Letter Self Employed Form

What is the Letter Self Employed

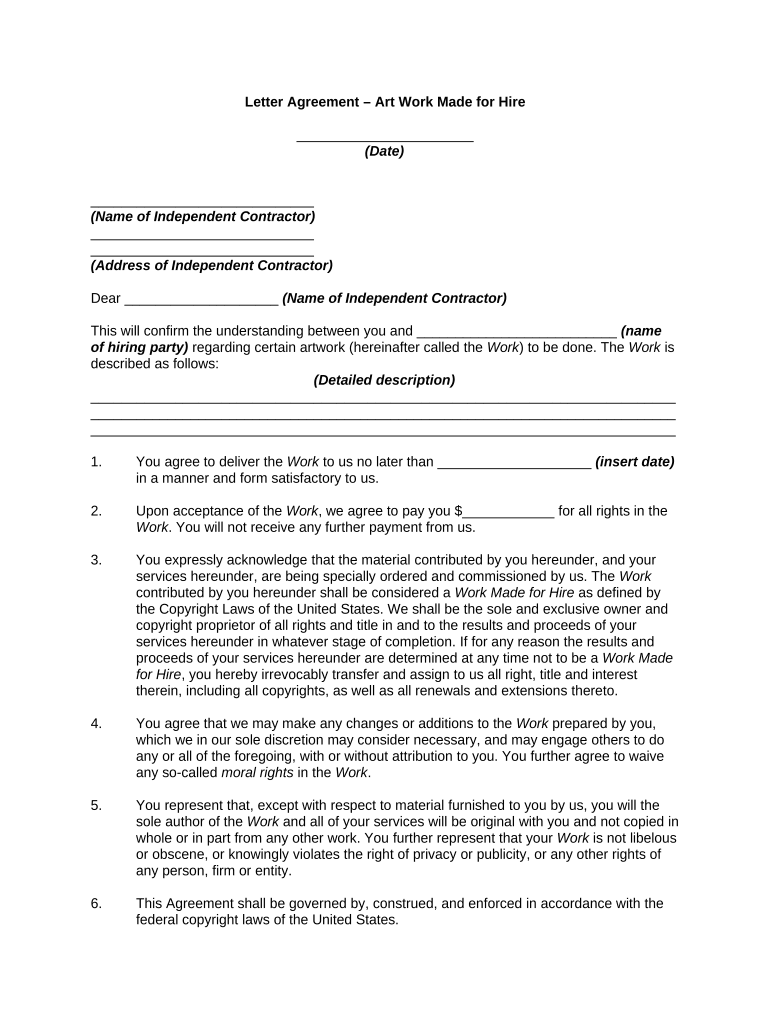

The letter self employed is a formal document used by individuals who operate as self-employed professionals. It serves as a declaration of their employment status and outlines the nature of their work. This letter can be essential for various purposes, including applying for loans, renting property, or fulfilling tax obligations. It typically includes information such as the individual’s name, business name, type of services provided, and income details. Understanding the components of this letter is crucial for ensuring it meets the requirements of the requesting party.

How to Use the Letter Self Employed

Using the letter self employed involves several steps to ensure it serves its intended purpose effectively. First, gather all necessary information, including your business details and income projections. Next, draft the letter clearly stating your self-employed status and the services you provide. It is advisable to include specific details about your business operations, such as the duration of your self-employment and any relevant licenses or certifications. Once the letter is prepared, review it for accuracy and completeness before submitting it to the relevant parties.

Steps to Complete the Letter Self Employed

Completing the letter self employed requires careful attention to detail. Follow these steps for a successful completion:

- Start with your personal information, including your name and contact details.

- Clearly state your self-employed status and the nature of your business.

- Include your business name and any relevant registration numbers.

- Detail the services you offer and your income for the past year.

- Sign and date the letter to validate its authenticity.

Ensuring that all information is accurate and up-to-date is vital for the letter's acceptance.

Legal Use of the Letter Self Employed

The legal use of the letter self employed is significant in various contexts, particularly when it comes to financial institutions or government agencies. This letter can serve as proof of income, which is often required when applying for loans or mortgages. It is essential to ensure that the letter complies with relevant laws and regulations, including any specific requirements set by the requesting entity. By adhering to these guidelines, individuals can ensure their letter is legally binding and accepted.

Key Elements of the Letter Self Employed

When drafting the letter self employed, certain key elements must be included to enhance its effectiveness:

- Your full name and contact information.

- The name of your business and its structure (e.g., sole proprietorship, LLC).

- A brief description of the services you provide.

- Your income details, including any relevant tax information.

- The date of the letter and your signature.

Including these elements ensures that the letter is comprehensive and meets the expectations of the recipient.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that are crucial for self-employed individuals. These guidelines outline how to report income and expenses, as well as the necessary documentation required for tax purposes. The letter self employed may need to align with these guidelines, particularly when it comes to income reporting. Familiarizing yourself with IRS requirements can help ensure compliance and avoid potential issues during tax season.

Eligibility Criteria

Eligibility for using the letter self employed typically includes being actively engaged in a business or trade as a self-employed individual. This can encompass freelancers, independent contractors, and small business owners. It is important to have a legitimate business operation and the necessary licenses or permits to support your self-employment status. Meeting these criteria can help validate the information presented in the letter and enhance its credibility.

Quick guide on how to complete letter self employed 497331114

Effortlessly Prepare Letter Self Employed on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Letter Self Employed on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to effortlessly modify and eSign Letter Self Employed

- Obtain Letter Self Employed and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate creating new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Letter Self Employed while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter self employed and how can airSlate SignNow help?

A letter self employed is a formal document that individuals create to signNow their self-employment status. With airSlate SignNow, you can easily eSign and send your letter self employed, ensuring it is professionally formatted and legally binding, which can help expedite your business processes.

-

How much does it cost to use airSlate SignNow for my letter self employed?

airSlate SignNow offers a range of pricing plans to suit different needs. Depending on the features you require for your letter self employed, the pricing is designed to be cost-effective, especially for freelancers and small businesses looking to manage documents efficiently.

-

Can I customize the template for my letter self employed in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your letter self employed templates. You can easily edit text, add your branding, and make necessary adjustments to ensure your document meets your specific requirements and reflects your personal style.

-

What benefits does airSlate SignNow provide for managing a letter self employed?

Using airSlate SignNow to manage your letter self employed provides numerous benefits, including the ability to track document status, get notifications upon signing, and maintain a secure storage of your signed documents. This streamlines your workflow and enhances your productivity.

-

Does airSlate SignNow integrate with other apps for my letter self employed?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easy to incorporate your letter self employed into your existing workflow. Whether you need to sync with CRM systems or file storage services, airSlate SignNow has you covered.

-

How secure is my information when signing a letter self employed on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you eSign your letter self employed on our platform, your data is encrypted and stored securely, ensuring that your sensitive information remains protected from unauthorized access.

-

Is it easy to share my signed letter self employed with clients?

Yes, sharing your signed letter self employed is incredibly easy with airSlate SignNow. You can quickly send the document via email or generate a shareable link, simplifying the process of distributing key documents to your clients and partners.

Get more for Letter Self Employed

- Letter of medical necessity for incontinence form

- Gerber application form

- Aflac group claim forms

- Weekly blood log form

- Medical laboratory technician reference form ascp ascp

- Gender reassignment surgery gender reassignment surgery form

- Form prenatal intake

- Merrimack pharmaceuticals medical education grant request form

Find out other Letter Self Employed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure