Dissolving a Corporation Form

Understanding the Process of Dissolving a Corporation

Dissolving a corporation involves formally closing a business entity, which can be a complex process. This action is legally recognized and requires adherence to specific state laws. Corporations may choose to dissolve for various reasons, including financial difficulties, changes in business strategy, or the completion of their purpose. The dissolution process typically includes filing a notice of intent to dissolve, settling debts, and distributing any remaining assets among shareholders.

Steps to Complete the Dissolution of a Corporation

To successfully dissolve a corporation, follow these essential steps:

- Board Resolution: The board of directors must approve the decision to dissolve the corporation.

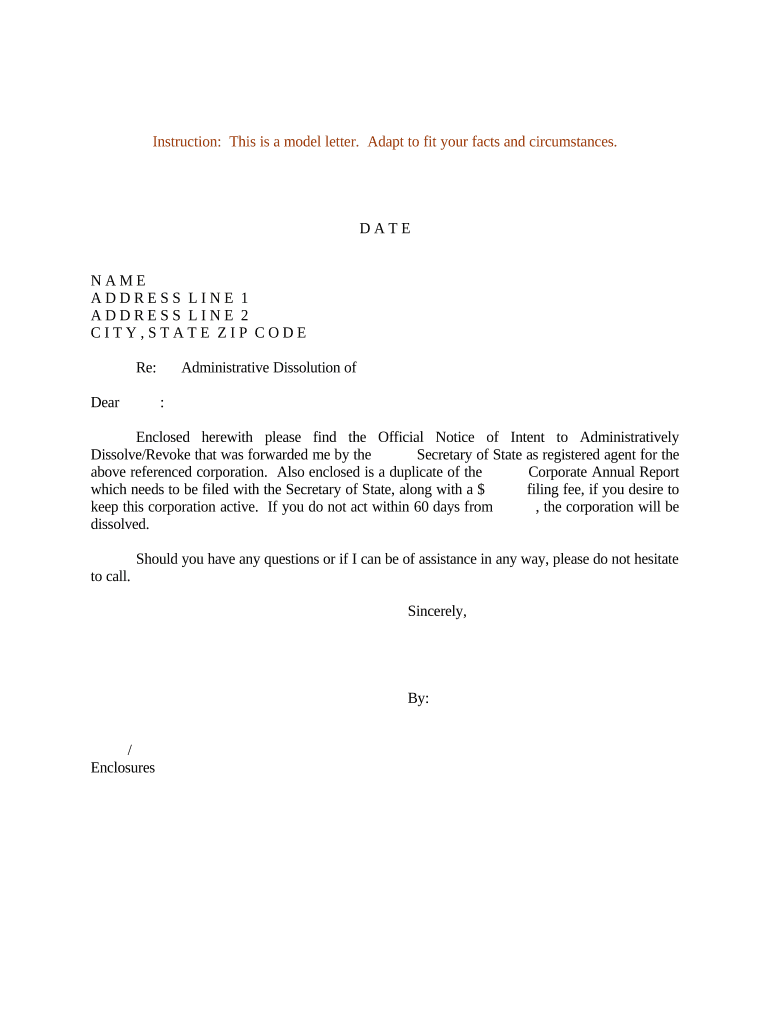

- Notice of Intent: File a notice of intent to dissolve with the appropriate state authority, which may include a sample letter intent.

- Settle Debts: Pay off any outstanding debts and obligations to creditors.

- Asset Distribution: Distribute remaining assets to shareholders according to their ownership percentages.

- Final Filings: Submit final tax returns and any required documents to state and federal agencies.

Legal Considerations for Dissolving a Corporation

When dissolving a corporation, it is crucial to understand the legal implications involved. Compliance with state laws is mandatory, as each state has its own regulations regarding dissolution. Failure to follow these laws can result in penalties or legal complications. Additionally, ensuring that all debts are settled and that proper notifications are sent to creditors and stakeholders is essential for a smooth dissolution process.

Required Documents for Corporation Dissolution

Several key documents are necessary to facilitate the dissolution of a corporation:

- Articles of Dissolution: This legal document officially terminates the corporation's existence and must be filed with the state.

- Final Tax Returns: Corporations must file final tax returns to report income and settle any tax obligations.

- Board Meeting Minutes: Documentation of the board's decision to dissolve the corporation is often required.

Filing Methods for Corporation Dissolution

Corporations can typically file their dissolution documents through various methods, including:

- Online Submission: Many states offer online portals for submitting dissolution documents, providing a quick and efficient process.

- Mail: Corporations may also choose to mail their dissolution paperwork to the appropriate state office.

- In-Person Filing: Some businesses prefer to file documents in person, allowing for immediate confirmation of receipt.

State-Specific Rules for Dissolution

Each state has unique rules and requirements for dissolving a corporation. It is important to research the specific regulations in your state to ensure compliance. This includes understanding filing fees, necessary forms, and any additional steps that may be required. Consulting with a legal professional can provide clarity on state-specific guidelines and help navigate the dissolution process effectively.

Quick guide on how to complete dissolving a corporation

Complete Dissolving A Corporation effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage Dissolving A Corporation on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The easiest way to edit and eSign Dissolving A Corporation effortlessly

- Obtain Dissolving A Corporation and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device of your choice. Modify and eSign Dissolving A Corporation and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter intent?

A sample letter intent is a document used to outline the intention of one party to engage in a future agreement with another party. This type of letter typically includes important details about the agreement's terms and can serve as a preliminary contract. Using airSlate SignNow, you can easily create, customize, and send a sample letter intent to ensure clarity and mutual understanding.

-

How can I create a sample letter intent using airSlate SignNow?

Creating a sample letter intent with airSlate SignNow is simple and efficient. You can start by choosing from our library of templates or create one from scratch using our intuitive drag-and-drop editor. Once your sample letter intent is ready, you can send it for eSignature directly through our platform, ensuring a smooth signing process.

-

What are the benefits of using airSlate SignNow for my sample letter intent?

Using airSlate SignNow for your sample letter intent offers numerous benefits, including improved efficiency and reduced turnaround times. Our platform enables you to promptly send and receive signed documents, eliminating the hassle of traditional signing methods. Additionally, you can maintain an organized digital record of all your agreements for easy access when needed.

-

Is airSlate SignNow cost-effective for sending sample letter intents?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various needs, allowing you to choose a plan that fits your budget while providing the essential features required for sending sample letter intents and other documents with ease.

-

Can I integrate airSlate SignNow with other tools for managing sample letter intents?

Yes, airSlate SignNow supports integrations with various popular tools, making it easy to manage your sample letter intents seamlessly. Whether you're using CRM systems, project management apps, or other business software, our platform can connect with them to enhance your workflow. This integration capability ensures that you can access and manage all your documents in one place.

-

What features does airSlate SignNow offer for handling sample letter intents?

airSlate SignNow provides several powerful features for handling sample letter intents, including customizable templates, automated reminders, and multiple signing options. These features streamline the document signing process and help ensure that agreements are executed promptly. Furthermore, our robust tracking and reporting tools can help you monitor the status of your sample letter intents efficiently.

-

How secure is airSlate SignNow for sending sample letter intents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like sample letter intents. Our platform employs state-of-the-art encryption protocols and complies with industry standards to ensure that your documents are safe from unauthorized access. You can confidently use airSlate SignNow to send your agreements, knowing that your information is protected.

Get more for Dissolving A Corporation

- Allergist aetna form

- Spine surgery clinical worksheet form

- Use the employee enrollment form to collect first time employee and dependent information

- Treatment of heartmate ii short to shield patients with an form

- Request for testing hemostasis reference laboratory fill in form

- Miradry a new service brought to the pine belt area form

- Forms ampamp applications cayuga addiction recovery services

- Prior authorization boutpatient formb cigna

Find out other Dissolving A Corporation

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple