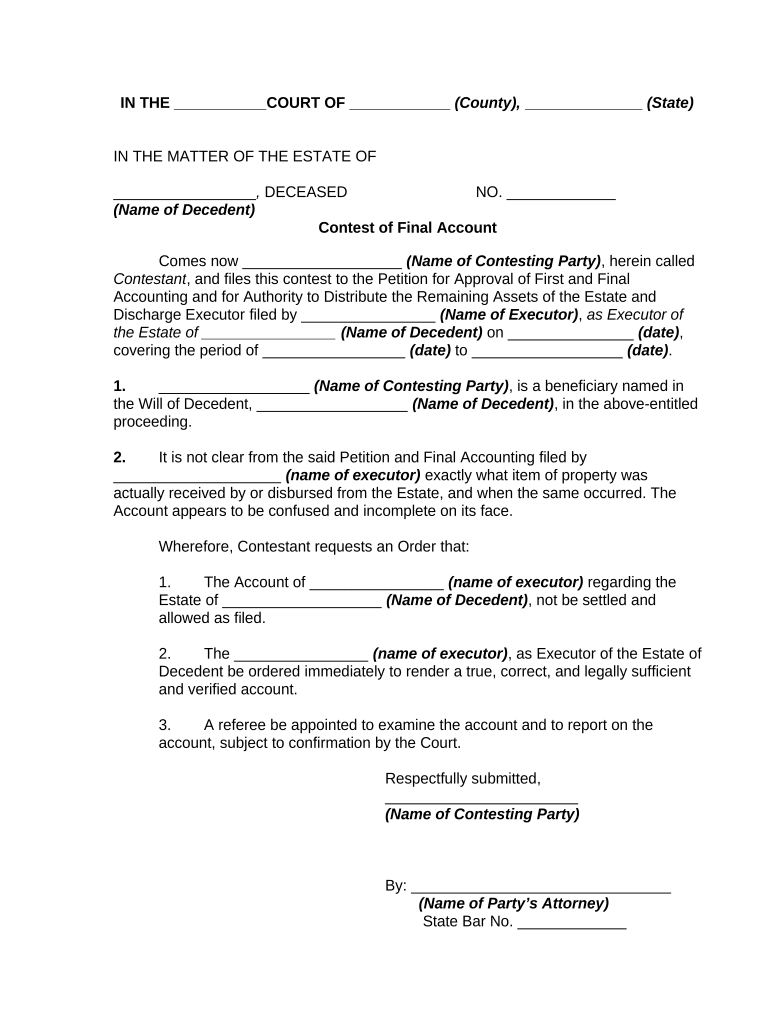

Final Account Estate Form

What is the Final Account Estate

The final account estate is a crucial document in the probate process, summarizing the financial activities of a deceased person's estate. It provides a comprehensive overview of all assets, liabilities, income, and expenses incurred during the administration of the estate. This document is essential for ensuring transparency and accountability to beneficiaries and the court. It typically includes details such as the valuation of assets, distributions to heirs, and any outstanding debts that need to be settled before the estate can be closed.

Steps to Complete the Final Account Estate

Completing the final account estate involves several important steps to ensure accuracy and compliance with legal requirements. Begin by gathering all necessary financial documents, including bank statements, property appraisals, and receipts for expenses. Next, compile a detailed list of all assets and liabilities, ensuring that each item is accurately valued. Once the financial information is organized, prepare the final account form, clearly outlining income, expenses, and distributions to beneficiaries. After completing the form, review it thoroughly for any errors or omissions before submitting it to the probate court.

Legal Use of the Final Account Estate

The final account estate serves a legal purpose in the probate process, as it provides a formal record of the estate's financial activities. It is required by law in most jurisdictions to ensure that the executor or administrator has fulfilled their fiduciary duties. This document must be filed with the probate court, where it may be subject to review by beneficiaries or other interested parties. Properly executing and submitting the final account form can help prevent disputes among heirs and facilitate the smooth closure of the estate.

