Credit Card Form Printable

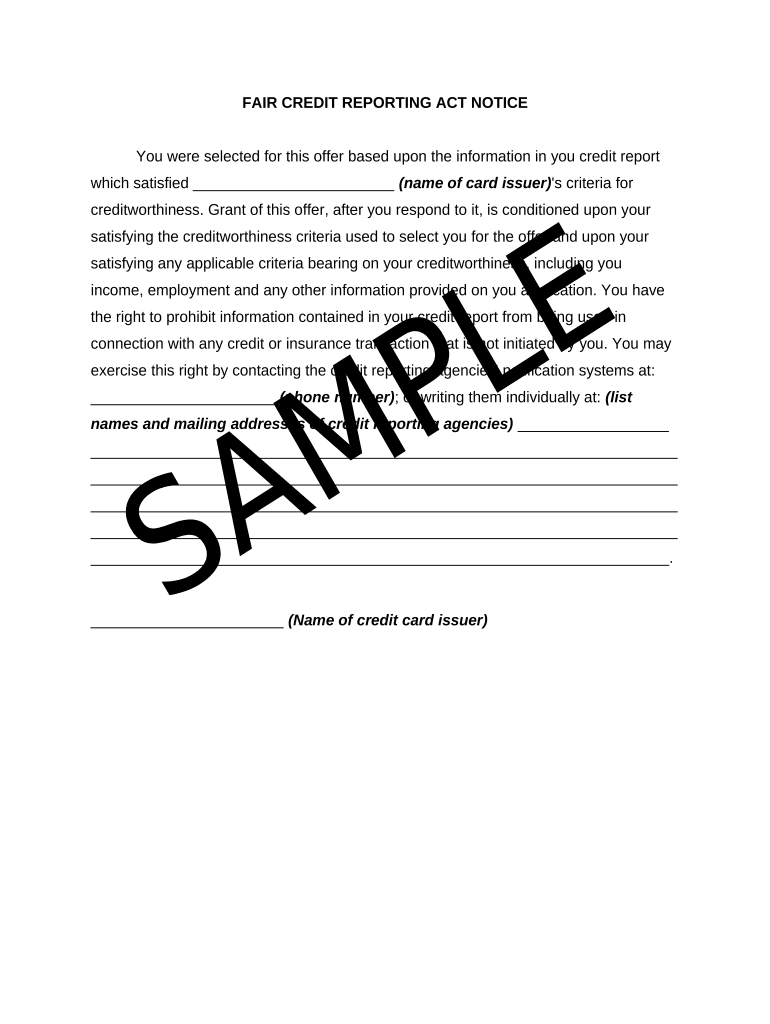

What is the credit prohibit form?

The credit prohibit form is a document used to outline the terms and conditions associated with the use of credit. This form is essential for both businesses and individuals as it helps clarify the rights and responsibilities related to credit transactions. It typically includes details such as the credit limit, interest rates, and any applicable fees. Understanding this form is crucial for ensuring compliance with financial regulations and protecting both parties involved in the credit agreement.

Key elements of the credit prohibit form

Several key elements are fundamental to the credit prohibit form, ensuring clarity and legal compliance. These include:

- Borrower Information: Full name, address, and identification details of the borrower.

- Credit Terms: Specifics on the credit limit, interest rates, and payment schedules.

- Fees and Charges: Any additional fees associated with the credit, such as late payment penalties.

- Signatures: Required signatures from both the lender and borrower to validate the agreement.

- Legal Compliance: Statements ensuring adherence to relevant laws and regulations.

Steps to complete the credit prohibit form

Completing the credit prohibit form involves several straightforward steps to ensure accuracy and compliance. Follow these steps to fill out the form effectively:

- Gather Necessary Information: Collect all relevant personal and financial information needed for the form.

- Fill in Borrower Details: Enter the borrower's name, address, and identification information accurately.

