Inter Vivos Form

What is the inter vivos irrevocable trust?

An inter vivos irrevocable trust is a legal arrangement established during a person's lifetime, where the trustor transfers assets into the trust and relinquishes control over them. This type of trust cannot be altered or revoked once it is created, which distinguishes it from revocable trusts. The primary purpose of an inter vivos irrevocable trust is to manage and protect assets for beneficiaries, often for estate planning or tax purposes. By placing assets in this trust, the trustor may also reduce their taxable estate, as the assets are no longer considered part of their personal holdings.

Key elements of the inter vivos irrevocable trust

Several crucial elements define an inter vivos irrevocable trust. First, the trustor must clearly outline the terms of the trust, including the beneficiaries and the assets involved. Second, a trustee must be appointed to manage the trust and ensure that the terms are followed. This trustee can be an individual or an institution. Third, the trust must comply with state laws governing trusts, which can vary significantly. Finally, the trust should include provisions for how the assets will be distributed to beneficiaries, ensuring clarity and minimizing disputes.

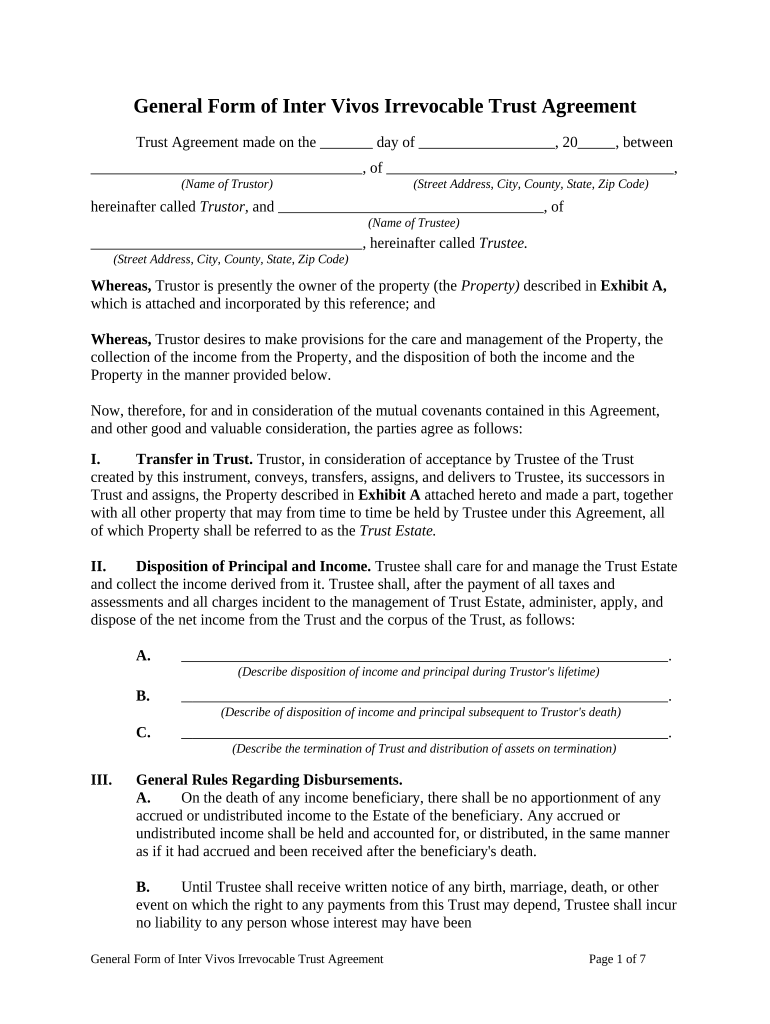

Steps to complete the inter vivos irrevocable trust

Completing an inter vivos irrevocable trust involves several steps. First, the trustor should consult with a legal professional to understand the implications and requirements. Next, they need to draft the trust document, clearly stating the terms and conditions. Once the document is prepared, the trustor must sign it in the presence of witnesses or a notary, depending on state laws. After signing, the trustor must transfer assets into the trust, which may involve retitling property or changing account ownership. Finally, it is essential to inform the beneficiaries about the trust and its terms.

Legal use of the inter vivos irrevocable trust

The legal use of an inter vivos irrevocable trust is primarily focused on asset protection and estate planning. By transferring assets into the trust, the trustor can shield them from creditors and reduce estate taxes upon their passing. Additionally, the trust can provide specific instructions for asset distribution, ensuring that beneficiaries receive their intended inheritance without the complications of probate. It is crucial for the trust to adhere to state laws and regulations to maintain its legal standing and effectiveness.

Required documents for the inter vivos irrevocable trust

To establish an inter vivos irrevocable trust, certain documents are typically required. These include the trust agreement, which outlines the terms and conditions, and any relevant asset documentation, such as titles or deeds for real estate, bank account statements, or investment account records. Additionally, identification documents for the trustor and trustee may be necessary, along with any required witness or notary signatures. It is advisable to keep copies of all documents for record-keeping and future reference.

State-specific rules for the inter vivos irrevocable trust

State-specific rules for inter vivos irrevocable trusts can vary widely, impacting how these trusts are created and managed. Each state has its own laws regarding trust formation, asset protection, and taxation. For example, some states may have specific requirements for the number of witnesses or notary involvement when signing the trust document. Additionally, tax implications may differ based on the state, affecting how assets are taxed during the trustor's lifetime and after their passing. Consulting with a legal expert familiar with local laws is essential to ensure compliance.

Quick guide on how to complete inter vivos 497331820

Complete Inter Vivos effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to find the needed template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Inter Vivos on any device using airSlate SignNow's Android or iOS applications and enhance your document-based tasks today.

The simplest method to alter and eSign Inter Vivos without difficulty

- Find Inter Vivos and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Thoroughly review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, be it via email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Inter Vivos to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an inter vivos irrevocable trust?

An inter vivos irrevocable trust is a estate planning tool that cannot be altered or dissolved after it has been established. This type of trust is created during the lifetime of the grantor, which allows for the avoidance of probate and ensures immediate asset distribution upon the grantor’s death. Utilizing airSlate SignNow can streamline the process of drafting and executing such trusts electronically.

-

How does an inter vivos irrevocable trust benefit estate planning?

An inter vivos irrevocable trust helps in reducing estate taxes and protecting assets from creditors by removing them from the grantor’s taxable estate. This trust provides clear instructions for asset distribution, ensuring that beneficiaries receive their inheritance efficiently. With airSlate SignNow, you can manage and eSign your estate planning documents effortlessly.

-

Can I modify an inter vivos irrevocable trust after it's set up?

No, an inter vivos irrevocable trust cannot be modified once it is established, which is a signNow characteristic. This permanence ensures that the assets are secured and distributed according to the grantor's wishes without any future alterations. airSlate SignNow offers templates to make the initial creation process simple and effective.

-

What are the costs associated with setting up an inter vivos irrevocable trust?

The costs of establishing an inter vivos irrevocable trust can vary widely based on legal fees and the complexity of the trust. While there are upfront costs involved, the long-term benefits in estate tax savings and asset protection often outweigh these. By utilizing airSlate SignNow’s affordable eSigning solutions, you can control some of the costs involved in preparing trust documents.

-

What features of airSlate SignNow are beneficial for creating inter vivos irrevocable trusts?

airSlate SignNow offers a wide range of features, including document templates, secure eSigning, and collaboration tools, making it ideal for creating inter vivos irrevocable trusts. The user-friendly interface allows for easy document management and ensures that your estate planning can be handled seamlessly online. Additionally, the platform supports compliance with legal standards, ensuring your trust documents are valid.

-

How does airSlate SignNow ensure the security of my inter vivos irrevocable documents?

Security is a top priority for airSlate SignNow; the platform employs advanced encryption and secure data storage protocols to protect your inter vivos irrevocable trust documents. Ensuring that sensitive information remains confidential is crucial in estate planning, and with airSlate SignNow, you can trust that your data is safeguarded against unauthorized access. Regular security audits further enhance the platform’s reliability.

-

What integrations does airSlate SignNow offer that can improve management of inter vivos irrevocable trusts?

airSlate SignNow seamlessly integrates with various applications, such as CRM systems and cloud storage services, facilitating the management of inter vivos irrevocable trusts. These integrations streamline the workflow of document creation, storage, and sharing, allowing for a more efficient estate planning process. By utilizing these tools within airSlate SignNow, you can enhance collaboration and accessibility.

Get more for Inter Vivos

- Np form patient info outline copy

- Medical servicesst vincent hospitalcancer genetics form

- Cornerstone therapy and wellness form

- Main street drug storewilburton okgood neighbor form

- 2019 hartford lc form

- Behavioral health facility and ancillary credentialing application form

- Pregnant declaration form

- In pdf form mu school of health professions

Find out other Inter Vivos

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form