Stock Purchase Transfer Form

What is the Stock Purchase Transfer?

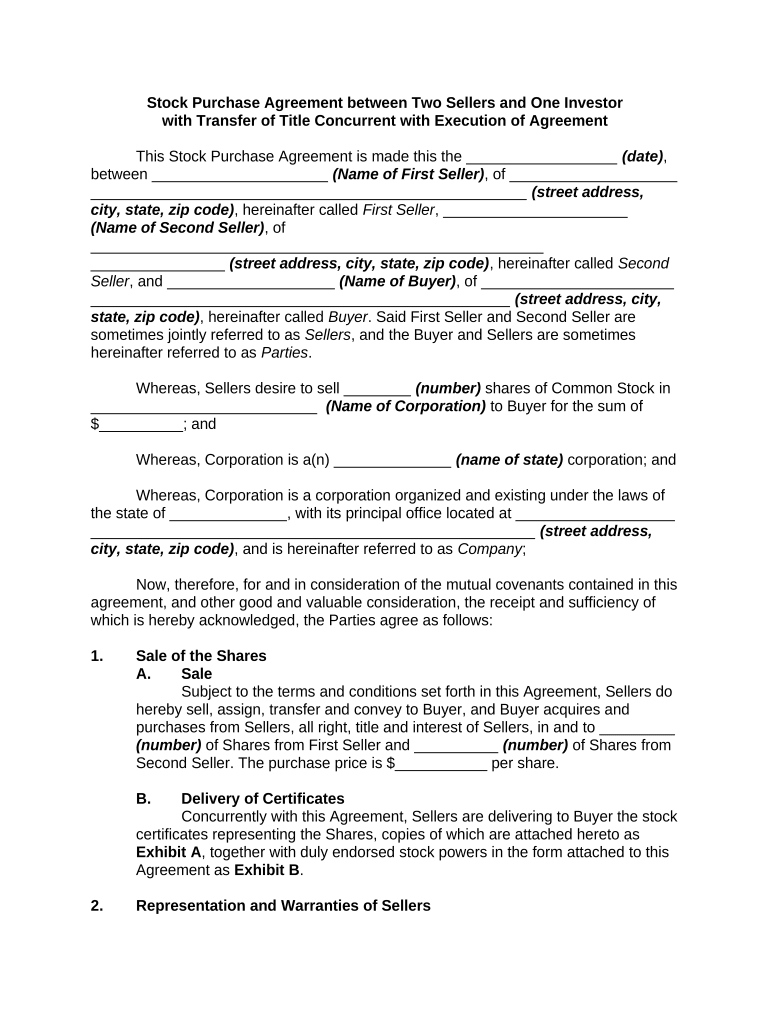

The stock purchase transfer is a legal document used to facilitate the transfer of ownership of shares from one party to another. This agreement outlines the terms and conditions under which the shares are sold, including the purchase price, the number of shares being transferred, and any warranties or representations made by the seller. It serves as a formal record of the transaction and is essential for maintaining accurate ownership records in corporate governance.

Steps to Complete the Stock Purchase Transfer

Completing a stock purchase transfer involves several key steps to ensure the transaction is legally binding and properly documented. Here are the essential steps:

- Identify the parties: Clearly state the names and addresses of the buyer and seller.

- Specify the shares: Indicate the number of shares being transferred and the class of stock.

- Determine the purchase price: Agree on the total amount to be paid for the shares.

- Draft the agreement: Create a formal document that includes all agreed-upon terms.

- Sign the agreement: Both parties must sign the document to make it legally binding.

- Notify the corporation: Inform the company whose shares are being transferred to update their records.

Legal Use of the Stock Purchase Transfer

The stock purchase transfer is legally binding when executed correctly, meaning it must comply with relevant state laws and regulations. To ensure its enforceability, the document should include essential elements such as the identities of the parties involved, a clear description of the shares, and the agreed purchase price. Additionally, both parties should retain copies of the signed agreement for their records. Compliance with corporate governance procedures is also crucial, as companies often have specific rules regarding share transfers.

