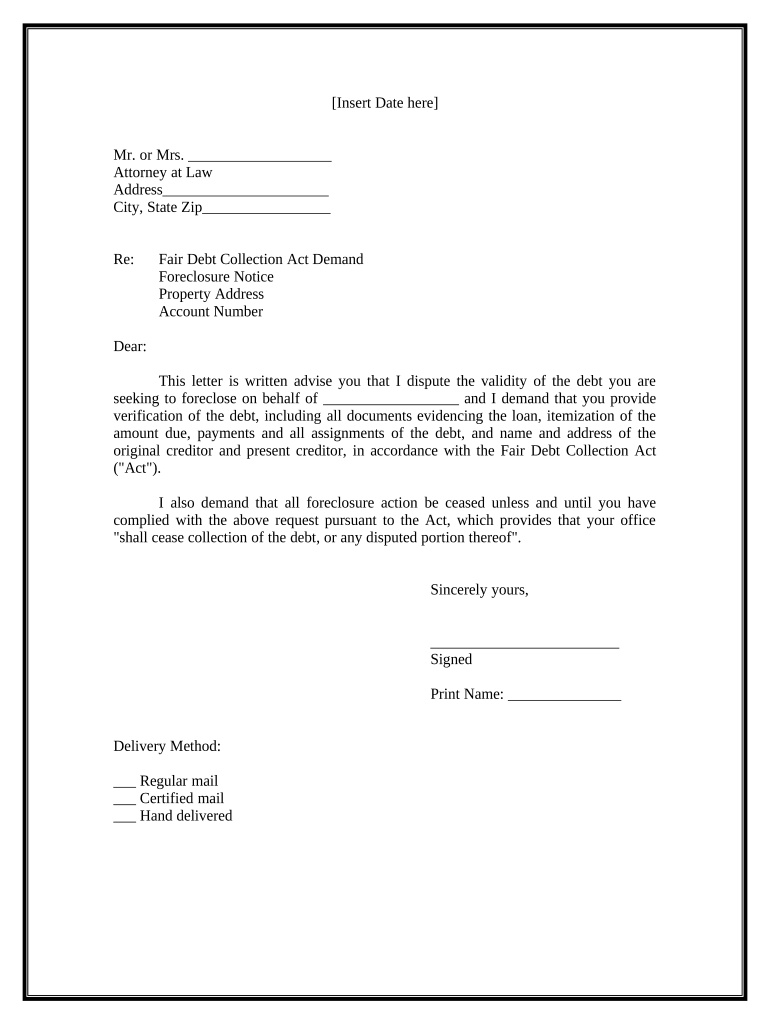

Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure Form

Understanding the Foreclosure Notice Template

A foreclosure notice template is a crucial document used in the process of notifying a borrower about the initiation of foreclosure proceedings. This template typically includes essential information such as the borrower's name, property address, and details regarding the loan default. It serves as a formal communication from the lender or mortgage servicer, outlining the consequences of failing to remedy the default. Understanding the structure and content of this template is vital for both lenders and borrowers to ensure compliance with legal requirements.

Key Elements of the Foreclosure Notice Template

When creating a foreclosure notice template, several key elements must be included to ensure its effectiveness and legality:

- Borrower Information: Full name and contact details of the borrower.

- Property Details: Complete address of the property subject to foreclosure.

- Loan Information: Details about the loan, including the loan number and original amount.

- Default Notification: Clear statement indicating the default status and the amount owed.

- Legal Rights: Information about the borrower's rights to contest the foreclosure.

- Contact Information: Details of the lender or foreclosure attorney for further inquiries.

Steps to Complete the Foreclosure Notice Template

Completing a foreclosure notice template involves several steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary details about the borrower and the property.

- Fill in the Template: Input the gathered information into the template, ensuring clarity and accuracy.

- Review for Accuracy: Double-check all entries for correctness to avoid legal issues.

- Sign and Date: Ensure the document is signed by the appropriate authority and dated correctly.

- Send the Notice: Deliver the notice to the borrower through certified mail or other legal means.

Legal Use of the Foreclosure Notice Template

The legal use of a foreclosure notice template is governed by state laws and regulations. It is essential that the notice complies with the Fair Debt Collection Practices Act (FDCPA) and any applicable state statutes. Failure to adhere to these legal requirements can result in delays in the foreclosure process or potential legal challenges from the borrower. Therefore, it is advisable to consult with a legal professional to ensure that the template meets all necessary legal standards.

Examples of Foreclosure Notice Templates

Examples of foreclosure notice templates can vary based on state laws and specific lender requirements. A typical template may include sections for:

- Notification of default and the amount due.

- Consequences of failing to respond or remedy the default.

- Instructions for contacting the lender or attorney.

Reviewing multiple examples can help in understanding the necessary components and variations that may be required.

Obtaining a Foreclosure Notice Template

Foreclosure notice templates can be obtained through various sources, including legal websites, mortgage servicers, and real estate professionals. It is important to ensure that the template used is up-to-date and compliant with current laws. Many legal document services offer customizable templates that can be tailored to specific needs, making it easier for lenders to create legally sound documents.

Quick guide on how to complete letter to foreclosure attorney to provide verification of debt and cease foreclosure

Easily prepare Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents promptly without hassles. Manage Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure effortlessly

- Locate Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors necessitating reprinting new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you choose. Edit and eSign Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a foreclosure notice template?

A foreclosure notice template is a standardized document that notifies a property owner of the initiation of foreclosure proceedings. It outlines important information such as the reason for the foreclosure, the amount owed, and the timeline for action. Using a clear and accurate foreclosure notice template helps ensure compliance with legal requirements.

-

How can I create a foreclosure notice template using airSlate SignNow?

Creating a foreclosure notice template with airSlate SignNow is simple and efficient. You can use our intuitive drag-and-drop interface to customize your template quickly. Once tailored to your needs, you can save it for future use, streamlining the foreclosure process for your business.

-

Is the foreclosure notice template included in airSlate SignNow's subscription?

Yes, the foreclosure notice template is available as part of our subscription plans. airSlate SignNow offers a variety of pricing tiers, allowing you to select a plan that fits your business needs while accessing essential document templates, including those for foreclosure notices.

-

What are the benefits of using a foreclosure notice template?

Using a foreclosure notice template saves time and ensures consistency in communication with property owners. It minimizes the risk of errors that could derail the foreclosure process. Additionally, having a ready-to-use foreclosure notice template allows for efficient management of multiple cases.

-

Can I integrate the foreclosure notice template with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your documents more efficiently. Whether you use CRM systems, document storage services, or other business applications, you can easily incorporate the foreclosure notice template into your workflow.

-

How does airSlate SignNow ensure the legal validity of the foreclosure notice template?

airSlate SignNow designs its foreclosure notice template to comply with legal standards and regulations. Our templates are regularly updated to reflect any changes in the law, ensuring that you use a reliable document that holds up in legal proceedings. Always consult with a legal professional for additional assurance.

-

What features does airSlate SignNow offer for customizing the foreclosure notice template?

airSlate SignNow provides a robust set of features for customizing your foreclosure notice template. You can easily add text fields, checkboxes, and signatures to make the document fit your specific needs. Additionally, you can personalize the layout, branding, and style to align with your business identity.

Get more for Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure

Find out other Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice