Disclaimer of Right to Inherit or Inheritance All Property from Estate or Trust Form

What is the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

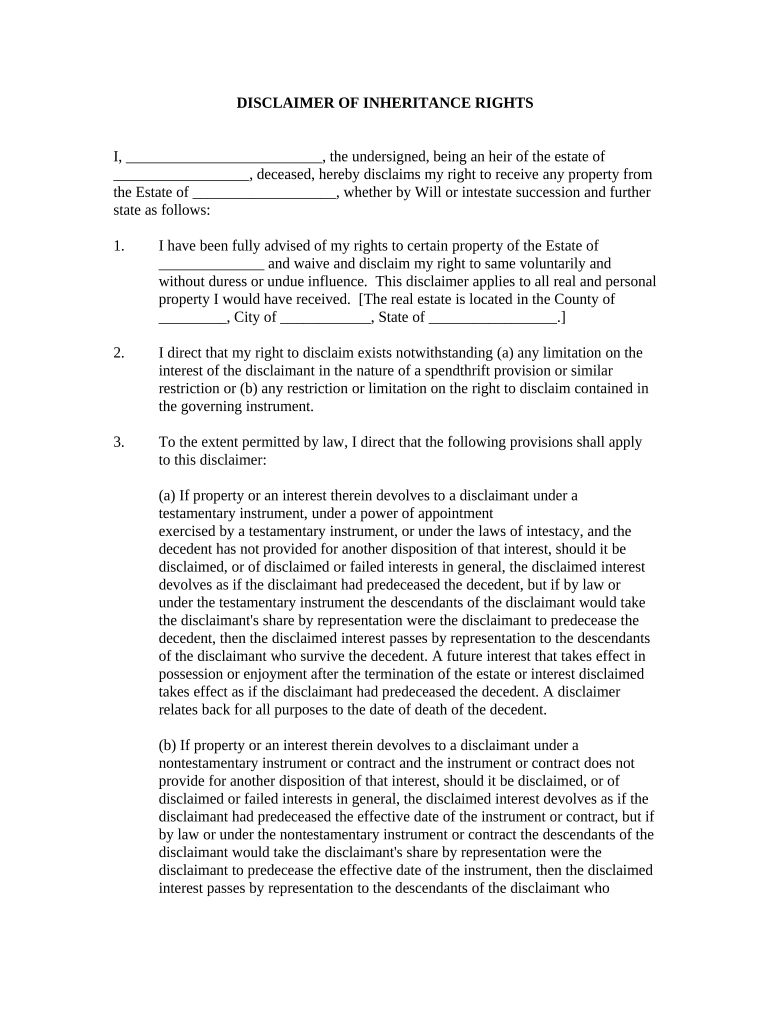

The Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust is a legal document that allows an individual to refuse their right to inherit property or assets from an estate or trust. This form is often used when a beneficiary wishes to decline their inheritance for various reasons, such as tax implications or personal circumstances. By executing this disclaimer, the individual formally relinquishes any claim to the assets, ensuring that they are distributed according to the terms of the estate or trust without their involvement.

How to use the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

Using the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust involves several steps. First, the individual must obtain the form, which can typically be found through legal resources or estate planning professionals. After filling out the necessary information, the form must be signed and dated. It is crucial to ensure that the disclaimer is executed within the time frame specified by state laws, as failing to do so may result in the individual unintentionally accepting the inheritance.

Steps to complete the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

Completing the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust involves the following steps:

- Obtain the disclaimer form from a reliable source.

- Fill in your personal details, including your name and relationship to the deceased.

- Clearly state your intention to disclaim the inheritance.

- Sign and date the form in the presence of a witness, if required by state law.

- Submit the completed form to the executor of the estate or the trustee of the trust.

Legal use of the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

The legal use of the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust is governed by state laws, which dictate the requirements for a valid disclaimer. Generally, the disclaimer must be in writing, signed by the disclaimant, and filed within a specific time frame after the individual becomes aware of their right to inherit. It is essential to consult with a legal professional to ensure compliance with all applicable laws and to understand the implications of the disclaimer on the distribution of the estate or trust assets.

Key elements of the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

Key elements of the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust include:

- The identity of the disclaimant and their relationship to the decedent.

- A clear statement of the intent to disclaim the inheritance.

- The description of the property or assets being disclaimed.

- The date of the disclaimer.

- A signature from the disclaimant, often requiring notarization or witness signatures depending on state requirements.

State-specific rules for the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

State-specific rules for the Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust can vary significantly. Each state has its own laws regarding the time frame for filing a disclaimer, the required format, and the consequences of disclaiming an inheritance. It is important for individuals to familiarize themselves with their state’s regulations to ensure that their disclaimer is valid and enforceable. Consulting with an estate planning attorney can provide clarity on these specific rules.

Quick guide on how to complete disclaimer of right to inherit or inheritance all property from estate or trust

Complete Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven activity today.

How to modify and eSign Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust seamlessly

- Locate Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust and then click Get Form to commence.

- Utilize the tools we supply to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and then click on the Done button to secure your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust?

A Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust is a legal document that allows an heir to refuse their inheritance. This can simplify estate management and help avoid unwanted tax liabilities. By utilizing airSlate SignNow, you can easily create and sign such disclaimers, ensuring a smooth and effective inheritance process.

-

How can I create a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust using airSlate SignNow?

You can create a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust by using our user-friendly document editor. Simply start a new document, select the necessary template, and fill in the required details. Our eSignature feature allows for quick and secure signing, making the process seamless.

-

Is there a cost associated with generating a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust with airSlate SignNow?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. We provide competitive pricing which includes the ability to generate and manage documents, such as a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for managing legal documents like disclaimers?

airSlate SignNow provides a range of features including customizable templates, secure eSignature capabilities, and extensive document management options. These features make it easy to create and store critical documents like a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust. Additionally, our integration options with other platforms enhance efficiency.

-

Can I integrate airSlate SignNow with other software for managing estates or trusts?

Yes, airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage your estate or trust documents more effectively. By integrating with accounting, CRM, and legal management tools, you can streamline the process of handling a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust and other legal documents.

-

What are the benefits of using airSlate SignNow for disclaimer documents?

Using airSlate SignNow for your Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust offers numerous benefits, such as quicker turnaround times, enhanced security, and ease of access from any device. Our platform ensures that you can manage your legal documents efficiently, saving time and reducing the hassle associated with traditional methods.

-

Is my information secure when using airSlate SignNow to sign legal documents?

Absolutely! airSlate SignNow prioritizes security and ensures that all documents, including a Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust, are protected with advanced encryption and secure cloud storage. We are committed to safeguarding your data so you can sign documents with peace of mind.

Get more for Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

- Ri 030 livescan fingerprint background check request driver education form

- Form llc 2 cagov

- 2020 publication 974 internal revenue service form

- Wi hunting disability permit form

- Phs 398 form

- Wh 380 f form

- An x form

- Bcal 1045 df dg 319 core unprotected bcal 3748 zoning approval for group child care homes form

Find out other Disclaimer Of Right To Inherit Or Inheritance All Property From Estate Or Trust

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word