Key Elements of the Stock Purchase Transfer

Several key elements must be included in a stock purchase transfer to ensure its validity:

- Parties involved: Names and addresses of the buyer and seller.

- Share details: Description of the shares being transferred, including the class and number.

- Purchase price: The agreed amount for the shares.

- Payment terms: Details on how and when the payment will be made.

- Representations and warranties: Any guarantees made by the seller regarding the shares.

- Governing law: The state law that will govern the agreement.

How to Obtain the Stock Purchase Transfer

Obtaining a stock purchase transfer can be done through several methods. Many companies provide templates or forms that can be customized for specific transactions. Additionally, legal professionals can draft a stock purchase transfer tailored to the needs of the parties involved. It is important to ensure that the document meets all legal requirements and accurately reflects the terms of the agreement. Online resources and legal document services may also offer downloadable templates for convenience.

Examples of Using the Stock Purchase Transfer

Stock purchase transfers are commonly used in various scenarios, including:

- Private sales: When an individual sells shares of a privately held company to another individual.

- Business acquisitions: When a company acquires another company and needs to transfer ownership of shares.

- Estate planning: When shares are transferred as part of an inheritance or estate settlement.

Quick guide on how to complete stock purchase transfer

Effortlessly prepare Stock Purchase Transfer on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without hindrances. Manage Stock Purchase Transfer on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to edit and electronically sign Stock Purchase Transfer with ease

- Obtain Stock Purchase Transfer and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the trouble of missing or lost files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Stock Purchase Transfer and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a purchase agreement title?

A purchase agreement title is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property or goods. This title serves as proof of ownership and helps to ensure that both parties adhere to the contractual obligations agreed upon. Using airSlate SignNow, you can easily create, send, and eSign purchase agreement titles with just a few clicks.

-

How does airSlate SignNow simplify the creation of purchase agreement titles?

airSlate SignNow simplifies the creation of purchase agreement titles by offering customizable templates that are easy to fill out. Users can quickly add necessary details, such as buyer and seller information, and terms of the agreement, allowing you to generate comprehensive and legally binding documents in minutes. This not only saves time but also reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for purchase agreement titles?

Using airSlate SignNow for your purchase agreement title provides several benefits, including enhanced efficiency, improved organization, and better collaboration. The platform allows users to track document status, send reminders, and manage workflows, ensuring all parties stay informed throughout the signing process. Additionally, it enhances security with encrypted eSigning.

-

Is there a cost associated with creating a purchase agreement title on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, though it is designed to be cost-effective for businesses of all sizes. Pricing plans depend on the features needed, such as the number of users and additional capabilities like templates and integrations. You can explore our pricing page to find a plan that suits your business needs for creating purchase agreement titles.

-

Can I integrate airSlate SignNow with other applications for my purchase agreement title process?

Absolutely! airSlate SignNow offers numerous integrations with popular applications, enabling a seamless workflow for managing purchase agreement titles. You can connect it with your CRM, payment systems, and cloud storage solutions, streamlining the entire process of document creation, signing, and storage.

-

Is it secure to eSign a purchase agreement title on airSlate SignNow?

Yes, eSigning a purchase agreement title on airSlate SignNow is highly secure. The platform employs industry-standard encryption and compliance with legal regulations, ensuring that your sensitive information remains protected. With advanced authentication methods, you can trust that your electronic signatures are legitimate and legally binding.

-

What types of purchase agreements can I create with airSlate SignNow?

With airSlate SignNow, you can create various types of purchase agreements, including real estate transactions, vehicle sales, and commercial transactions. Our customizable templates cater to different industries, helping you draft documents that meet specific legal requirements while ensuring a professional appearance.

Get more for Stock Purchase Transfer

Find out other Stock Purchase Transfer

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract