Printable California Form 590 P Nonresident Withholding Exemption Certificate for Previously Reported Income

Understanding the California Form 590 P Nonresident Withholding Exemption Certificate

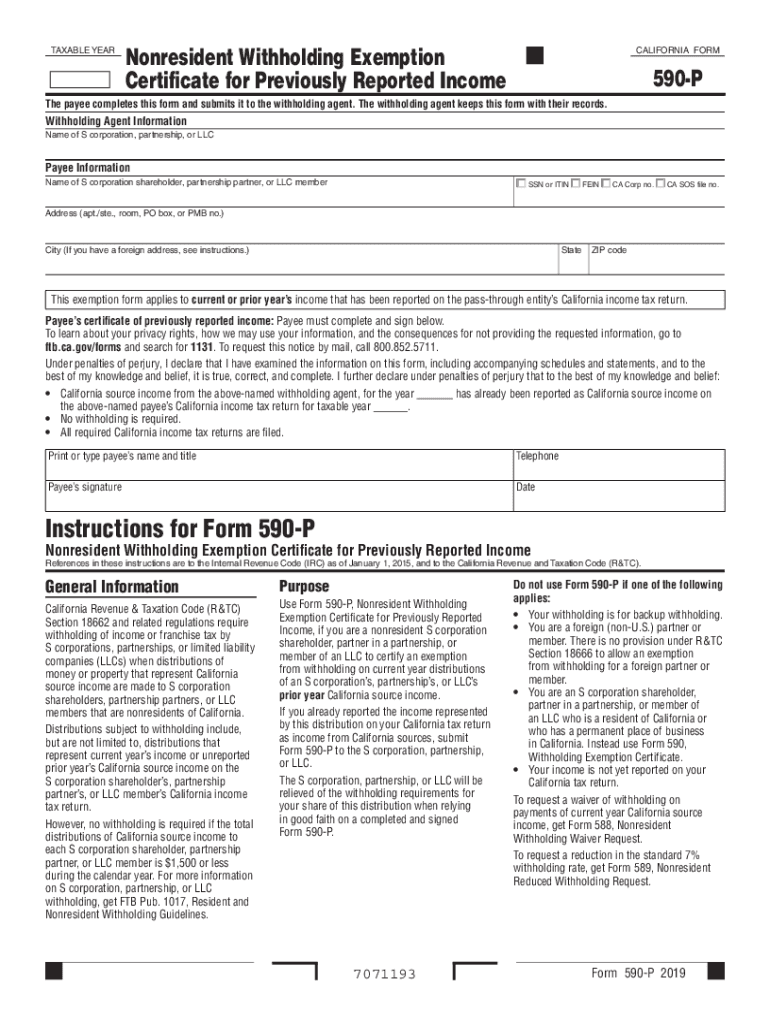

The California Form 590 P serves as a Nonresident Withholding Exemption Certificate. This form is essential for individuals who have previously reported income and wish to claim an exemption from withholding on certain types of income. It helps nonresidents avoid unnecessary tax withholding on income that is not subject to California tax. Understanding this form is crucial for ensuring compliance with state tax regulations while optimizing your tax situation.

Steps to Complete the California Form 590 P

Completing the California Form 590 P involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your name, address, and taxpayer identification number. Next, provide details about the income for which you are claiming the exemption. It is important to accurately fill out each section to avoid delays or issues with the California Franchise Tax Board. Ensure that you sign and date the form before submission.

Eligibility Criteria for Using the California Form 590 P

To qualify for the California Form 590 P, you must meet specific eligibility criteria. Primarily, this form is intended for nonresidents who have previously reported income that is not subject to withholding. Additionally, you should confirm that the income in question falls under the categories eligible for exemption. Understanding these criteria is vital to ensure that you correctly utilize the form and avoid potential penalties.

Legal Use of the California Form 590 P

The legal use of the California Form 590 P is governed by state tax laws. This form is designed to comply with California's withholding regulations, allowing nonresidents to claim exemptions as warranted. It is essential to use the form accurately to ensure that your exemption is recognized by the California Franchise Tax Board. Misuse or incorrect completion of the form may lead to penalties or additional tax liabilities.

Filing Deadlines for the California Form 590 P

Filing deadlines for the California Form 590 P are critical to ensure timely compliance with tax regulations. Generally, the form should be submitted prior to the payment of income subject to withholding. It is advisable to check the California Franchise Tax Board's official guidelines for specific deadlines, as these can vary based on the type of income and other factors. Staying informed about these dates helps prevent unnecessary withholding and potential penalties.

Examples of Using the California Form 590 P

Practical examples of using the California Form 590 P can help clarify its application. For instance, a nonresident contractor performing services in California may use this form to claim an exemption on payments received for work completed. Similarly, a nonresident investor receiving rental income from California properties can utilize the form to avoid withholding on that income. Understanding these scenarios can enhance your ability to effectively utilize the form.

Quick guide on how to complete printable 2020 california form 590 p nonresident withholding exemption certificate for previously reported income

Effortlessly Prepare Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to access the right form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income on any device with the airSlate SignNow apps for Android or iOS and simplify any document-driven procedure today.

How to Edit and eSign Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income with Ease

- Find Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard handwritten signature.

- Review the details and hit the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 california form 590 p nonresident withholding exemption certificate for previously reported income

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the 590 2020 form and why is it important?

The 590 2020 form is a crucial document for California tax purposes, specifically used to report income tax withholding exemptions. Properly filling out this form can help ensure that you do not have unnecessary state tax withheld from your paychecks. Understanding the implications of the 590 2020 form can signNowly impact your tax obligations.

-

How can airSlate SignNow help with the 590 2020 form?

airSlate SignNow streamlines the process of completing the 590 2020 form by providing an easy-to-use eSigning solution. You can quickly fill out, sign, and send the 590 2020 form electronically, saving time and reducing the risk of errors. This efficiency is especially helpful during tax season when ensuring accuracy is paramount.

-

Is there a cost associated with using airSlate SignNow for the 590 2020 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs and budgets. Whether you need basic eSignature capabilities or advanced document management features, you can find a plan that suits your requirements while efficiently managing the 590 2020 form. Investing in our platform can enhance your document workflow signNowly.

-

Can I integrate airSlate SignNow with other tools for managing the 590 2020 form?

Absolutely! airSlate SignNow integrates seamlessly with various popular tools, including cloud storage services and CRM systems. This integration allows for a more streamlined process when accessing and managing the 590 2020 form alongside other essential documents. Enjoy increased productivity by connecting your favorite apps to airSlate SignNow.

-

What features does airSlate SignNow offer for handling the 590 2020 form?

airSlate SignNow provides several key features that simplify handling the 590 2020 form, including templates, automated workflows, and secure document storage. With user-friendly tools to customize your documents, you can ensure that the 590 2020 form is always up to date. Additionally, our platform offers robust security features to protect your sensitive information.

-

How secure is airSlate SignNow when signing the 590 2020 form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to ensure that all transactions, including those involving the 590 2020 form, are protected. You can confidently sign and send sensitive documents knowing that they are shielded from unauthorized access.

-

Can I track the status of my 590 2020 form once sent through airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tracking features that allow you to monitor the status of your sent 590 2020 form. This includes notifications when the document is viewed, signed, or completed. Keeping track of your documents ensures you never miss a step in your filing process.

Get more for Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

Find out other Printable California Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer