Receipt Deposit Form

What is the receipt deposit?

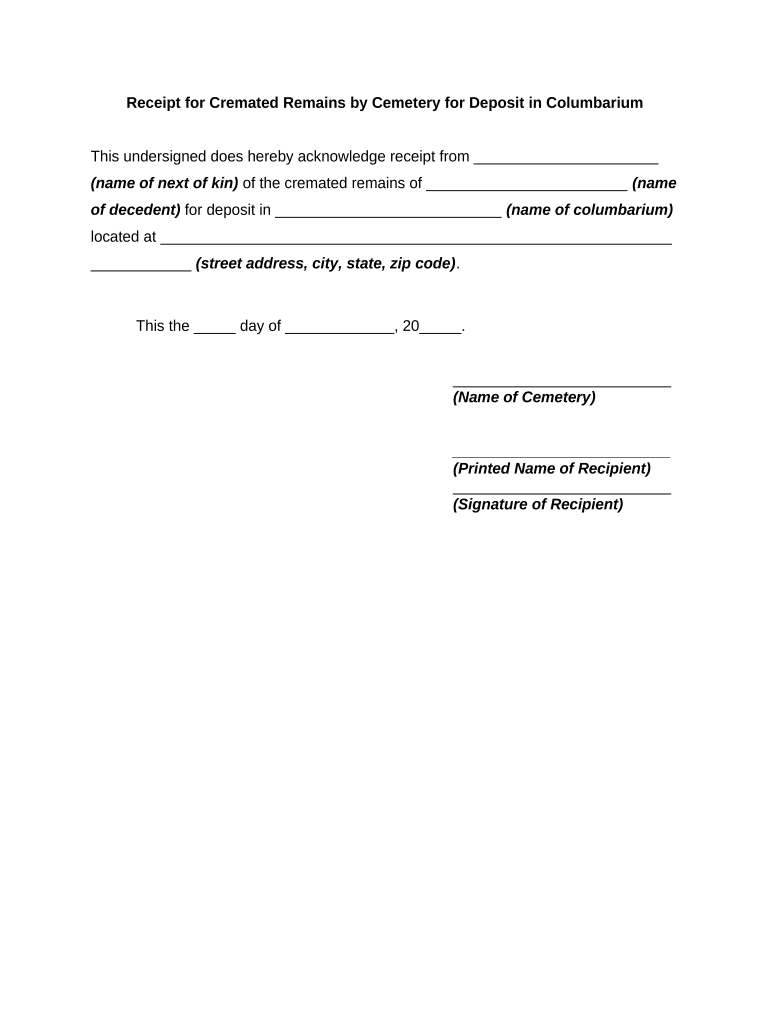

The receipt deposit is a document used to confirm that a specific amount of money has been deposited into an account. This form serves as proof of transaction for both the depositor and the financial institution. It typically includes details such as the date of deposit, the amount, and the account information. Understanding the purpose and structure of the receipt deposit is essential for maintaining accurate financial records.

How to complete the receipt deposit

Completing the receipt deposit involves several straightforward steps. First, gather all necessary information, including the date, amount, and account number. Next, accurately fill out the form, ensuring that all details are correct to avoid any discrepancies. After filling out the form, review it for accuracy before submitting it to the bank or financial institution. This careful approach helps ensure that the deposit is processed smoothly.

Legal use of the receipt deposit

The receipt deposit holds legal significance as it serves as a record of a financial transaction. For it to be considered legally binding, it must meet specific criteria, such as being signed by both the depositor and the receiving institution. Additionally, compliance with relevant regulations, such as the Electronic Signatures in Global and National Commerce Act (ESIGN), is crucial when submitting the form electronically. This ensures that the receipt deposit is recognized as valid in legal contexts.

Key elements of the receipt deposit

Several key elements must be included in the receipt deposit to ensure its effectiveness. These include:

- Date of deposit: The exact date the money was deposited.

- Amount: The total sum of money being deposited.

- Account information: Details about the account into which the money is being deposited.

- Depositor's signature: The signature of the individual making the deposit, confirming the transaction.

- Receiving institution's acknowledgment: A section for the bank or financial institution to confirm receipt of the deposit.

Examples of using the receipt deposit

The receipt deposit can be utilized in various scenarios, such as personal banking, business transactions, and real estate dealings. For instance, an individual may use a receipt deposit when making a cash deposit to their savings account. Similarly, a business might issue a receipt deposit when accepting payments from clients, ensuring that both parties have a record of the transaction. In real estate, a receipt deposit may serve as proof of earnest money when purchasing a property.

Form submission methods

Submitting the receipt deposit can be done through various methods, depending on the financial institution's policies. Common submission methods include:

- Online: Many banks allow users to submit receipt deposits electronically through their websites or mobile apps.

- Mail: Depositors can send the completed form via postal service to the bank's designated address.

- In-person: Visiting a local branch to submit the receipt deposit directly to a teller is also an option.

Quick guide on how to complete receipt deposit

Complete Receipt Deposit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Receipt Deposit on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Receipt Deposit with ease

- Obtain Receipt Deposit and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and eSign Receipt Deposit and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a receipt deposit in airSlate SignNow?

A receipt deposit in airSlate SignNow refers to the digital confirmation of a transaction or payment that has been received. This feature enables users to streamline their financial documentation, ensuring that all receipt deposits are securely stored and easily accessible for future reference.

-

How does airSlate SignNow simplify receipt deposit management?

airSlate SignNow simplifies receipt deposit management by allowing users to create, send, and sign receipts electronically. This eliminates the need for physical paperwork, reduces errors, and speeds up the entire process, making it easy to track and manage all receipt deposits efficiently.

-

Is there a cost associated with using the receipt deposit feature?

The receipt deposit feature in airSlate SignNow is included in various pricing plans, which cater to different business needs. Users can choose a plan that best fits their budget while enjoying the benefits of seamless document management, including receipt deposits at no additional charge.

-

Can I integrate airSlate SignNow with other financial software for receipt deposits?

Yes, airSlate SignNow offers various integrations with popular financial software, allowing users to seamlessly manage their receipt deposits. These integrations ensure that all financial data, including eSignatures and receipts, flows smoothly between platforms, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for receipt deposits?

Using airSlate SignNow for receipt deposits offers numerous benefits, including increased efficiency, enhanced security, and easier tracking of financial transactions. With eSigning capabilities, you can ensure that all receipt deposits are authenticated and legally binding, improving trust and accountability.

-

How secure is the data associated with receipt deposits in airSlate SignNow?

airSlate SignNow prioritizes data security for all documents, including receipt deposits. The platform employs industry-leading encryption and compliance protocols to protect sensitive financial information, ensuring that your receipt deposits remain confidential and secure.

-

Can I customize my receipt deposit templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize receipt deposit templates to fit their specific business needs. This feature ensures that your receipts align with your branding while allowing for the inclusion of all necessary information, improving professionalism and consistency.

Get more for Receipt Deposit

Find out other Receipt Deposit

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure