Wake County Food and Beverage Tax Form

What is the Wake County Food and Beverage Tax?

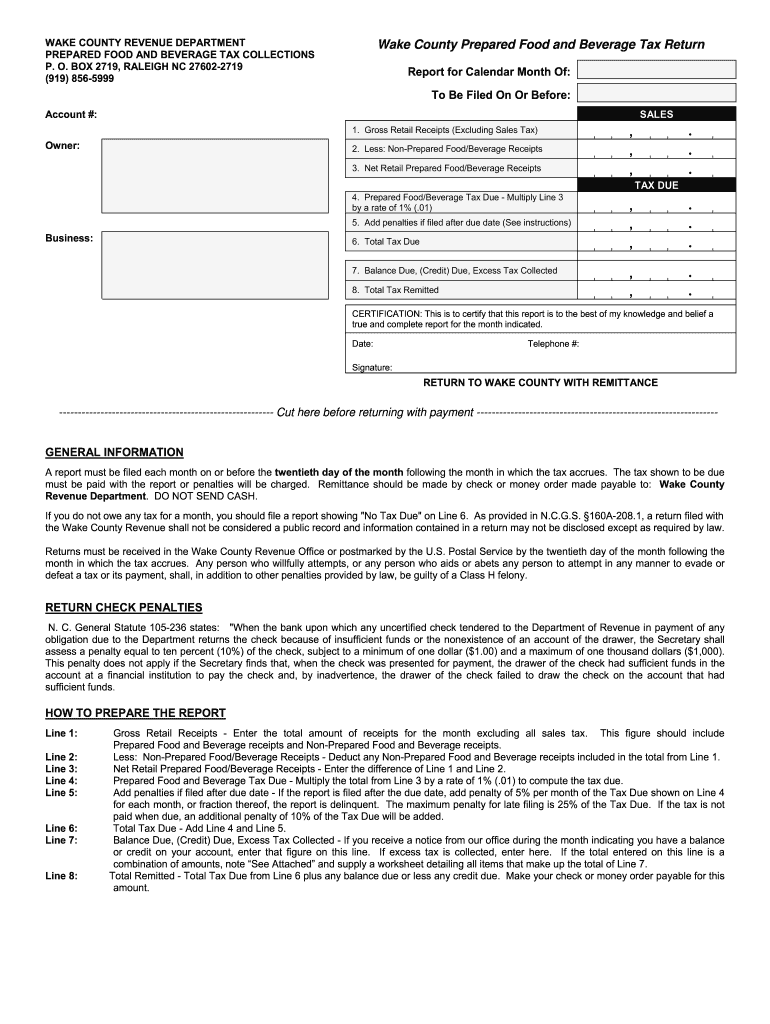

The Wake County Food and Beverage Tax is a local tax applied to prepared food and beverages sold within Wake County, North Carolina. This tax is typically levied on meals served in restaurants, catering services, and other food establishments. The revenue generated from this tax is often allocated to various community projects and initiatives, enhancing local infrastructure and services.

Steps to Complete the Wake County Food and Beverage Tax Return

Completing the Wake County prepared food and beverage tax return involves several key steps. First, gather all necessary financial records, including sales receipts and invoices for prepared food and beverage sales. Next, accurately calculate the total amount of tax owed based on your sales figures. Once your calculations are complete, fill out the tax return form, ensuring all information is correct and complete. Finally, submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Wake County prepared food and beverage tax return. Typically, returns are due on a quarterly basis, with specific dates set for each quarter. Mark your calendar for these deadlines to avoid any late fees or penalties. Additionally, keep an eye on any announcements from the Wake County tax office regarding changes to deadlines or filing procedures.

Required Documents

To successfully file the Wake County food and beverage tax return, you will need several key documents. These include sales records that detail the total revenue generated from prepared food and beverage sales, any relevant invoices, and previous tax returns if applicable. Having these documents organized and readily available will streamline the filing process.

Penalties for Non-Compliance

Failure to comply with the requirements for the Wake County prepared food and beverage tax can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential to understand these consequences and ensure timely and accurate filing to avoid such issues.

Digital vs. Paper Version

When filing the Wake County food and beverage tax return, you have the option to submit your documents digitally or in paper format. The digital version often allows for quicker processing and easier tracking of your submission. However, some individuals may prefer the traditional paper method for its tangible nature. Consider your comfort level with technology and choose the method that best suits your needs.

Who Issues the Form

The Wake County prepared food and beverage tax return form is issued by the Wake County Revenue Department. This department is responsible for overseeing tax collection and ensuring compliance with local tax laws. For any questions regarding the form or the filing process, you can contact the department directly for assistance.

Quick guide on how to complete wake county food and beverage tax

Effortlessly Prepare Wake County Food And Beverage Tax on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Wake County Food And Beverage Tax across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Wake County Food And Beverage Tax with Ease

- Find Wake County Food And Beverage Tax and click on Get Form to begin.

- Use the tools provided to complete your document.

- Mark important sections of your files or obscure confidential information with the tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to confirm your modifications.

- Select your preferred method of submission, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes requiring the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Wake County Food And Beverage Tax while ensuring outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wake county food and beverage tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wake County prepared food and beverage tax return?

The Wake County prepared food and beverage tax return is a required document that businesses must submit to report taxes collected on the sale of prepared food and beverages within Wake County. This return helps ensure compliance with local tax regulations and contributes to community services.

-

How can airSlate SignNow help with my Wake County prepared food and beverage tax return?

AirSlate SignNow simplifies the process of completing and submitting your Wake County prepared food and beverage tax return. With features like eSignature capabilities and document tracking, you can easily manage your tax returns and ensure everything is filed accurately and on time.

-

Are there any costs associated with filing the Wake County prepared food and beverage tax return using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for managing documents, there may be associated fees with certain advanced features. However, using SignNow can save you money in potential fines from missed tax deadlines for your Wake County prepared food and beverage tax return.

-

Can I integrate airSlate SignNow with my accounting software for the Wake County prepared food and beverage tax return?

Yes, airSlate SignNow easily integrates with many popular accounting software tools, enabling seamless data transfer for your Wake County prepared food and beverage tax return. This integration reduces errors and helps streamline your financial processes.

-

What features does airSlate SignNow offer that assist with the Wake County prepared food and beverage tax return?

AirSlate SignNow offers features such as customizable templates, eSignatures, and real-time collaboration. These functionalities make preparing your Wake County prepared food and beverage tax return straightforward and efficient, enhancing your overall tax filing experience.

-

Is there a mobile app for managing my Wake County prepared food and beverage tax return?

Yes, airSlate SignNow has a mobile app that allows you to manage your Wake County prepared food and beverage tax return on the go. This flexibility means you can review, edit, and submit documents from anywhere, ensuring you never miss a deadline.

-

How can I ensure my Wake County prepared food and beverage tax return is filed on time?

To ensure your Wake County prepared food and beverage tax return is filed on time, utilize airSlate SignNow's reminders and deadline tracking features. This proactive approach allows you to stay organized and ensures compliance with local tax laws.

Get more for Wake County Food And Beverage Tax

Find out other Wake County Food And Beverage Tax

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement