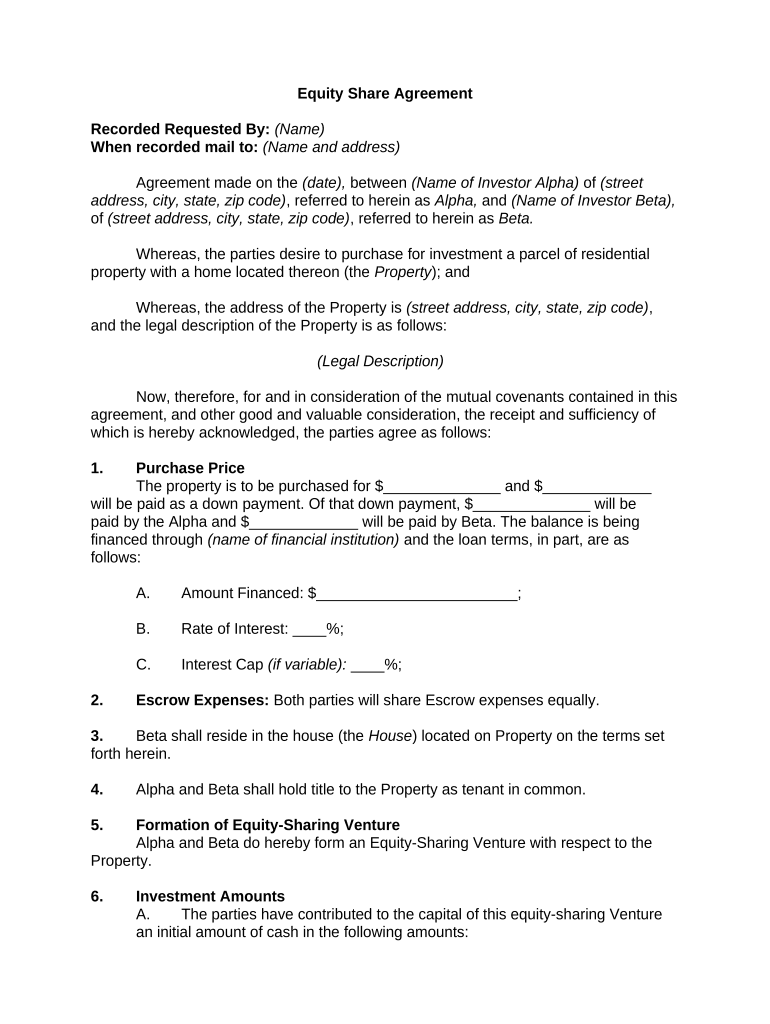

Equity Share Form

What is the equity share?

The equity share represents ownership in a company, typically in the form of shares of stock. When an individual or entity holds equity shares, they have a claim on a portion of the company's assets and earnings. Equity shares are fundamental to corporate finance, allowing businesses to raise capital by selling ownership stakes to investors. This form is essential for both private and public companies, as it delineates the rights and responsibilities of shareholders, including voting rights and dividend entitlements.

Steps to complete the equity share

Completing the equity share form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details and the number of shares being issued. Next, fill out the form clearly, ensuring that all fields are completed as required. Once the form is filled, review it for any errors or omissions. After verification, the form must be signed by the appropriate parties, which may include company executives and shareholders. Finally, submit the completed form to the relevant regulatory body or keep it for internal records, depending on the specific requirements of your jurisdiction.

Legal use of the equity share

The legal use of the equity share is governed by various regulations and laws that ensure proper issuance and management of shares. In the United States, compliance with the Securities and Exchange Commission (SEC) regulations is crucial for public companies. Equity shares must be issued in accordance with state laws, which may vary significantly. It is essential to ensure that all disclosures are made to potential investors, including risks associated with the investment. Additionally, maintaining accurate records of share ownership and transactions is vital for legal compliance and corporate governance.

Key elements of the equity share

Several key elements define the equity share, including:

- Ownership Rights: Equity shareholders possess ownership rights, which may include voting rights on corporate matters.

- Dividends: Shareholders may receive dividends, which are a portion of the company’s profits distributed to owners.

- Transferability: Equity shares can typically be bought and sold, providing liquidity for investors.

- Risk Exposure: Shareholders bear the risk of the company’s performance; if the company fails, they may lose their investment.

Examples of using the equity share

Equity shares are utilized in various scenarios, including:

- Startup Funding: New businesses often issue equity shares to raise initial capital from investors.

- Employee Stock Options: Companies may offer equity shares as part of employee compensation packages, incentivizing performance and retention.

- Mergers and Acquisitions: Equity shares can be exchanged during mergers, allowing companies to combine resources and expand their market presence.

Filing deadlines / Important dates

Filing deadlines for equity share-related documents can vary based on state regulations and the nature of the business. Typically, companies must adhere to specific timelines when issuing shares or reporting changes in ownership. For public companies, quarterly and annual reports must be filed with the SEC, detailing share issuance and ownership changes. It is crucial to stay informed about these deadlines to maintain compliance and avoid potential penalties.

Quick guide on how to complete equity share

Complete Equity Share effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without complications. Manage Equity Share on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Equity Share with ease

- Locate Equity Share and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Equity Share and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an equity share in the context of airSlate SignNow?

An equity share refers to the ownership stake that represents a portion of a company's assets and earnings. With airSlate SignNow, businesses can streamline the process of issuing equity shares by using electronic signatures for necessary documentation, ensuring that all transactions are legally binding and easy to manage.

-

How does airSlate SignNow facilitate the process of issuing equity shares?

airSlate SignNow simplifies the issuance of equity shares by allowing businesses to send, sign, and store necessary documents online. This process enhances efficiency by reducing paperwork and enabling quick access to signed agreements, making it a valuable tool for companies handling equity shares.

-

What are the pricing options for using airSlate SignNow for equity share transactions?

airSlate SignNow offers various pricing plans tailored to different business needs, including options suitable for handling equity share transactions. By providing a cost-effective solution, businesses can efficiently manage the eSigning of documents related to equity shares without overwhelming costs.

-

What features of airSlate SignNow are beneficial for managing equity shares?

Key features of airSlate SignNow that benefit equity share management include customizable templates, automated workflows, and real-time tracking of document statuses. These tools allow businesses to easily create, distribute, and sign equity share agreements, enhancing operational efficiency.

-

Can airSlate SignNow integrate with other platforms for equity share management?

Yes, airSlate SignNow integrates seamlessly with various business platforms, such as CRMs and accounting software, to facilitate equity share management. This integration helps businesses maintain their workflows, making the handling of equity shares more efficient and organized.

-

What benefits does airSlate SignNow provide for startups issuing equity shares?

For startups, airSlate SignNow offers numerous benefits when issuing equity shares, including reduced administrative burdens and faster turnaround times on essential documents. By using eSignatures, startups can ensure that their equity share agreements are compliant and quickly executed, paving the way for swift growth.

-

Is airSlate SignNow secure for handling equity share documents?

Absolutely, airSlate SignNow prioritizes document security, utilizing encryption and secure storage to protect equity share agreements. This ensures that sensitive information remains confidential and that all transactions are safe from unauthorized access.

Get more for Equity Share

Find out other Equity Share

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed