IndividualOwnerSole Proprietor Form

What is the IndividualOwnerSole Proprietor

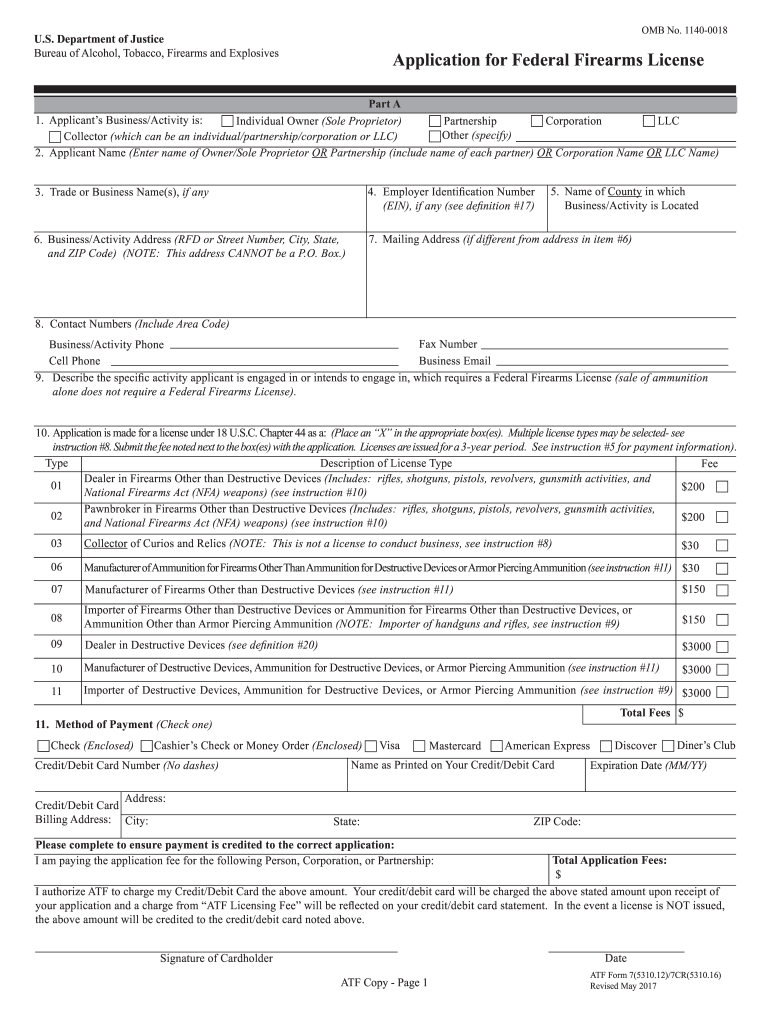

The IndividualOwnerSole Proprietor form is a crucial document for individuals operating as sole proprietors in the United States. This form serves as a declaration of the individual's business activities and is often required for tax reporting purposes. Sole proprietorships are the simplest form of business entity, where the owner and the business are legally considered the same entity. This means that the owner is personally liable for all debts and obligations incurred by the business.

How to use the IndividualOwnerSole Proprietor

Using the IndividualOwnerSole Proprietor form involves several key steps. First, gather all necessary information, including your business name, address, and any relevant financial data. Next, fill out the form accurately, ensuring that all information is complete and truthful. Once completed, the form can be submitted to the appropriate tax authority or used for various business-related purposes, such as opening a business bank account or applying for licenses.

Steps to complete the IndividualOwnerSole Proprietor

Completing the IndividualOwnerSole Proprietor form requires attention to detail. Follow these steps:

- Collect your personal information, including Social Security number and business details.

- Fill in the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form electronically or via mail, depending on the requirements of your local tax authority.

Legal use of the IndividualOwnerSole Proprietor

The IndividualOwnerSole Proprietor form is legally binding when completed correctly. It must comply with federal and state regulations regarding business operations and tax obligations. Ensuring that the form is filled out accurately and submitted on time helps avoid legal complications and penalties. Additionally, using a reliable electronic signature solution can enhance the form's validity and security.

Key elements of the IndividualOwnerSole Proprietor

Several key elements define the IndividualOwnerSole Proprietor form. These include:

- Business Name: The name under which the business operates.

- Owner Information: Personal details of the sole proprietor, including name and contact information.

- Business Address: The physical location where the business operates.

- Tax Identification Number: The Social Security number or Employer Identification Number (EIN) used for tax purposes.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the IndividualOwnerSole Proprietor form. It is essential for sole proprietors to understand their tax obligations, including income reporting and allowable deductions. The IRS requires sole proprietors to report business income on their personal tax returns, typically using Schedule C. Familiarizing yourself with IRS guidelines ensures compliance and helps maximize potential tax benefits.

Quick guide on how to complete individualownersole proprietor

Complete IndividualOwnerSole Proprietor effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage IndividualOwnerSole Proprietor on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign IndividualOwnerSole Proprietor effortlessly

- Locate IndividualOwnerSole Proprietor and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Edit and eSign IndividualOwnerSole Proprietor and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individualownersole proprietor

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it benefit an IndividualOwnerSole Proprietor?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents. For an IndividualOwnerSole Proprietor, it saves time, enhances professionalism, and ensures legal compliance. With features tailored for single-person businesses, it offers a cost-effective way to manage documents securely.

-

What pricing plans are available for IndividualOwnerSole Proprietors?

airSlate SignNow offers flexible pricing plans that cater specifically to IndividualOwnerSole Proprietor needs. You can choose from monthly or annual subscriptions, with a notable discount for annual commitments. This ensures you get the best value while gaining access to essential features and tools.

-

What key features does airSlate SignNow provide for IndividualOwnerSole Proprietors?

airSlate SignNow includes essential features like document templates, automated workflows, and unlimited eSignatures, all beneficial for an IndividualOwnerSole Proprietor. These features streamline the document management process, allowing you to focus more on your business. Additionally, the user-friendly interface makes it easy for anyone to get started.

-

Is airSlate SignNow secure for an IndividualOwnerSole Proprietor?

Absolutely! airSlate SignNow prioritizes security and compliance, making it safe for IndividualOwnerSole Proprietor use. With encryption and secure data storage, your documents and sensitive information are protected. You can confidently send and receive documents knowing they are secure.

-

Can IndividualOwnerSole Proprietors integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, especially beneficial for IndividualOwnerSole Proprietors. You can easily connect it with tools like Google Drive, Salesforce, and more, enhancing your workflow and ensuring smoother operations. This flexibility allows you to customize your document management process.

-

How does airSlate SignNow improve productivity for an IndividualOwnerSole Proprietor?

By automating document workflows, airSlate SignNow signNowly boosts productivity for an IndividualOwnerSole Proprietor. You can send, receive, and sign documents quickly, minimizing delays and enhancing efficiency. This allows you to dedicate more time to other critical aspects of your business.

-

What support options are available for IndividualOwnerSole Proprietors using airSlate SignNow?

airSlate SignNow provides comprehensive support options for IndividualOwnerSole Proprietors, including tutorials, FAQ sections, and customer service. Whether you have questions about features or need technical assistance, help is readily available. This ensures you can make the most of the platform without any hassle.

Get more for IndividualOwnerSole Proprietor

- Church reimbursement form 53344827

- Mv 2cdl form

- Borang makna form

- Dna fill in the blanks form

- Tax credit recap schedule west virginia tax division form

- S corporation partnership pass through entity form

- West virginia nonresident income tax agreement 702776592 form

- Pub 14 pdf utah state tax commission form

Find out other IndividualOwnerSole Proprietor

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document