- Specify Credit Terms: Clearly outline the credit limit, interest rates, and payment terms.

- Review Fees: List any applicable fees and charges associated with the credit agreement.

- Sign the Form: Ensure both parties sign the document to validate the agreement.

Legal use of the credit prohibit form

The legal use of the credit prohibit form is governed by various regulations that ensure its validity. For the form to be considered legally binding, it must meet specific criteria:

- Compliance with ESIGN and UETA: The form must adhere to electronic signature laws, ensuring that eSignatures are recognized legally.

- Clear Terms: All terms must be clearly defined to avoid ambiguity and potential disputes.

- Proper Signatures: Both parties must provide valid signatures, whether electronic or handwritten, to authenticate the agreement.

How to use the credit prohibit form

The credit prohibit form can be utilized in various scenarios, primarily in financial transactions involving credit. Here’s how to effectively use this form:

- Loan Applications: Use the form when applying for loans to outline the credit terms and conditions.

- Credit Agreements: Implement the form in agreements between lenders and borrowers to formalize the credit arrangement.

- Record Keeping: Maintain a copy of the completed form for personal records and future reference.

Examples of using the credit prohibit form

Understanding practical applications of the credit prohibit form can enhance its effectiveness. Here are a few examples:

- Personal Loans: Individuals can use the form when borrowing money from friends or family, ensuring clarity on repayment terms.

- Business Financing: Companies may utilize the form when securing financing from banks or investors, detailing the credit terms.

- Credit Card Agreements: Financial institutions often use similar forms to outline the terms for credit card usage, including fees and interest rates.

Quick guide on how to complete credit card form printable

Effortlessly Prepare Credit Card Form Printable on Any Device

The management of online documents has gained signNow traction among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right format and securely save it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents quickly and seamlessly. Handle Credit Card Form Printable on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The simplest way to alter and electronically sign Credit Card Form Printable without hassle

- Find Credit Card Form Printable and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Credit Card Form Printable and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'credit prohibit blank' mean in terms of eSigning documents?

The term 'credit prohibit blank' refers to a situation where a document cannot have any blank fields when requesting a credit application. With airSlate SignNow, you can ensure that all required fields are filled before your document is sent, preventing any instances of credit prohibit blank situations.

-

How does airSlate SignNow help prevent credit prohibit blank issues?

airSlate SignNow provides features that enable you to set mandatory fields within your documents. By utilizing these tools, you can ensure that your documents are completed correctly, thereby avoiding any complications related to credit prohibit blank requirements.

-

Are there any additional costs associated with addressing credit prohibit blank requirements?

No, airSlate SignNow does not charge extra for ensuring compliance with credit prohibit blank regulations. Our pricing is straightforward and includes all necessary features to help you manage document compliance without hidden fees.

-

What features does airSlate SignNow offer to enhance compliance with credit prohibit blank standards?

Key features include custom templates, mandatory field settings, and document tracking. These tools are designed to ensure that all necessary information is filled out correctly, addressing the credit prohibit blank standards effectively.

-

Can I integrate airSlate SignNow with my existing systems to manage credit prohibit blank requirements?

Yes, airSlate SignNow offers seamless integrations with various platforms, such as CRMs and document management systems. This capability allows you to streamline your processes while ensuring compliance with credit prohibit blank guidelines.

-

How secure is airSlate SignNow when handling documents subject to credit prohibit blank regulations?

AirSlate SignNow employs industry-leading security protocols, including encryption and secure server environments. This ensures that documents subject to credit prohibit blank requirements are handled securely and are protected from unauthorized access.

-

What benefits does using airSlate SignNow provide for credit prohibit blank documentation?

Using airSlate SignNow streamlines the document signing process while ensuring that your documents comply with credit prohibit blank requirements. This reduces errors, saves time, and improves the overall efficiency of your business operations.

Get more for Credit Card Form Printable

Find out other Credit Card Form Printable

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online