Processor Certification Form

What is the Processor Certification Form

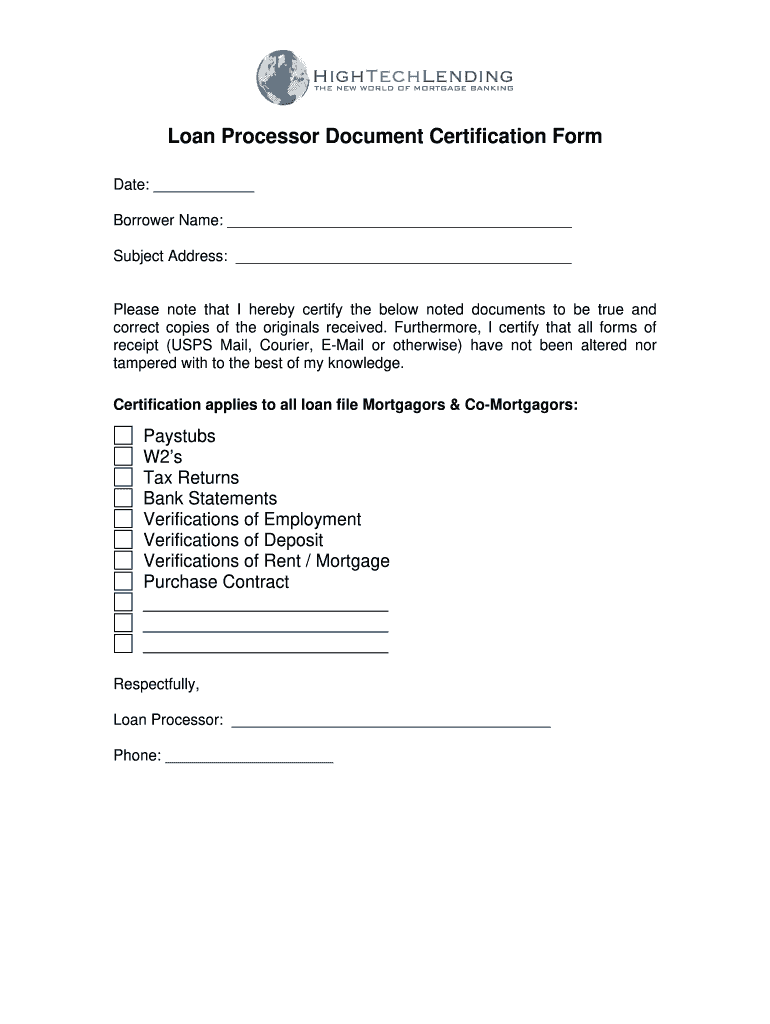

The processor certification form is a crucial document used primarily in the mortgage industry to verify the qualifications of loan processors. This form serves as a formal declaration that a processor meets specific standards and possesses the necessary skills to handle mortgage applications and related tasks. It typically includes information about the processor’s experience, training, and any certifications they hold, ensuring compliance with industry regulations.

How to use the Processor Certification Form

To use the processor certification form effectively, begin by gathering all necessary information about the loan processor. This includes their name, contact details, and relevant certifications. Next, fill out the form accurately, ensuring that all sections are completed. Once the form is filled, it should be reviewed for accuracy before submission. Depending on the requirements, the completed form may need to be signed by a supervisor or a designated authority to validate the certification.

Steps to complete the Processor Certification Form

Completing the processor certification form involves several key steps:

- Gather necessary personal and professional information about the loan processor.

- Fill out each section of the form, ensuring all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Obtain any required signatures from supervisors or authorized personnel.

- Submit the form as per the specified guidelines, whether online or via mail.

Key elements of the Processor Certification Form

The processor certification form typically includes several key elements that are essential for its validity:

- Processor Information: Name, contact details, and professional background.

- Certification Details: Information about any relevant certifications or training.

- Compliance Statements: Declarations regarding adherence to industry standards and regulations.

- Signature Section: Space for required signatures to authenticate the form.

Legal use of the Processor Certification Form

The legal use of the processor certification form is critical in ensuring compliance with federal and state regulations governing the mortgage industry. This form acts as a safeguard, confirming that the loan processor has met the necessary qualifications to handle sensitive financial information. It is important that the form is filled out accurately and submitted in accordance with applicable laws to avoid any potential legal repercussions.

Who Issues the Form

The processor certification form is typically issued by mortgage companies, lenders, or regulatory bodies within the financial services sector. These organizations establish the requirements for the form and ensure that it aligns with industry standards. It is important for processors to obtain the correct version of the form from their employer or the relevant authority to ensure compliance.

Quick guide on how to complete loan processor form

The optimal method to locate and endorse Processor Certification Form

At the scale of your whole organization, ineffective procedures concerning paper approval can consume a signNow amount of work time. Endorsing documents like Processor Certification Form is an inherent element of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the company’s overall efficiency. With airSlate SignNow, endorsing your Processor Certification Form is as straightforward and swift as possible. You will have access to the latest version of nearly any form through this platform. Even better, you can endorse it immediately without needing to install external software on your device or printing any hard copies.

How to obtain and endorse your Processor Certification Form

- Browse our collection by category or use the search bar to find the form you require.

- Check the form preview by clicking Learn more to ensure it's the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and incorporate any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Processor Certification Form.

- Select the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything you need to handle your documents efficiently. You can find, fill out, edit, and even send your Processor Certification Form within a single tab without any trouble. Enhance your processes by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How does Rocket Mortgage expedite the approval process for buying a mortgage? Or is it just a tool to streamline the pre-approval process?

Rocket Mortgage is a legitimate deal, but more than that, it’s pretty spiffy marketing.A couple of things are worth knowing about how mortgages are approved today. A borrower fills out an application (or a loan officer fills it out for them), and provides documentation for income and assets. This documentation typically consists of a current month’s pay stubs and at least one year’s W2s to verify employment and income, and two months’ bank statements to verify assets. With that documentation, the loan officer completes the application and submits it to the Automated Underwriting System (AUS). There are two primary systems: Desktop Underwriter (Fannie Mae) and Loan Prospector (Freddie Mac). If the AUS returns an outcome of “Approve/Eligible” or “LP Accept,” the loan package goes to the underwriter for review. As long as all the documents match up with the numbers on the application, the loan is typically approved.This can be a time-consuming process, because the loan processor often has to order a Verification Of Employment from the employer. This is done manually, and depends on someone in the borrower’s HR department to fill out the form promptly and completely and return it to the lender. The lender’s underwriter reviews it for accuracy and consistency and signs it off.The same thing happens with asset verification. The underwriter reviews the bank statements to be sure that the balances match up with what is on the application, and that there are no large deposits that could indicate undisclosed debt (don’t laugh—I had a borrower once who had a $10,000 deposit that turned out to be a cash advance from her credit card, an unacceptable source of funds).Although the AUS renders a decision in seconds, reviewing the numbers manually is time consuming. Frequently underwriters have additional questions about the documentation they’ve received, and issue conditions to be satisfied before they an issue a final approval and draw loan documents.Rocket Mortgage (Quicken Loans) is just one company that has automated the process. There are companies like The Work Number (Experian) that keep an extensive database of employers and employees, together with their earnings data. In many cases, a lender can verify a borrower’s employment and income literally in seconds thorough one of these services. When this happens, the income is not only verified—it is validated. This means that the underwriter doesn’t need to examine the documents; she can accept the number as presented.The same thing happens with assets. The borrower electronically authorizes the lender to get bank information from their institution. The information that comes back is both verified and validated, requiring no further effort on the underwriter’s part.This direct validation of loan parameters saves a tremendous amount of time for the lender, while still providing the appropriate level of due diligence on each borrower seeking to borrow hundreds of thousands of dollars from them.Here’s what’s brilliant about Rocket Mortgage: First, the name. The ad copy just writes itself, with lots of easily-accessible metaphors. And cool sound effects.Second, many people think Quicken is the only game in town for quick loan approval. They aren’t. One example, Caliber Home Loans (full disclosure: I am a branch manager for Caliber) has its “Ultimate Home Buying Experience.” We’re getting loans funded as quickly as ten days from application using this technology. But the name doesn’t have the kind of pizzazz that “Rocket Mortgage” does. The point is, an increasing number of lenders has automated the process; Rocket Mortgage is by no means the only game in town.Here’s where there are problems with a company like Quicken. While they are a perfectly good organization, they are what we refer to as a “call center lener.” This means that the borrower’s point of contact with the lender is some guy or gal sitting in a cubicle with a headset in a call center. That person’s job is to get the caller to agree to do the loan. Period. They are not equipped or trained to offer advice about the best loan program, or what actions the borrower can take to get the best possible rate.A call center seldom has the ability to get a loan back on track if it starts to go sideways—and this kind of occurrence is not at all uncommon.Finally, there is the matter of credibility with sellers. Most buyers in today’s hyper-competitive market know that making an offer without a solid preapproval letter is completely futile. Most sellers won’t even consider a buyer who hasn’t been at a minimum prequalified. It is increasingly common to get borrower approved by the underwriter on a “TBD” basis (property To Be Determined”) before making an offer. This type of approval is several levels beyond a “prequal” letter.For many sellers and their agents, an “internet company” like Quicken, Rocket Mortgage, or any of the other call center companies doesn’t carry the weight or credibility that an approval from a local branch of a mortgage company. In our practice, we invite sellers’ agents to call us to discuss and verify the strength of the people who have made an offer on their clients’ home. There have been many cases where the conversation between the seller’s agent and the loan officer working with the buyer has been able to get that one offer accepted over multiple other competing contracts.I hope this is helpful.

Create this form in 5 minutes!

How to create an eSignature for the loan processor form

How to make an electronic signature for your Loan Processor Form online

How to make an electronic signature for your Loan Processor Form in Google Chrome

How to make an eSignature for putting it on the Loan Processor Form in Gmail

How to create an eSignature for the Loan Processor Form from your mobile device

How to generate an electronic signature for the Loan Processor Form on iOS

How to create an electronic signature for the Loan Processor Form on Android OS

People also ask

-

What is the Processor Certification Form in airSlate SignNow?

The Processor Certification Form in airSlate SignNow is a vital document that certifies your compliance with data protection regulations. It ensures that your business processes documents securely and efficiently, maintaining the integrity of sensitive information. By utilizing this form, you can demonstrate your commitment to best practices in data management.

-

How can I access the Processor Certification Form in airSlate SignNow?

You can easily access the Processor Certification Form within the airSlate SignNow platform. Simply log into your account, navigate to the compliance section, and select the Processor Certification Form. This user-friendly interface makes it straightforward to complete and submit the necessary documentation.

-

Are there any costs associated with the Processor Certification Form?

The Processor Certification Form itself is included in your airSlate SignNow subscription at no additional cost. This makes it a cost-effective solution for businesses looking to ensure compliance without incurring extra fees. Additionally, our affordable pricing plans cover all essential features, including access to the certification form.

-

What features does the Processor Certification Form offer?

The Processor Certification Form in airSlate SignNow offers features such as customizable fields, secure eSignature capabilities, and automated workflows. These features streamline the certification process, allowing businesses to manage their compliance efficiently. With airSlate SignNow, you can track the status of your form in real-time.

-

How does the Processor Certification Form benefit my business?

Using the Processor Certification Form helps your business demonstrate compliance with data protection laws, which can enhance your reputation with clients and partners. It also simplifies the documentation process, saving time and reducing errors. Overall, this form contributes to a more organized and trustworthy business operation.

-

Can I integrate the Processor Certification Form with other tools?

Yes, the Processor Certification Form can be integrated with various third-party applications through airSlate SignNow's extensive API. This allows you to streamline your workflows and enhance your document management processes further. Integration capabilities ensure that you can use the form alongside tools you already rely on.

-

Is the Processor Certification Form secure?

Absolutely! The Processor Certification Form in airSlate SignNow is designed with top-notch security measures, including encryption and secure cloud storage. We prioritize the protection of your data, ensuring that all documents and information are handled safely and in compliance with relevant regulations.

Get more for Processor Certification Form

- Interrogatories to plaintiff for motor vehicle occurrence maryland form

- Interrogatories to defendant for motor vehicle accident maryland form

- Llc notices resolutions and other operations forms package maryland

- Real estate disclosure maryland form

- Notice of dishonored check civil keywords bad check bounced check maryland form

- Mutual wills containing last will and testaments for unmarried persons living together with no children maryland form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children maryland form

- Mutual wills or last will and testaments for unmarried persons living together with minor children maryland form

Find out other Processor Certification Form

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding