Independent Contractor Licensed Form

What is the Independent Contractor Licensed

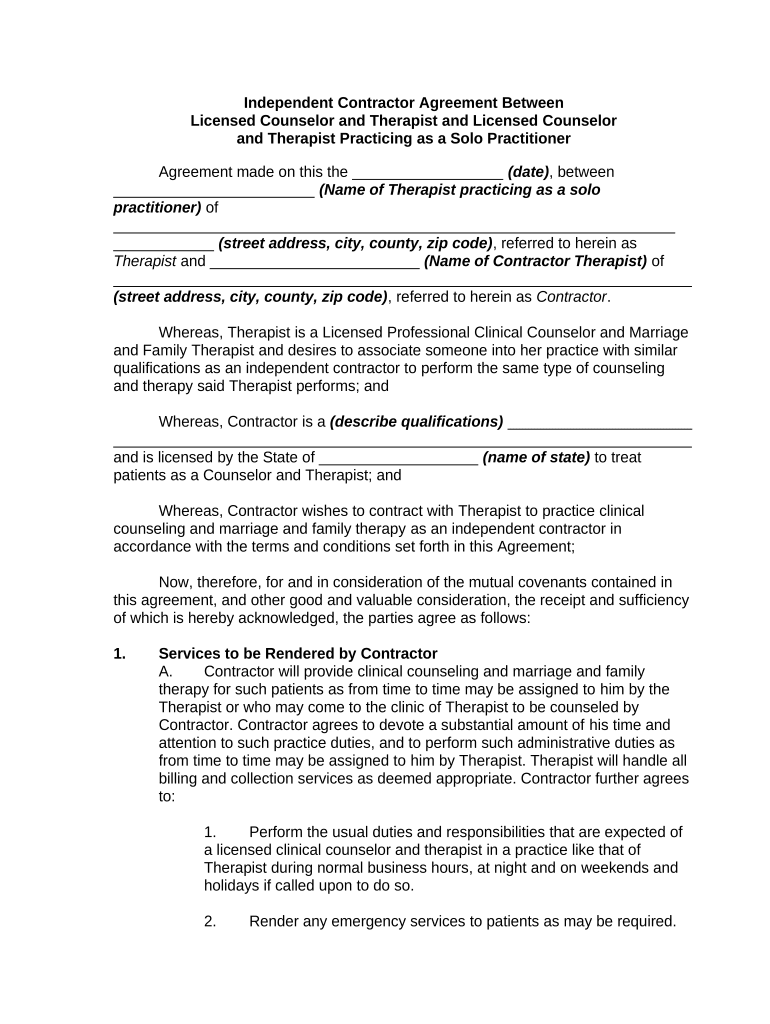

The independent contractor licensed form is a crucial document for individuals or businesses that engage independent contractors. This form outlines the terms of the working relationship, including the scope of work, payment structure, and duration of the contract. It serves to protect both parties by clearly defining expectations and responsibilities. In many cases, having this form can help ensure compliance with state and federal regulations, making it a vital component of the contracting process.

How to use the Independent Contractor Licensed

Using the independent contractor licensed form involves several steps to ensure that all necessary information is captured accurately. First, gather essential details about the contractor, including their name, contact information, and any relevant licensing numbers. Next, outline the specific services to be provided, including timelines and payment terms. Once all information is compiled, both parties should review the document for clarity and accuracy before signing. Utilizing a secure digital platform, like signNow, can streamline this process, allowing for easy editing and signing of the document.

Steps to complete the Independent Contractor Licensed

Completing the independent contractor licensed form requires careful attention to detail. Follow these steps for a smooth process:

- Collect necessary information about the contractor and the project.

- Clearly define the scope of work, including deliverables and deadlines.

- Specify payment terms, including rates and payment schedules.

- Include clauses related to confidentiality, termination, and dispute resolution.

- Review the completed form for accuracy and completeness.

- Sign the document electronically or in person, ensuring both parties retain a copy.

Legal use of the Independent Contractor Licensed

The legal use of the independent contractor licensed form hinges on compliance with applicable laws. It is essential to ensure that the form meets the requirements set forth by the IRS and state regulations. This includes proper classification of workers to avoid misclassification penalties. The form should also adhere to eSignature laws, ensuring that electronic signatures are legally binding. Using a reputable eSigning platform can help maintain compliance and provide necessary legal protections.

Key elements of the Independent Contractor Licensed

Key elements of the independent contractor licensed form include:

- Identification of Parties: Names and addresses of both the contractor and the hiring entity.

- Scope of Work: Detailed description of the services to be performed.

- Payment Terms: Rates, payment methods, and schedule.

- Duration: Start and end dates of the contract.

- Termination Clause: Conditions under which the contract can be terminated.

- Confidentiality Agreement: Provisions to protect sensitive information.

State-specific rules for the Independent Contractor Licensed

State-specific rules for the independent contractor licensed form can vary significantly. Each state may have unique requirements regarding the classification of independent contractors, tax obligations, and licensing. It is important to consult state regulations to ensure compliance. Some states may require additional documentation or specific language in the contract to meet legal standards. Understanding these nuances can help prevent legal issues and ensure that both parties are protected under the law.

Quick guide on how to complete independent contractor licensed

Complete Independent Contractor Licensed effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Independent Contractor Licensed on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Independent Contractor Licensed with ease

- Obtain Independent Contractor Licensed and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the exact same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, burdensome form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign Independent Contractor Licensed and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an independent contractor licensed and why is it important?

An independent contractor licensed is an individual who operates as a self-employed professional and possesses the necessary licensing for their specific industry. This licensing ensures compliance with local regulations and enhances credibility with clients. Understanding the significance of being an independent contractor licensed is crucial for anyone looking to establish a reputable business.

-

How does airSlate SignNow facilitate document signing for independent contractors?

airSlate SignNow provides independent contractors licensed with a seamless way to send, sign, and manage documents electronically. Its user-friendly interface allows for quick eSigning and document tracking, making it easier to maintain organization and efficiency. This solution is especially beneficial for independent contractors looking to streamline their operations.

-

What are the pricing options for airSlate SignNow for independent contractors licensed?

airSlate SignNow offers flexible pricing plans suitable for independent contractors licensed, ensuring that you only pay for the features you need. Plans range from basic options to more advanced features that cater to different business sizes and needs. It’s a cost-effective solution designed to enhance productivity without breaking the bank.

-

Can airSlate SignNow integrate with other software for independent contractors licensed?

Yes, airSlate SignNow easily integrates with popular software platforms that independent contractors licensed may already be using, such as CRM and project management tools. These integrations enhance workflow efficiency by allowing for seamless data transfer and document management. This ensures that all aspects of your business remain connected.

-

What security features does airSlate SignNow offer for independent contractors licensed?

airSlate SignNow prioritizes the security of documents for independent contractors licensed by implementing industry-standard encryption and secure storage measures. Each signed document is protected, ensuring that sensitive information remains confidential. This commitment to security builds trust with clients and protects business interests.

-

Are there any benefits of using airSlate SignNow for independent contractors licensed?

Using airSlate SignNow benefits independent contractors licensed by offering an efficient and reliable method for handling document signatures. This not only speeds up the process of getting contracts signed but also ensures that all documents are stored securely and easily accessible. Such features allow independent contractors to focus more on their core business activities.

-

How can independent contractors licensed ensure compliance with legal regulations using airSlate SignNow?

Independent contractors licensed can ensure compliance with legal regulations by utilizing airSlate SignNow's compliant eSignature features. The platform adheres to various legal standards, providing legally binding signatures that meet industry requirements. This helps independent contractors maintain their professional standing and avoid potential legal issues.

Get more for Independent Contractor Licensed

Find out other Independent Contractor Licensed

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple