Receivable Write off Form

What is the Receivable Write Off Form

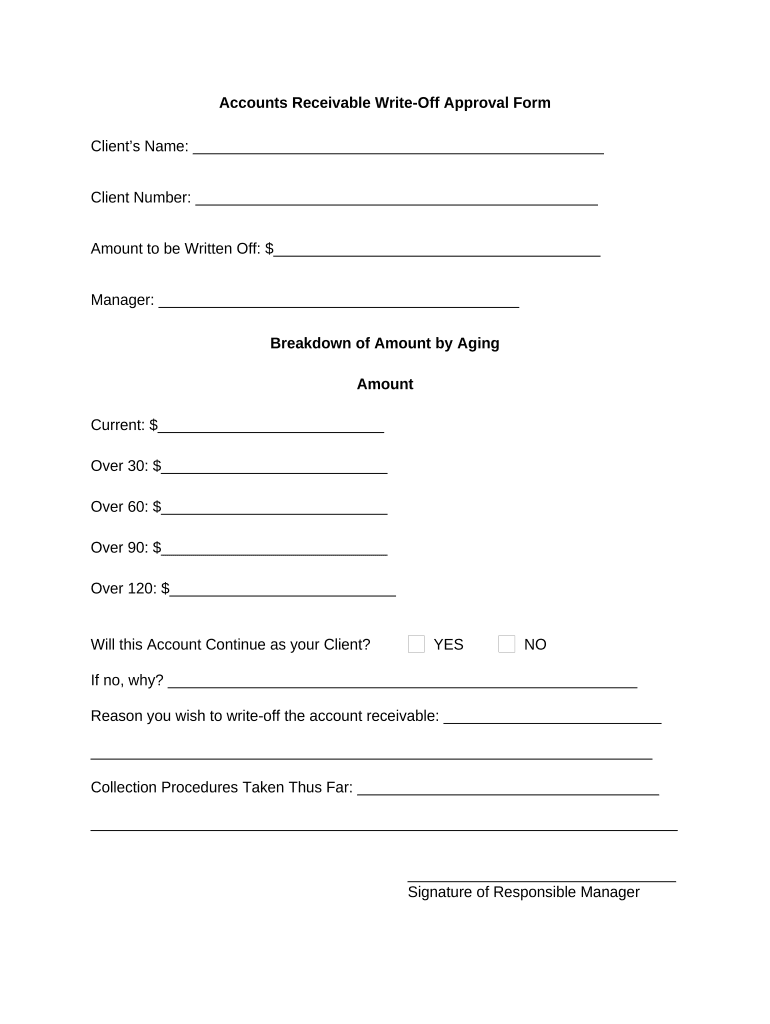

The accounts receivable write off form is a crucial document used by businesses to formally acknowledge and document the decision to write off uncollectible debts. This form serves as an official record that a specific account is no longer expected to be paid, allowing companies to maintain accurate financial statements. The write off form typically includes essential details such as the debtor's name, the amount owed, and the reason for the write off. By utilizing this form, businesses can ensure compliance with accounting standards and maintain transparency in their financial practices.

How to Use the Receivable Write Off Form

Using the accounts receivable write off form involves several straightforward steps. First, gather all relevant information about the account you wish to write off, including the customer’s details and the outstanding amount. Next, complete the form by filling in the required fields, which may include the date of the write off, the account number, and the justification for the write off. Once the form is filled out, it should be reviewed for accuracy before being submitted to the appropriate department for approval. Finally, ensure that a copy of the completed form is retained for your records, as it may be needed for future reference or audits.

Key Elements of the Receivable Write Off Form

Several key elements are essential for the effectiveness of the accounts receivable write off form. These elements include:

- Debtor Information: Full name and contact details of the customer.

- Account Details: The account number and the amount owed.

- Reason for Write Off: A clear explanation of why the debt is deemed uncollectible.

- Date of Write Off: The date when the decision was made to write off the account.

- Approval Section: A space for signatures from authorized personnel to validate the write off.

Steps to Complete the Receivable Write Off Form

Completing the accounts receivable write off form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all relevant account information, including the customer's history and outstanding balance.

- Access the write off form and begin filling in the debtor's details.

- Clearly state the reason for the write off, providing any necessary documentation to support your claim.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the designated authority within your organization for approval.

- Keep a copy of the signed form for your records, ensuring it is easily accessible for future audits.

Legal Use of the Receivable Write Off Form

The accounts receivable write off form plays a significant role in ensuring that businesses comply with legal and regulatory standards. When properly executed, this form can serve as a legal document that protects the organization in case of disputes regarding the uncollectible debt. It is essential to follow all applicable laws and regulations when completing and submitting the form, including maintaining accurate records and ensuring that the write off is justified. Compliance with accounting principles and legal requirements helps businesses avoid potential penalties and maintain their credibility in the marketplace.

Form Submission Methods

The accounts receivable write off form can typically be submitted through various methods, depending on the organization's policies. Common submission methods include:

- Online Submission: Many businesses utilize digital platforms to allow for electronic submission of forms, which can streamline the process and enhance efficiency.

- Mail: The form can be printed and mailed to the appropriate department or individual responsible for processing write offs.

- In-Person Submission: For organizations that require personal interaction, the form can be submitted directly to the finance or accounting department.

Quick guide on how to complete receivable write off form

Prepare Receivable Write Off Form effortlessly on all devices

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delay. Manage Receivable Write Off Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and eSign Receivable Write Off Form with ease

- Obtain Receivable Write Off Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select how you'd like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Receivable Write Off Form and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an inventory write off form template?

An inventory write off form template is a standardized document used by businesses to formally record and process the removal of damaged or obsolete inventory. This template helps streamline the write-off process, ensuring accuracy and compliance. By utilizing an inventory write off form template, businesses can maintain better inventory management and financial records.

-

How can the inventory write off form template benefit my business?

Using an inventory write off form template can signNowly enhance your business operations by providing a clear and concise method for tracking inventory losses. This results in improved financial reporting and decision-making. Additionally, having a standardized template can save time and reduce errors during the write-off process.

-

Is there a cost associated with using the inventory write off form template?

The inventory write off form template offered by airSlate SignNow is part of our cost-effective eSignature solution. While specific pricing may vary based on your subscription plan, we aim to provide affordable options for all business sizes. You can easily access the template without hidden fees, making it a budget-friendly choice.

-

Can I customize the inventory write off form template?

Yes, the inventory write off form template from airSlate SignNow is fully customizable. You can modify fields, add your branding, and tailor the template to meet your specific needs. This flexibility ensures that the form aligns with your business processes and requirements.

-

What features are included with the inventory write off form template?

The inventory write off form template includes features such as eSignature capabilities, templated fields for essential information, and mobile compatibility for easy access. Additionally, our platform allows for real-time tracking of document status, helping you manage the workflow efficiently. These features enhance user experience and simplify the write-off process.

-

Does the inventory write off form template integrate with other software tools?

Absolutely! The inventory write off form template is designed to integrate seamlessly with various business management tools and software. This allows for better data synchronization and enhances your overall workflow. Integrations with accounting and inventory management systems can optimize your operations further.

-

How does the eSigning process work with the inventory write off form template?

With the inventory write off form template, the eSigning process is straightforward and user-friendly. After filling out the necessary information, you can send it to your colleagues or stakeholders for their eSignature. Our platform ensures secure and legally binding signatures, making the process efficient and hassle-free.

Get more for Receivable Write Off Form

- Gas testing form 2021 pdf

- 128 team bracket fillable form

- 1 asociaia de proprietari locatari 1 bloc nr form

- Incident report form qbuaorg

- Loving family animal hospital form

- Dog park incident report form lower makefield township

- Archdiocese of galveston houston benefit enrollment form for

- Pet care agreement alyssas pet sitting form

Find out other Receivable Write Off Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online