Initial Disclosure Statement Form

What is the Initial Disclosure Statement

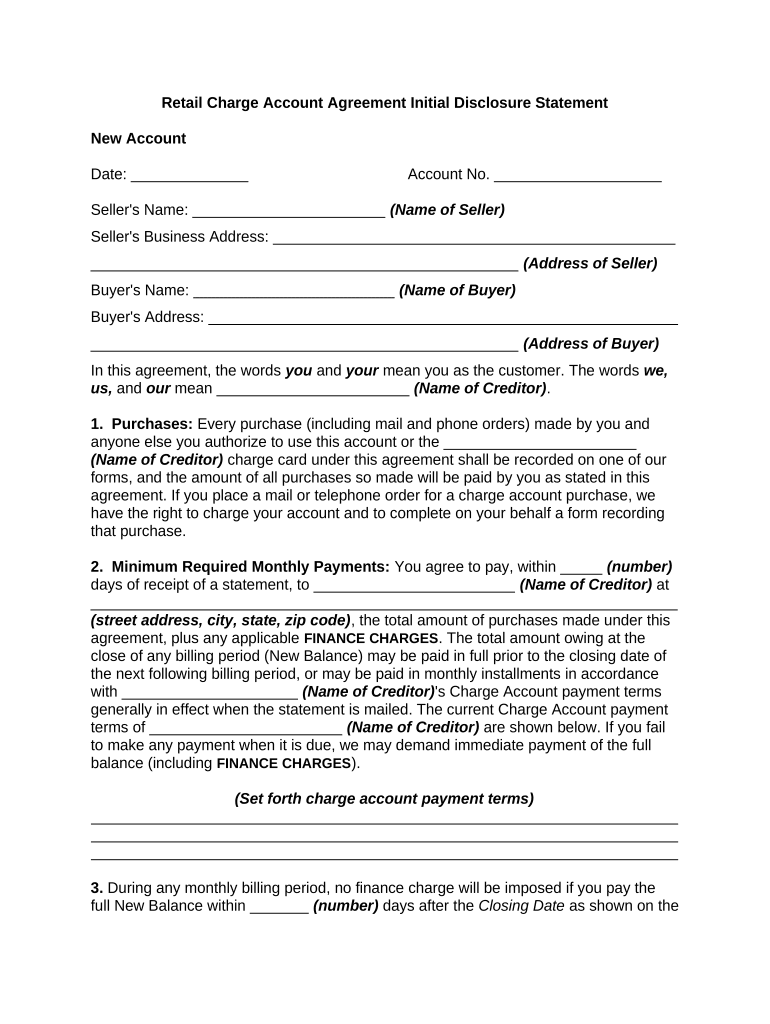

The Initial Disclosure Statement is a crucial document that outlines the terms and conditions of a financial account. It provides essential information to account holders regarding fees, interest rates, and other important details that affect their financial relationship with the institution. This statement is designed to ensure transparency and help consumers make informed decisions about their accounts. In the context of an account agreement, it serves as a foundational element that establishes the expectations and obligations of both parties involved.

Key Elements of the Initial Disclosure Statement

Several key elements must be included in the Initial Disclosure Statement to ensure compliance and clarity. These elements typically encompass:

- Account Fees: A detailed breakdown of any fees associated with the account, such as maintenance fees, transaction fees, and penalties for overdrafts.

- Interest Rates: Information on the interest rates applicable to the account, including how they are calculated and whether they are fixed or variable.

- Terms of Use: Clear guidelines on how the account can be used, including any restrictions or requirements that account holders must adhere to.

- Contact Information: Details on how to reach customer service for questions or concerns regarding the account.

Steps to Complete the Initial Disclosure Statement

Completing the Initial Disclosure Statement involves several straightforward steps. First, users should gather all necessary information related to their account, including personal identification and financial details. Next, they should carefully read through the disclosure statement to understand all terms and conditions. After that, users can fill out any required fields, ensuring accuracy in their entries. Finally, it is important to review the completed statement for any errors before submitting it to the financial institution.

Legal Use of the Initial Disclosure Statement

The Initial Disclosure Statement is governed by various legal frameworks that ensure its validity and enforceability. In the United States, compliance with regulations such as the Truth in Lending Act (TILA) is essential. This legislation mandates that financial institutions provide clear and concise information regarding credit terms, including those found in the Initial Disclosure Statement. Adhering to these legal standards not only protects consumers but also helps institutions maintain transparency and trust.

Digital vs. Paper Version

In today's digital age, the option to complete and submit the Initial Disclosure Statement online is increasingly popular. Digital versions offer several advantages, including ease of access, faster processing times, and enhanced security features. However, some individuals may prefer paper versions for their tangible nature. Regardless of the format chosen, it is important to ensure that all information is accurately captured and securely transmitted to the financial institution to maintain compliance.

Who Issues the Form

The Initial Disclosure Statement is typically issued by financial institutions, including banks, credit unions, and other lending organizations. These entities are responsible for providing the statement to prospective account holders before the account is opened. It is crucial for consumers to review this document carefully, as it contains vital information that will govern their account usage and obligations.

Disclosure Requirements

Disclosure requirements for the Initial Disclosure Statement are designed to protect consumers by ensuring they receive all necessary information about their financial products. Institutions must disclose specific details about fees, interest rates, and terms of use. This transparency allows consumers to compare different account options and make informed decisions. Failure to comply with these disclosure requirements can result in legal penalties for the institution, reinforcing the importance of thorough and accurate communication.

Quick guide on how to complete initial disclosure statement

Effortlessly prepare Initial Disclosure Statement on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Initial Disclosure Statement on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Initial Disclosure Statement with ease

- Obtain Initial Disclosure Statement and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Initial Disclosure Statement while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an account agreement with airSlate SignNow?

An account agreement with airSlate SignNow establishes the terms and conditions for using our eSignature services. It outlines the obligations of both parties and provides a clear framework for document management. Understanding this agreement ensures compliance and enhances your experience with our platform.

-

How much does an account agreement cost with airSlate SignNow?

The cost associated with an account agreement at airSlate SignNow varies depending on the chosen pricing plan. We offer flexible pricing options suitable for businesses of all sizes. Visit our pricing page to find the best plan that meets your needs and budget.

-

What features are included in the airSlate SignNow account agreement?

The airSlate SignNow account agreement includes features such as document eSigning, real-time tracking, and secure cloud storage. Additionally, users gain access to templates, integration options, and customizable workflows, enhancing the overall efficiency of document management.

-

Can I integrate the airSlate SignNow account agreement with other software?

Yes, the airSlate SignNow account agreement supports integrations with various third-party applications including CRMs, cloud storage services, and productivity tools. This interoperability allows users to streamline their workflows and improve their overall business operations.

-

What are the benefits of using airSlate SignNow for my account agreement?

Using airSlate SignNow for your account agreement simplifies the eSigning process, saving time and enhancing productivity. Our platform is user-friendly and provides secure document handling, ensuring your agreements are signed promptly and safely. It also reduces paper waste, making it an environmentally friendly solution.

-

Is the airSlate SignNow account agreement legally binding?

Yes, the airSlate SignNow account agreement is legally binding and compliant with eSignature laws. This means that once an agreement is signed through our platform, it holds the same legal weight as a traditional hand-signed document. This offers peace of mind when completing business transactions.

-

What support does airSlate SignNow provide for account agreement queries?

airSlate SignNow offers comprehensive support for any queries related to account agreements. Our customer service team is available via phone, email, or live chat to assist you. Additionally, we provide extensive online resources, including guides and FAQs, to help you navigate your account agreement.

Get more for Initial Disclosure Statement

Find out other Initial Disclosure Statement

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself