Claim Collection Form

What is the claim collection?

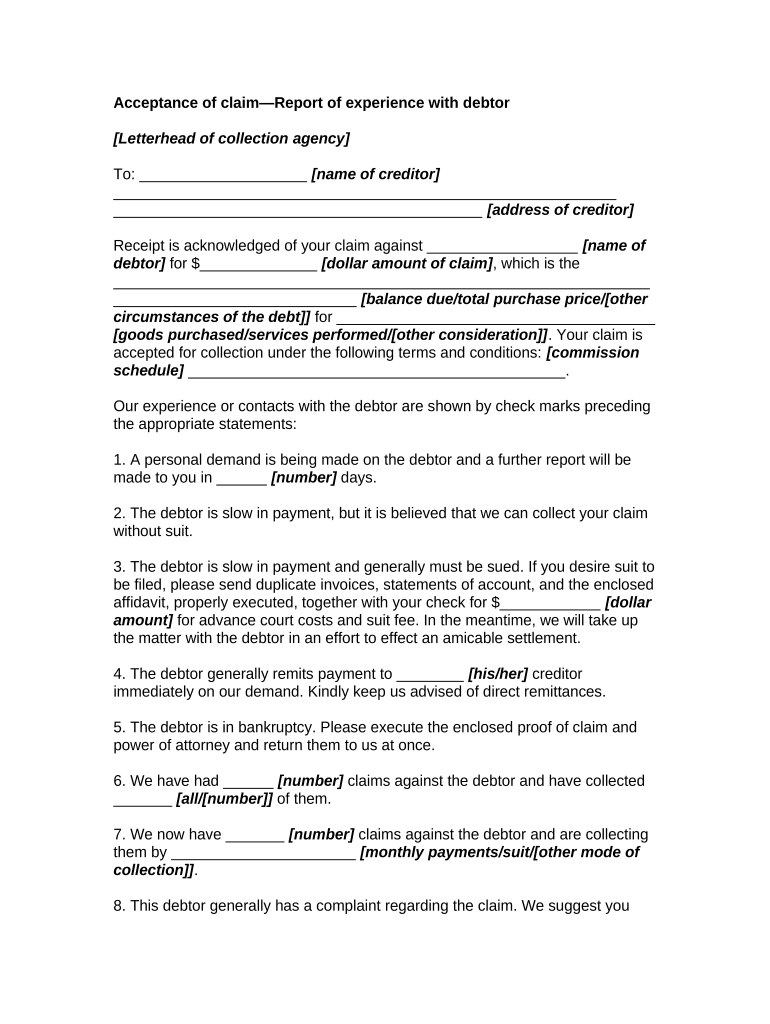

The claim collection refers to the process by which creditors seek to recover debts owed to them. This can involve various forms of documentation, including a claim collection form, which serves as a formal request for payment. The claim collection process is essential for businesses and individuals to ensure that they receive the funds they are owed, particularly in cases of unpaid invoices or loans. Understanding the legal framework surrounding claim collections is crucial for both creditors and debtors to navigate this process effectively.

Steps to complete the claim collection

Completing a claim collection form involves several key steps to ensure that the document is filled out correctly and meets legal requirements. These steps include:

- Gather necessary information: Collect all relevant details, such as the debtor's name, contact information, and the amount owed.

- Fill out the form: Accurately complete the claim collection form, ensuring that all fields are filled in and that the information is correct.

- Review for accuracy: Double-check the completed form for any errors or omissions that could delay the process.

- Submit the form: Follow the appropriate submission method, whether online or via mail, to ensure timely processing.

Legal use of the claim collection

The legal use of a claim collection form is governed by various regulations that ensure the process is fair and transparent. To be considered legally binding, the claim collection must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and documents hold the same weight as traditional paper documents, provided that specific criteria are met. This compliance is essential for both creditors and debtors to ensure that the collection process adheres to legal standards.

Key elements of the claim collection

Several key elements must be included in a claim collection form to ensure its validity and effectiveness. These elements typically include:

- Creditor information: The name, address, and contact details of the creditor.

- Debtor information: The name, address, and contact details of the debtor.

- Amount owed: A clear statement of the total amount being claimed.

- Reason for the claim: A brief description of why the debt is owed, such as unpaid invoices or loans.

- Signature: The signature of the creditor or an authorized representative to validate the claim.

Who issues the form?

The claim collection form is typically issued by the creditor or a collection agency acting on behalf of the creditor. In some cases, legal professionals may also prepare the form to ensure compliance with relevant laws and regulations. It is important for creditors to use a standardized form that meets legal requirements, as this helps streamline the collection process and increases the likelihood of successful recovery of the debt.

Required documents

To complete a claim collection, certain documents may be required to support the claim. These documents can include:

- Invoices: Copies of unpaid invoices that detail the goods or services provided.

- Contracts: Any agreements that outline the terms of the debt.

- Payment records: Documentation showing any payments made or missed deadlines.

- Correspondence: Records of communication with the debtor regarding the debt.

Quick guide on how to complete claim collection

Effortlessly Prepare Claim Collection on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Claim Collection on any device using the airSlate SignNow Android or iOS applications and streamline your document-based procedures today.

Edit and eSign Claim Collection with Ease

- Locate Claim Collection and then click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Claim Collection to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is claim collection and how does airSlate SignNow assist with it?

Claim collection is the process of gathering necessary documentation and signatures to validate claims in various business scenarios. airSlate SignNow streamlines this process by providing an efficient platform for sending and eSigning documents, ensuring timely and secure claim collection.

-

What features does airSlate SignNow offer for claim collection?

AirSlate SignNow provides a range of features designed for efficient claim collection, such as customizable templates, real-time tracking, and team collaboration tools. These features help businesses manage their documentation flow and ensure that every claim is processed smoothly.

-

How does pricing work for airSlate SignNow when focusing on claim collection?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making claim collection more accessible. With competitive rates, organizations can choose a plan that suits their needs while leveraging effective tools for claim collection and document management.

-

Can airSlate SignNow integrate with other software for claim collection purposes?

Yes, airSlate SignNow provides integrations with various third-party applications to enhance your claim collection process. Users can connect their existing systems, ensuring seamless data sharing and improved workflow efficiency.

-

What benefits does airSlate SignNow provide for businesses focusing on claim collection?

Businesses utilizing airSlate SignNow for claim collection benefit from enhanced efficiency, reduced turnaround times, and improved accuracy in document handling. The electronic signature feature signNowly expedites the process, reducing delays in claim approval.

-

Is airSlate SignNow secure for managing sensitive information in claim collection?

Absolutely, airSlate SignNow prioritizes security in claim collection by employing robust encryption and compliance with industry standards. This ensures that sensitive information remains protected throughout the claim collection process.

-

How can I start using airSlate SignNow for claim collection?

To start using airSlate SignNow for claim collection, simply sign up for an account on our website. You'll gain access to powerful tools that will help you streamline your claim collection processes and facilitate faster document signing.

Get more for Claim Collection

- Baseline amp person centered care plans nursing home help form

- Fillable online worldcare claim form now health fax email print

- Patient registration form spine and sport

- Patient assistance program needymeds needymeds form

- Illinois wesleyan university20 21 ma brochure eiia form

- Alg west sample submission form virology and molecular testing

- Molina healthcare inc health delivery organization hdo form

- File a life insurance claimamerican fidelity form

Find out other Claim Collection

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation