Consultant Self Employed Form

What is the Consultant Self Employed

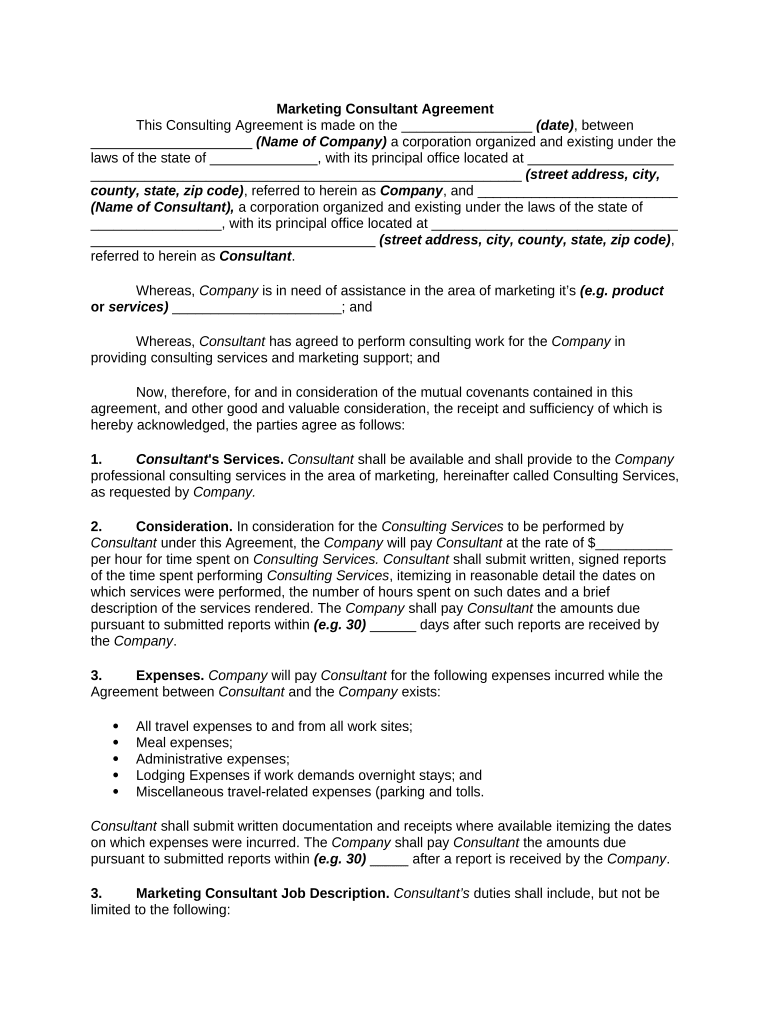

The consultant self employed form is a crucial document for individuals who operate as independent consultants. This form serves to outline the terms of engagement between the consultant and their clients. It typically includes details such as the scope of work, payment terms, and duration of the agreement. By clearly defining these elements, both parties can ensure mutual understanding and avoid potential disputes.

Steps to complete the Consultant Self Employed

Completing the consultant self employed form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including personal details, business structure, and relevant client information. Next, fill out the form carefully, paying attention to sections that require specific data, such as payment terms and project timelines. Once completed, review the form for any errors or omissions. Finally, sign the document electronically to ensure it is legally binding.

Legal use of the Consultant Self Employed

To ensure the legal validity of the consultant self employed form, it is essential to comply with relevant laws and regulations. This includes adhering to the ESIGN Act, which governs electronic signatures, and ensuring that all parties involved understand the terms outlined in the agreement. The use of a reliable eSignature solution can enhance the legal standing of the document, providing an electronic certificate and maintaining compliance with various legal frameworks.

Key elements of the Consultant Self Employed

Key elements of the consultant self employed form include the identification of the parties involved, a detailed description of the services to be provided, and payment terms. It is also important to include the duration of the agreement, confidentiality clauses, and termination conditions. These elements help create a comprehensive understanding between the consultant and the client, ensuring that both parties are aligned on expectations and responsibilities.

IRS Guidelines

The IRS provides specific guidelines for individuals operating as self-employed consultants. It is important to understand how income from consulting services is reported and taxed. Consultants must typically file a Schedule C (Form 1040) to report their income and expenses. Additionally, self-employed individuals may be responsible for paying self-employment taxes, which cover Social Security and Medicare contributions. Familiarizing oneself with these guidelines can help ensure compliance and avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

Submitting the consultant self employed form can be done through various methods, depending on the requirements of the client or organization. Many prefer electronic submission due to its efficiency and speed. This can be accomplished using secure eSignature platforms. Alternatively, forms can be mailed or delivered in person, though these methods may take longer and require additional steps for verification. Understanding the preferred submission method can streamline the process and enhance communication with clients.

Examples of using the Consultant Self Employed

Examples of using the consultant self employed form include scenarios where an individual provides marketing consulting services to a small business or offers IT consulting to a startup. In each case, the form outlines the specific services provided, payment structures, and timelines. These examples illustrate how the form can be tailored to different consulting scenarios, ensuring clarity and professionalism in the business relationship.

Quick guide on how to complete consultant self employed 497331052

Effortlessly Prepare Consultant Self Employed on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to quickly create, modify, and eSign your documents without any delays. Manage Consultant Self Employed on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-centric process today.

How to Modify and eSign Consultant Self Employed with Ease

- Obtain Consultant Self Employed and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you want to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign Consultant Self Employed to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit a consultant self employed?

airSlate SignNow is an intuitive eSignature platform that simplifies document management for a consultant self employed. With features like document templates and secure signing, it allows you to focus more on your clients and less on paperwork, thus enhancing your productivity.

-

How much does airSlate SignNow cost for a consultant self employed?

airSlate SignNow offers various pricing plans tailored to the needs of a consultant self employed. You can choose from flexible monthly or yearly subscriptions, making it affordable and scalable as your business grows.

-

What features does airSlate SignNow offer for a consultant self employed?

For a consultant self employed, airSlate SignNow provides features like customizable workflows, templates, and real-time tracking of document statuses. These tools save time and streamline the signing process, allowing you to serve your clients more efficiently.

-

Can a consultant self employed integrate airSlate SignNow with other tools?

Yes, airSlate SignNow supports integration with popular business applications like CRM systems, cloud storage solutions, and project management tools, making it an ideal choice for a consultant self employed. This versatility enhances your workflow by connecting your essential tools in one place.

-

Is airSlate SignNow compliant with legal requirements for a consultant self employed?

Absolutely! airSlate SignNow complies with various legal regulations for digital signatures, ensuring that documents signed through the platform are legally binding. This compliance is essential for a consultant self employed to maintain trust with clients and fulfill legal obligations.

-

How can a consultant self employed ensure the security of their documents using airSlate SignNow?

airSlate SignNow employs industry-standard encryption protocols and secure access controls to protect your documents. For a consultant self employed, these security measures guarantee that sensitive client information remains private and secure at all times.

-

What kind of support does airSlate SignNow provide for a consultant self employed?

airSlate SignNow offers robust customer support tailored for a consultant self employed, including live chat, email support, and an extensive knowledge base. This ensures that you can get assistance whenever needed and continue focusing on your consulting work without interruptions.

Get more for Consultant Self Employed

- Example of an affidavit for ksa 58 4301 form

- 5113 1 354 in the district court of judicial council kansasjudicialcouncil form

- 5113 213 in the district court of county kansas in the interest of name year of birth a male female case no form

- 5113 1 133 in the district court of kansas judicial council kansasjudicialcouncil form

- Protective orders and the importance of tcic reporting texas kansasjudicialcouncil form

- Petition promissory form

- Kansasjudicialcouncil 6969217 form

- 5113 200 in the district court of county kansas in the interest of name year of birth a male female case no form

Find out other Consultant Self Employed

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now