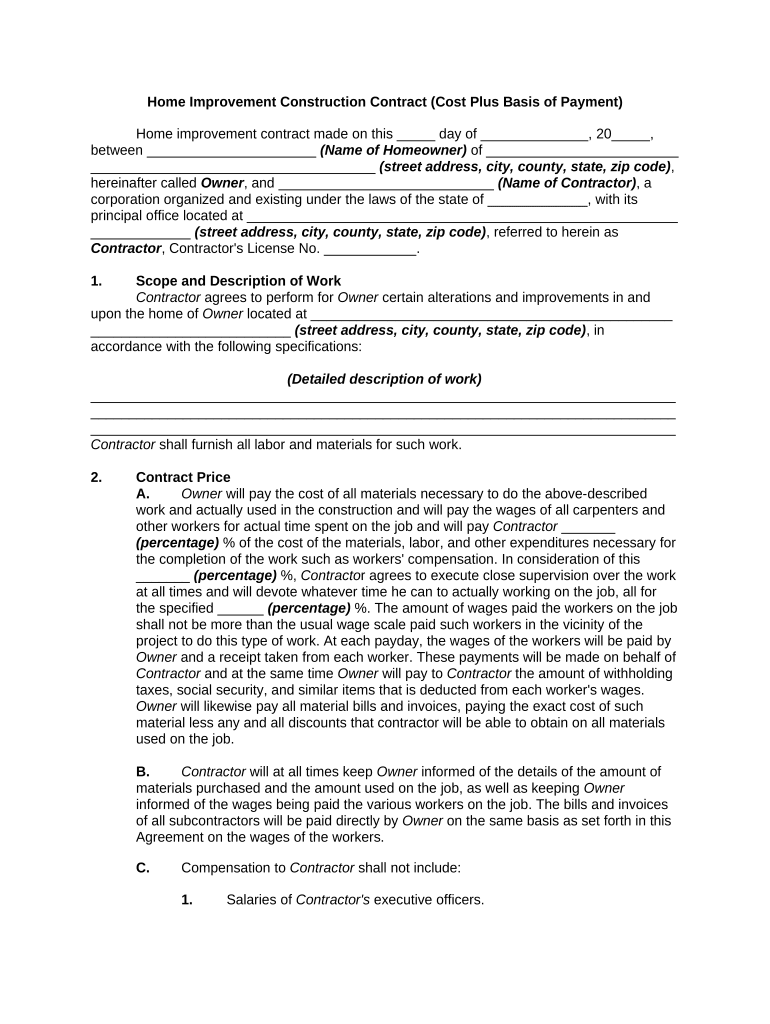

Home Basis Form

What is the Home Basis

The home basis refers to the total amount invested in a property, including the purchase price and any additional costs incurred during the acquisition and improvement of the property. This concept is crucial for homeowners and investors alike, as it determines the capital gains tax liability when selling the property. Understanding the home basis helps individuals make informed decisions regarding property transactions and tax implications.

How to use the Home Basis

Using the home basis effectively involves calculating the total investment in a property to accurately report gains or losses during a sale. Homeowners should keep detailed records of all expenses related to the purchase and improvements, including:

- Purchase price of the property

- Closing costs, such as title insurance and attorney fees

- Home improvements that increase the property's value

- Any other associated costs that enhance the property

By maintaining comprehensive records, homeowners can ensure they have an accurate home basis for tax reporting purposes.

Steps to complete the Home Basis

Completing the home basis involves several key steps to ensure accuracy and compliance with tax regulations:

- Gather all documentation related to the purchase and improvements of the property.

- Calculate the initial purchase price, including any associated closing costs.

- Document any improvements made to the property, noting their costs and dates of completion.

- Sum all costs to determine the total home basis.

- Keep this information organized for future reference, especially when preparing for the sale of the property.

Legal use of the Home Basis

The legal use of the home basis is primarily related to tax reporting and compliance. Homeowners must accurately report their home basis when filing taxes, particularly when selling a property. The Internal Revenue Service (IRS) requires that capital gains be calculated based on the difference between the sale price and the home basis. Failure to report accurately can result in penalties or increased tax liabilities.

IRS Guidelines

The IRS provides specific guidelines regarding the home basis, particularly in relation to capital gains tax. Homeowners should be aware of the following points:

- The home basis includes the purchase price and any improvements made.

- Homeowners can exclude a portion of capital gains from taxation under certain conditions, such as using the property as a primary residence.

- Documentation is essential for substantiating the home basis and any claims for exclusions.

Staying informed about IRS guidelines can help homeowners navigate tax obligations related to their property.

Required Documents

To establish and verify the home basis, homeowners should maintain a comprehensive set of documents, including:

- Purchase agreement and closing statement

- Receipts for home improvements

- Records of any repairs that may affect the basis

- Documentation of any additional costs incurred during the acquisition

Having these documents readily available is essential for accurate tax reporting and compliance.

Quick guide on how to complete home basis

Prepare Home Basis effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Home Basis on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign Home Basis with ease

- Find Home Basis and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Home Basis and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it work on a home basis?

airSlate SignNow is an electronic signature solution designed to streamline document signing processes. On a home basis, it allows users to easily send, receive, and eSign documents from the comfort of their home office. This enhances productivity and simplifies workflows for remote teams.

-

What are the pricing options for airSlate SignNow on a home basis?

airSlate SignNow offers several pricing tiers to accommodate different needs, even on a home basis. Plans can be customized for individuals and small businesses, ensuring a cost-effective solution for signing documents. Each plan provides various features to suit users' requirements.

-

What features does airSlate SignNow provide for home users?

airSlate SignNow includes essential features like unlimited document signing, templates, and automated workflows. On a home basis, these tools make it easy for users to manage their documents efficiently. The platform is user-friendly, ensuring a seamless experience for remote individuals.

-

How can airSlate SignNow benefit my home business?

Using airSlate SignNow can signNowly enhance your home business operations by minimizing the time spent on paperwork. The platform offers an efficient way to execute agreements electronically, which not only saves time but also increases the security of your documents. Adopting this solution helps maintain professionalism and speed in transactions.

-

Is there a mobile app for airSlate SignNow for home use?

Yes, airSlate SignNow provides a mobile app that enables users to manage their document signing on a home basis. The app allows you to send, sign, and store documents securely right from your smartphone or tablet. This flexibility is perfect for users who work remotely or need to sign documents on the go.

-

What integrations does airSlate SignNow offer for home users?

airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Dropbox, and CRM systems. This capability enhances the productivity of home users by allowing them to utilize their existing tools while managing document signing. The integration options foster a cohesive workflow, promoting efficiency.

-

Can I try airSlate SignNow for free before committing on a home basis?

Absolutely! airSlate SignNow offers a free trial that allows home users to explore its features and capabilities. This trial period helps potential customers assess if the solution meets their needs without any financial commitment. It's an excellent opportunity to experience the benefits firsthand.

Get more for Home Basis

- Publication 1141 rev august 2020 general rules and specifications for substitute forms w 2 and w 3

- Irs releases forms for reporting 2020 retirement plan and

- 2020 schedule i form 1041 alternative minimum taxestates and trusts

- 2020 schedule m form 990 noncash contributions

- 2019 instructions for schedule 8812 internal revenue serviceabout schedule 8812 form 1040 additional child tax federal 1040

- 2020 form 8879 pe irs e file signature authorization for form 1065

- Form 656 l offer in compromise internal revenue service

- 2020 schedule d form 1120 capital gains and losses

Find out other Home Basis

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT