Agreement Exchange Form

What is the Agreement Exchange

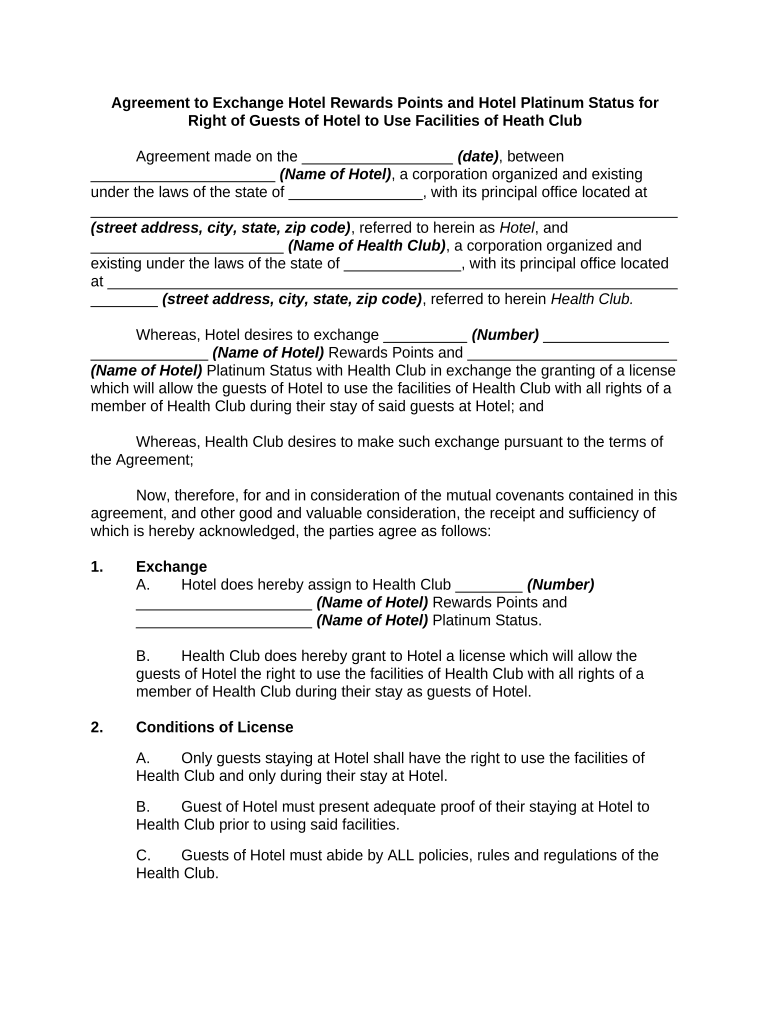

The agreement exchange refers to a structured process where parties involved in a transaction or negotiation share and finalize terms through a formal document. This document outlines the specific agreement points that both parties must adhere to, ensuring clarity and mutual understanding. The agreement exchange is crucial in various contexts, including business partnerships, service contracts, and legal obligations. By utilizing electronic tools, businesses can streamline this process, making it more efficient and accessible.

Key elements of the Agreement Exchange

Understanding the key elements of the agreement exchange is essential for effective document preparation. These elements typically include:

- Parties involved: Clearly identify all individuals or entities entering the agreement.

- Terms and conditions: Specify the obligations, rights, and responsibilities of each party.

- Agreement points: Highlight the critical aspects that need to be agreed upon, such as payment terms, deadlines, and deliverables.

- Signatures: Ensure that all parties provide their signatures, indicating acceptance of the terms.

- Effective date: State when the agreement becomes enforceable.

How to use the Agreement Exchange

Using the agreement exchange effectively involves several steps to ensure that all parties understand and agree to the terms laid out in the document. Begin by drafting the agreement with clear and concise language. Once the draft is ready, share it with all parties for review. Encourage feedback and make necessary adjustments to address any concerns. After finalizing the document, utilize an electronic signature solution to facilitate the signing process. This method not only saves time but also ensures that the agreement is legally binding.

Steps to complete the Agreement Exchange

Completing the agreement exchange involves a systematic approach to ensure all necessary components are addressed. Follow these steps:

- Draft the agreement, including all essential agreement points.

- Distribute the draft to all parties for review and feedback.

- Incorporate any necessary changes based on feedback.

- Finalize the document and prepare it for signatures.

- Utilize an electronic signing platform to collect signatures.

- Store the signed agreement securely for future reference.

Legal use of the Agreement Exchange

The legal validity of the agreement exchange is supported by various regulations, such as the ESIGN Act and UETA. These laws affirm that electronic signatures and documents hold the same legal weight as traditional paper documents, provided that specific criteria are met. It is essential for businesses to ensure compliance with these regulations when engaging in electronic agreements. This includes maintaining proper records and providing a clear process for signing and storing documents.

State-specific rules for the Agreement Exchange

Each state may have its own regulations regarding the agreement exchange, particularly concerning electronic signatures and document storage. It is important for businesses to familiarize themselves with these state-specific rules to ensure compliance. This may involve understanding the requirements for notarization, witness signatures, or specific language that must be included in the agreement. Consulting with a legal professional can provide clarity on these matters.

Quick guide on how to complete agreement exchange

Prepare Agreement Exchange easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed forms, allowing you to access the correct document and securely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without any hassles. Manage Agreement Exchange across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Agreement Exchange effortlessly

- Find Agreement Exchange and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Agreement Exchange and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are agreement points in the context of airSlate SignNow?

Agreement points refer to the specific terms and conditions within a contract or document that require acknowledgment or acceptance by the parties involved. With airSlate SignNow, you can easily highlight these agreement points for clarity, ensuring all parties understand their commitments before signing. This feature enhances communication and reduces misunderstandings.

-

How does airSlate SignNow simplify the management of agreement points?

airSlate SignNow simplifies the management of agreement points by providing a user-friendly interface that allows you to add, edit, and track key terms effortlessly. Document templates can be customized to highlight important agreement points, making it easier for signers to navigate and comprehend essential information. This streamlines the signing process and improves overall efficiency.

-

Is there a cost associated with using airSlate SignNow for agreements?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options for solo users and teams. Each plan allows businesses to manage their agreement points effectively while providing essential features such as unlimited document signing and templates. It's a cost-effective solution that can help save time and boost productivity.

-

What features does airSlate SignNow offer for handling agreement points?

airSlate SignNow includes features such as document templates, reminder notifications, and automated workflows to manage agreement points efficiently. Users can collaborate in real-time to negotiate terms directly on the platform, ensuring that all agreement points are clear and agreed upon before finalizing a document. This leads to a smoother signing experience.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, cloud storage services, and productivity tools. This integration allows you to manage agreement points across platforms without hindrance, ensuring a streamlined workflow that enhances your overall document management process. Simplifying multi-platform communication is one of our key advantages.

-

How does eSigning with airSlate SignNow enhance the handling of agreement points?

eSigning with airSlate SignNow enhances the handling of agreement points by providing a secure and efficient electronic signature process. It ensures that all parties can quickly review and sign documents, acknowledging their agreement points. This reduces delays and increases trust in the signing process, fostering better business relationships.

-

What benefits do businesses get from using airSlate SignNow for their agreement points?

Businesses benefit from using airSlate SignNow for agreement points by reducing paperwork, saving time, and ensuring compliance. The intuitive platform allows for quick access to all necessary documents, ultimately leading to faster deals and agreements. Enhanced tracking features also provide insights into the signing process and document status.

Get more for Agreement Exchange

- Sba has released new borrower application form for schedule c

- Faa form 8610 2 560713814

- Stock transfer form

- Printable 2020 california form 5870 a tax on accumulation distribution of trusts

- Application for benefits georgia department of human form

- Application for a certified copy michigan certificate of form

- Metroplus health plan hiring medicare part cd operations form

- Navpers form 13363 download fillable pdf or fill online

Find out other Agreement Exchange

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter