Inter Vivos QTIP Trust with Principal to Donor's Children on Spouse's Death Form

What is the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

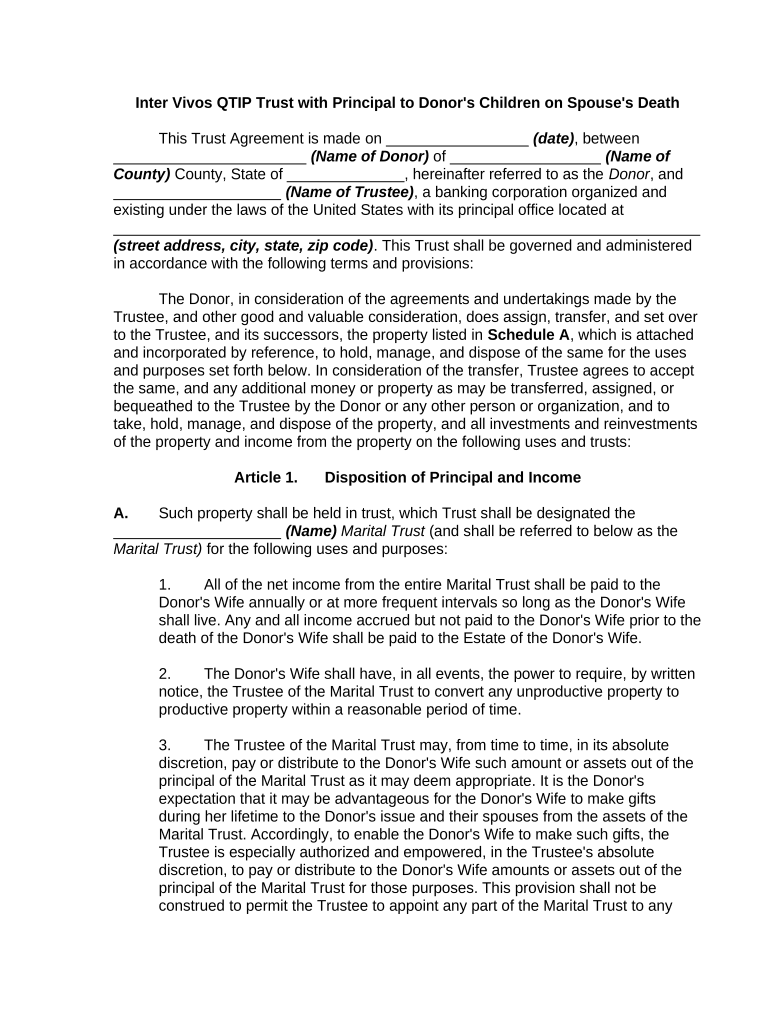

The Inter Vivos QTIP Trust with principal to donor's children on spouse's death is a specialized estate planning tool. This trust allows a donor to transfer assets into a trust during their lifetime while ensuring that the surviving spouse receives income from the trust assets until their death. Upon the spouse's death, the principal of the trust is distributed to the donor's children. This arrangement provides financial security for the spouse while also ensuring that the donor's children ultimately inherit the assets, thereby balancing the interests of both parties.

Key elements of the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

Several key elements define the Inter Vivos QTIP Trust. First, it must be established during the donor's lifetime, distinguishing it from testamentary trusts that take effect after death. Second, the trust must specify that the surviving spouse is entitled to all income generated by the trust assets. Additionally, the trust must clearly outline the distribution of the principal to the donor's children upon the spouse's death. These elements ensure that both the income needs of the spouse and the inheritance rights of the children are met.

Steps to complete the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

Completing the Inter Vivos QTIP Trust involves several important steps. First, the donor should consult with an estate planning attorney to ensure compliance with state laws. Next, the donor must draft the trust document, clearly outlining the terms, including the income distribution to the spouse and the principal distribution to the children. After drafting, the donor should fund the trust by transferring assets into it. Finally, the donor and spouse must sign the trust document, ensuring it is legally binding. Proper execution of these steps is crucial for the trust to function as intended.

Legal use of the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

The legal use of the Inter Vivos QTIP Trust is governed by both federal and state laws. It is essential that the trust complies with the requirements set forth in the Internal Revenue Code to qualify for QTIP treatment. This includes ensuring that the trust provides for the surviving spouse to receive all income generated by the trust assets during their lifetime. Additionally, the trust must be irrevocable, meaning it cannot be altered or terminated by the donor after it is established. Understanding these legal requirements helps in the proper administration of the trust and ensures its intended benefits are realized.

How to use the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

Using the Inter Vivos QTIP Trust effectively involves understanding its structure and purpose. The donor should first ensure that the trust is properly funded with suitable assets, such as real estate or investments. The surviving spouse can then benefit from the income generated by these assets, providing financial support during their lifetime. Upon the spouse's death, the trust's principal will be distributed to the donor's children, as specified in the trust document. This method allows for a smooth transition of assets while fulfilling the donor's wishes regarding their estate.

Examples of using the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

Examples of the Inter Vivos QTIP Trust in action can illustrate its benefits. For instance, a donor might establish a QTIP trust with a family home as the primary asset. The surviving spouse can live in the home and receive any rental income generated from it. Upon the spouse's death, the home and any remaining assets in the trust would pass directly to the donor's children, ensuring they inherit the property without going through probate. This example highlights how the trust can facilitate both income support for the spouse and a clear inheritance path for the children.

Quick guide on how to complete inter vivos qtip trust with principal to donors children on spouses death

Manage Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can find the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death without hassle

- Obtain Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death and then click Get Form to begin.

- Utilize the tools we offer to complete your file.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

An Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death is a type of trust that allows donors to provide income for a spouse during their lifetime, while ensuring that the principal amount ultimately passes to the donor's children upon the spouse's death. This arrangement offers financial security for the spouse and protects the interests of the children.

-

How does an Inter Vivos QTIP Trust benefit my estate planning?

Using an Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death can simplify your estate planning by clearly delineating the distribution of your assets. It allows you to provide for your spouse while safeguarding your children's inheritance, thus ensuring that your wishes are honored after your passing.

-

What are the key features of the Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

Key features of the Inter Vivos QTIP Trust include the ability to provide income to a spouse, dictate when and how assets are distributed to children, and potentially reduce estate taxes. Additionally, it offers flexibility in managing trust assets and can adapt to changing family circumstances.

-

Are there any costs associated with establishing an Inter Vivos QTIP Trust?

The costs of establishing an Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death may vary depending on legal fees and administrative expenses. It's generally considered a cost-effective option compared to other estate planning strategies, especially in safeguarding asset distribution.

-

Can the Inter Vivos QTIP Trust be modified after it's established?

Yes, an Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death can be modified or revoked by the grantor as long as they are alive and competent. This flexibility allows you to adjust the terms of the trust to reflect changes in your family or financial situation.

-

What are the tax implications of an Inter Vivos QTIP Trust?

An Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death can offer several tax benefits, including potential estate tax deferment and income tax deductions for the spouse receiving trust income. Consulting with a tax professional can help you understand the specific implications for your situation.

-

How does airSlate SignNow assist with creating and managing an Inter Vivos QTIP Trust?

airSlate SignNow simplifies the process of creating and managing documents related to an Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death by providing an intuitive eSign platform. With easy document sharing and secure electronic signatures, you can ensure that all necessary trust documents are properly executed and stored.

Get more for Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

- 5417 form

- Publication 5412 c sp 4 2020 get my payment online tool spanish version form

- Publication 1 ko rev 09 2017 your rights as a taxpayer korean version form

- Irs publication 5420 form

- Publication 5412 o sp 5 2020 economic impact payments amp coronavirus tax relief special section on irsgov spanish version form

- Publication 1 km rev 9 2017 your rights as a taxpayer khmer central cambodia version form

- Irs publication 1 form

- 5412 c form

Find out other Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors