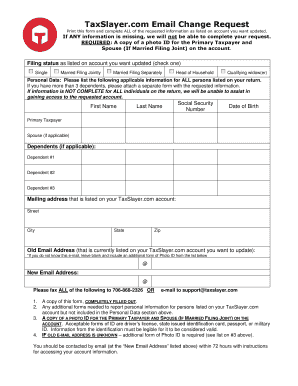

Taxslayer Email Change Form

What is the Taxslayer Email Change

The Taxslayer email change request is a formal process that allows users to update their registered email address associated with their Taxslayer account. This change is essential for maintaining access to important tax documents, notifications, and account security. Users may need to make this change for various reasons, such as switching to a new email provider or enhancing their account security.

Steps to Complete the Taxslayer Email Change

To successfully complete the Taxslayer email change request, follow these steps:

- Log in to your Taxslayer account using your current email and password.

- Navigate to the account settings or profile section.

- Select the option to change your email address.

- Enter your new email address and confirm it by re-entering.

- Submit the request and check your new email for a confirmation link.

- Click the confirmation link to finalize the email change.

Legal Use of the Taxslayer Email Change

Changing your email address within the Taxslayer system is legally permissible as long as the request is made by the account holder. It is important to ensure that the new email address is valid and accessible to prevent any disruptions in receiving tax-related communications. The process must comply with relevant privacy regulations to protect user data.

Required Documents

While changing your email address in Taxslayer does not typically require extensive documentation, you may need to provide:

- Your current Taxslayer account information.

- Verification of identity, such as answering security questions or providing a phone number.

- The new email address you wish to use.

Form Submission Methods

The Taxslayer email change request can be submitted electronically through the Taxslayer platform. Users are encouraged to use the online method for a quicker and more efficient process. This method ensures that the request is processed immediately, and users receive confirmation via their new email address.

Examples of Using the Taxslayer Email Change

Consider the following scenarios where a Taxslayer email change might be necessary:

- A user switches from a personal email to a work email for better organization.

- A user wants to enhance security by using an email with two-factor authentication.

- A user has lost access to their previous email and needs to update it to regain account access.

Quick guide on how to complete taxslayer email change

Effortlessly Prepare Taxslayer Email Change on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Taxslayer Email Change on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Taxslayer Email Change with Ease

- Locate Taxslayer Email Change and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just a few seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Taxslayer Email Change and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxslayer email change

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxslayer email change request?

A taxslayer email change request is the process by which users can update the email associated with their TaxSlayer account. This ensures that users receive important notifications and access to their tax documents at the correct email address. Making this change is essential for maintaining the security and accessibility of your tax information.

-

How do I submit a taxslayer email change request?

To submit a taxslayer email change request, log into your TaxSlayer account and navigate to the account settings. From there, you can find the option to update your email address. Follow the prompts to complete the request and ensure you verify the new email for successful updates.

-

Can I change my email without the original email address for a taxslayer email change request?

If you no longer have access to your original email address, you may need to contact TaxSlayer customer support directly. They have procedures in place to verify your identity before processing a taxslayer email change request without the original email. Make sure to have identification and account details ready.

-

Are there any fees associated with a taxslayer email change request?

There are no fees associated with submitting a taxslayer email change request. This service is provided for free by TaxSlayer to ensure users can maintain their account information easily. Ensuring your email is current helps keep your tax information secure.

-

What benefits come from changing your email through a taxslayer email change request?

Changing your email via a taxslayer email change request allows you to receive timely updates and important alerts about your tax filings. Additionally, it helps prevent unauthorized access to your account, ensuring that only you can view and modify sensitive tax documents. Keeping your email current strengthens your account security.

-

How long does it take to process a taxslayer email change request?

A taxslayer email change request is typically processed promptly, often within 24 hours. After submission, you'll receive a confirmation email at your new address once the change has been made. If you don’t see this confirmation, it’s advisable to check your spam folder or contact customer support.

-

Can I use airSlate SignNow to facilitate my taxslayer email change request?

Yes, airSlate SignNow can help you manage and eSign documents related to your taxslayer email change request. By using airSlate SignNow, you can streamline the process and ensure all your requests are documented and easily accessible. It's an effective tool to enhance your experience with TaxSlayer.

Get more for Taxslayer Email Change

- The undersigned hereby makes application on behalf of form

- Downloading the paper intent to graduate form

- New time block chart student viewxlsxread only form

- Non custodial parents form 2018 19 academic year office of

- Non custodial parents form us domestic 2019 20 academic year non custodial parents form

- Legal namegender change form

- Fvwd20 parent verification worksheet form

- University scholarships amp financial aid services 4202 east fowler avenue svc 1102 tampa florida 33620 6960 form

Find out other Taxslayer Email Change

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF