Independent Contractor Services Form

What is the Independent Contractor Services

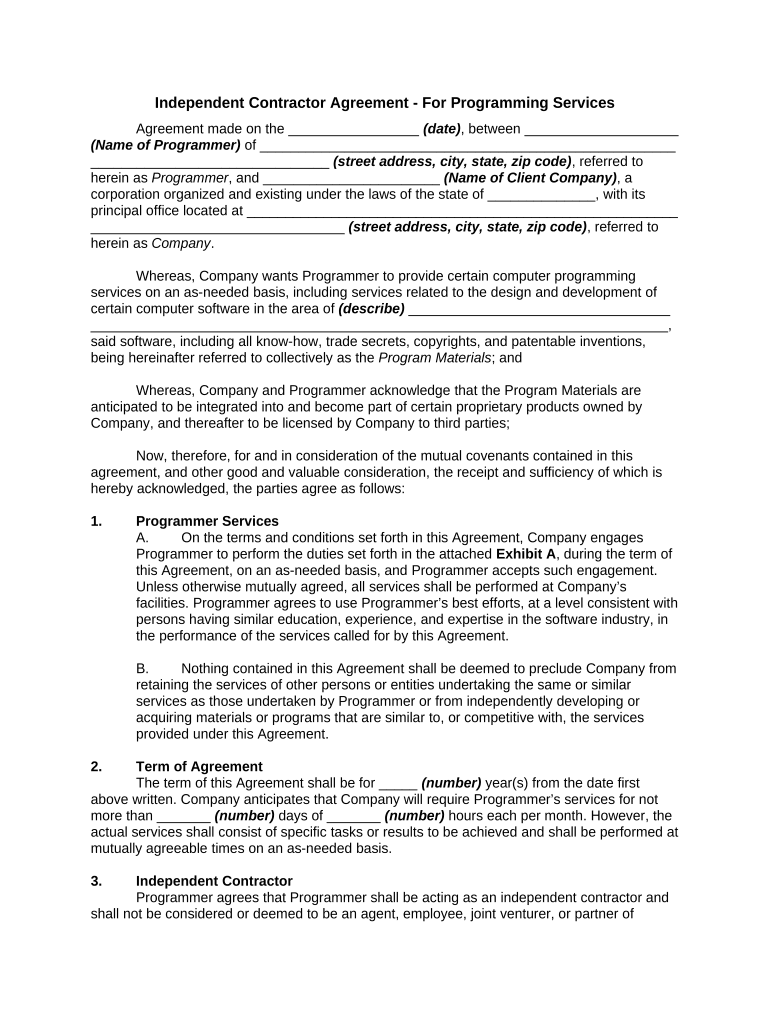

The Independent Contractor Services form is a crucial document used by businesses to outline the terms and conditions of a working relationship with independent contractors. This form typically includes details such as the scope of work, payment terms, and the duration of the contract. It serves to clarify expectations and protect both parties legally. Understanding the purpose of this form is essential for both contractors and businesses to ensure compliance with applicable laws and regulations.

Steps to complete the Independent Contractor Services

Completing the Independent Contractor Services form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including the contractor's name, address, and tax identification number. Next, clearly define the scope of work, including specific tasks and deadlines. After detailing payment terms, review the document for clarity and completeness. Finally, both parties should sign the form electronically to ensure it is legally binding. Utilizing a reliable eSignature solution can streamline this process and enhance security.

Legal use of the Independent Contractor Services

The legal use of the Independent Contractor Services form is governed by various federal and state laws. To ensure its validity, the form must meet specific requirements, such as obtaining proper signatures and adhering to eSignature laws like ESIGN and UETA. Additionally, it is vital to ensure that the contract does not misclassify the worker, as this can lead to legal complications. Understanding these legal frameworks helps protect both the contractor and the hiring entity.

Key elements of the Independent Contractor Services

Key elements of the Independent Contractor Services form include essential information that outlines the working relationship. These elements typically consist of:

- Contractor Information: Name, address, and contact details.

- Scope of Work: Detailed description of the tasks to be performed.

- Payment Terms: Compensation structure, payment schedule, and invoicing process.

- Duration: Timeframe for the contract and any renewal options.

- Termination Clause: Conditions under which either party can terminate the agreement.

Including these elements ensures clarity and helps mitigate potential disputes between the contractor and the hiring entity.

IRS Guidelines

The IRS provides specific guidelines regarding the classification of independent contractors. It is essential to understand the criteria used to determine whether a worker qualifies as an independent contractor or an employee. Factors such as behavioral control, financial control, and the relationship between the parties play a significant role in this classification. Misclassification can lead to penalties and back taxes, making it crucial for businesses to adhere to IRS guidelines when using the Independent Contractor Services form.

Required Documents

When completing the Independent Contractor Services form, certain documents may be required to verify the contractor's identity and business status. Commonly required documents include:

- W-9 Form: To provide taxpayer identification information.

- Business License: Proof of the contractor's legal ability to operate.

- Insurance Certificates: Evidence of liability insurance, if applicable.

Having these documents ready can facilitate a smoother contracting process and ensure compliance with legal requirements.

Quick guide on how to complete independent contractor services

Prepare Independent Contractor Services effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly with no delays. Manage Independent Contractor Services on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to modify and electronically sign Independent Contractor Services without hassle

- Find Independent Contractor Services and then click Get Form to get started.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Independent Contractor Services to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are independent contractor services offered by airSlate SignNow?

airSlate SignNow provides independent contractor services that streamline document management through electronic signatures. This includes easy document sending, management, and tracking, making it ideal for contractors needing efficiency in their operations. The platform empowers users with the tools to handle contracts seamlessly.

-

How does pricing work for airSlate SignNow's independent contractor services?

Pricing for independent contractor services on airSlate SignNow is designed to be cost-effective, offering various subscription plans to fit different business needs. Users can choose from monthly or annual billing options, with flexible tiers based on the number of users and features required. This ensures that independent contractors can find a plan that fits their budget.

-

What features can I expect from airSlate SignNow for independent contractors?

airSlate SignNow provides several features tailored for independent contractor services, such as customizable templates, mobile access, and real-time tracking of signed documents. These features help contractors manage their paperwork efficiently while maintaining compliance. Additionally, the platform enhances collaboration with built-in tools for comments and approvals.

-

Can I integrate airSlate SignNow with other tools I use for my independent contractor services?

Yes, airSlate SignNow offers robust integrations with various applications that independent contractors often use, such as CRM systems, project management tools, and cloud storage services. This connectivity enhances workflow efficiency by allowing users to manage documents within their preferred environments. Seamless integration is key to maximizing productivity in independent contractor services.

-

What are the benefits of using airSlate SignNow for independent contractors?

Using airSlate SignNow for independent contractor services offers numerous benefits, including increased efficiency, reduced turnaround time for documents, and enhanced security for sensitive information. The platform's user-friendly interface simplifies the signing process, leading to improved client satisfaction. This ensures that independent contractors can focus more on their core services rather than paperwork.

-

Is airSlate SignNow mobile-friendly for independent contractors?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing independent contractors to send and sign documents on-the-go. This capability ensures that contractors can manage their paperwork from anywhere, thus maintaining productivity regardless of their location. The mobile version features all the essential tools needed for independent contractor services.

-

How secure is airSlate SignNow for independent contractor services?

Security is a top priority for airSlate SignNow when it comes to independent contractor services. The platform employs advanced encryption and complies with industry standards to protect sensitive documents. Contractors can confidently manage contracts and agreements knowing their information is safeguarded.

Get more for Independent Contractor Services

- Signed and stamped as an agreement on legal stamp form

- Residential construction walk through inspection sheet form

- Nothing cakes fundraiser form

- Qualification continuity form

- Of the love and affection of our volunteers form

- Rf 1037e form

- Wp3 thailand form

- 2017 vacation bible school registration form eaganhillsorg

Find out other Independent Contractor Services

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free