Late Payment Fee Form

What is the late payment fee?

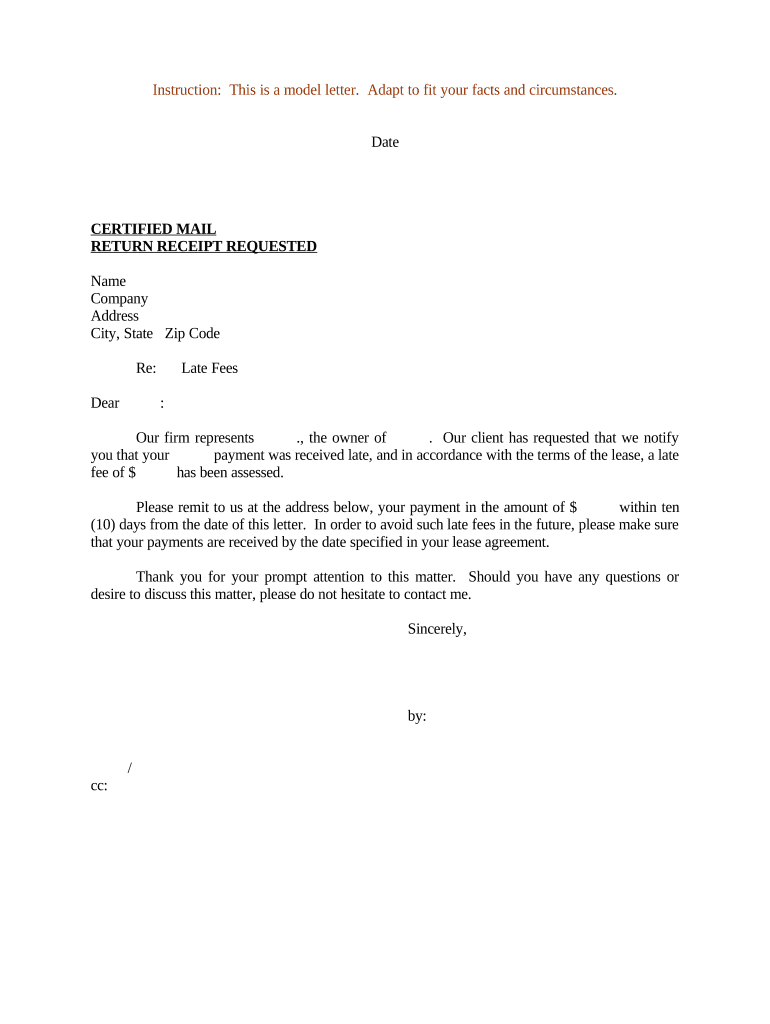

A late payment fee is a charge imposed when a payment is not made by the due date specified in an agreement or invoice. This fee serves as a financial incentive for timely payments and helps businesses manage their cash flow effectively. The amount of the late payment fee can vary based on the terms set forth in the original agreement, and it is essential for both parties to understand these terms to avoid misunderstandings.

Key elements of the late payment fee

When drafting a letter for late payment of fees, it is crucial to include specific elements to ensure clarity and legality. Key components include:

- Recipient Information: Clearly state the name and address of the individual or organization responsible for the late payment.

- Invoice Details: Reference the invoice number, date of issuance, and the original due date.

- Amount Due: Specify the total amount owed, including any applicable late fees.

- Payment Instructions: Provide clear instructions on how the payment can be made, including acceptable payment methods.

- Consequences of Non-Payment: Outline any further actions that may be taken if the payment is not received, such as additional fees or legal action.

How to use the late payment fee

Utilizing a late payment fee effectively requires clear communication and adherence to the terms outlined in the original agreement. When a payment is late, the following steps should be taken:

- Review the original agreement to confirm the late payment terms and fee structure.

- Draft a letter for late payment of fees, including all necessary details.

- Send the letter through a reliable method, ensuring it reaches the recipient promptly.

- Keep a record of all communications and payments related to the late fee.

Steps to complete the late payment fee

Completing the process of imposing a late payment fee involves several important steps:

- Identify the overdue payment and confirm the amount due.

- Draft a formal letter detailing the late payment fee.

- Send the letter to the debtor, ensuring it is delivered to the correct address.

- Monitor the payment status and follow up if necessary.

- Document all interactions regarding the late payment for future reference.

Legal use of the late payment fee

For a late payment fee to be legally enforceable, it must comply with applicable laws and regulations. This includes:

- Clearly stating the fee in the original agreement.

- Ensuring the fee is reasonable and not excessively punitive.

- Providing proper notice to the debtor regarding the late payment and associated fees.

Examples of using the late payment fee

Examples can help illustrate how late payment fees are applied in real-world scenarios:

- A contractor may include a late fee clause in their service agreement, charging a specific percentage of the total invoice for each week a payment is overdue.

- A landlord might impose a flat late fee for rent payments received after the due date, as specified in the lease agreement.

- A utility company may charge a late fee after a grace period, encouraging timely bill payments from customers.

Quick guide on how to complete late payment fee

Complete Late Payment Fee effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Late Payment Fee using the airSlate SignNow apps available for Android or iOS and enhance any document-based task today.

How to modify and electronically sign Late Payment Fee with ease

- Obtain Late Payment Fee and click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize relevant parts of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Late Payment Fee to ensure great communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a late fee letter template?

A late fee letter template is a pre-designed document that outlines a late payment's terms and consequences. It's essential for businesses to communicate payment expectations clearly. With airSlate SignNow, you can easily customize and send these templates to ensure timely payments from customers.

-

How can I create a late fee letter template using airSlate SignNow?

Creating a late fee letter template with airSlate SignNow is simple. You can select from our range of customizable templates or start from scratch, adding your terms, amounts, and additional information. Once tailored to your needs, you can save it for future use, streamlining your billing process.

-

What are the benefits of using a late fee letter template?

Using a late fee letter template helps maintain professionalism and consistency in your communication with clients. It ensures that your terms are clear, reducing confusion and promoting timely payments. By using airSlate SignNow's templates, you can also save time and minimize administrative effort.

-

Is there a cost associated with using the late fee letter template in airSlate SignNow?

Yes, airSlate SignNow offers different pricing plans that include access to various templates, including the late fee letter template. We provide flexible options catering to businesses of all sizes. Check our pricing page for detailed information on what each plan includes.

-

Can I integrate the late fee letter template with my existing CRM system?

Absolutely! airSlate SignNow offers seamless integrations with multiple CRM systems. You can easily integrate the late fee letter template into your existing workflows, automating your billing and payment processes for enhanced efficiency.

-

How does airSlate SignNow ensure the security of my late fee letter template?

Security is a top priority for airSlate SignNow. We implement industry-standard security measures, including encryption and authentication protocols, to protect your late fee letter templates and any sensitive information. You can send and store your documents with confidence.

-

Can I customize the late fee letter template for different clients?

Yes, the late fee letter template in airSlate SignNow can be easily customized for different clients. You can edit terms, amounts, and personal messages to tailor the content according to each client's situation. This versatility helps maintain a good relationship while communicating necessary information.

Get more for Late Payment Fee

Find out other Late Payment Fee

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form