Required Documents

To complete the final account estate, several key documents are necessary. These include:

- Death certificate of the deceased

- Will or trust documents, if applicable

- Inventory of estate assets

- Records of all income received by the estate

- Receipts for all expenses paid during the administration

- Any correspondence related to the estate

Having these documents readily available will streamline the process and ensure that all necessary information is included in the final account.

Filing Deadlines / Important Dates

Filing deadlines for the final account estate can vary by state, so it is crucial to be aware of the specific timelines applicable in your jurisdiction. Generally, the final account must be submitted within a certain period after the estate has been fully administered, often ranging from six months to one year. It is important to check with the local probate court for exact deadlines to avoid potential penalties or complications in the probate process.

Examples of Using the Final Account Estate

The final account estate can be used in various scenarios to demonstrate the proper handling of an estate's finances. For instance, if an executor is distributing assets to beneficiaries, the final account can provide a clear record of how those distributions were calculated. Additionally, if disputes arise among heirs regarding the management of the estate, the final account serves as a legal document that can clarify the executor's actions and decisions. These examples illustrate the importance of maintaining accurate records throughout the probate process.

Quick guide on how to complete final account estate

Easily Prepare Final Account Estate on Any Device

Digital document management has become increasingly popular among both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without any holdups. Manage Final Account Estate on any platform using the airSlate SignNow applications for Android or iOS and enhance your document-centric workflows today.

How to Edit and Electronically Sign Final Account Estate with Ease

- Find Final Account Estate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with utilities provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and is legally equivalent to a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, and mistakes that require printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Final Account Estate to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a final account estate?

A final account estate refers to the comprehensive financial summary of a deceased person's estate, detailing all assets, liabilities, and distributions. It is typically prepared during the probate process to ensure accurate reporting to beneficiaries and tax authorities. Understanding the final account estate is essential for establishing clear asset management and compliance with legal requirements.

-

How can airSlate SignNow help with final account estates?

airSlate SignNow provides a streamlined solution for managing documents involved in final account estates. Its eSignature features allow for secure and efficient signing of necessary documents, facilitating faster estate settlements. By using airSlate SignNow, professionals can enhance collaboration and maintain compliance with estate laws.

-

What features does airSlate SignNow offer for managing final account estates?

airSlate SignNow offers a range of features tailored to managing final account estates, including customizable templates, secure eSignatures, and document tracking. These tools simplify the process of gathering necessary signatures from multiple parties involved in the estate. Additionally, real-time notifications ensure that all key stakeholders are kept informed throughout the process.

-

Is airSlate SignNow cost-effective for handling final account estates?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling final account estates. With transparent pricing plans and no hidden fees, users can efficiently manage their document workflows without incurring excessive costs. By reducing paperwork and speeding up the eSignature process, airSlate SignNow ultimately saves time and resources.

-

Can I integrate airSlate SignNow with other tools when managing final account estates?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, such as CRMs, legal software, and document management systems. This flexibility ensures that you can incorporate airSlate SignNow into your existing workflows when dealing with final account estates, enhancing efficiency and productivity.

-

What benefits does airSlate SignNow provide for legally closing a final account estate?

Using airSlate SignNow to close a final account estate provides numerous benefits, including faster document turnaround and enhanced security. The platform’s compliance with eSignature laws ensures that your documents are legally binding and secure. Additionally, the ease of use allows estate executors to focus on their responsibilities without being bogged down by paperwork.

-

How secure is airSlate SignNow for managing sensitive final account estate documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information related to final account estates. The platform utilizes advanced encryption technologies and complies with industry standards for data protection. Users can rest assured that their documents are handled with the utmost security and confidentiality.

Get more for Final Account Estate

- To act as my representative in connection with my claim or asserted form

- Export certain national firearmsact nfa firearms form

- Agency summary department of justiceit dashboard form

- Form 027 part 2 new aircraft owner to become registration holder

- Mr1 application for registration and compulsory third party form

- Individualownersole proprietor form

- Printable 2020 california form 590 p nonresident withholding exemption certificate for previously reported income

- To be filled up by bir dln form

Find out other Final Account Estate

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document