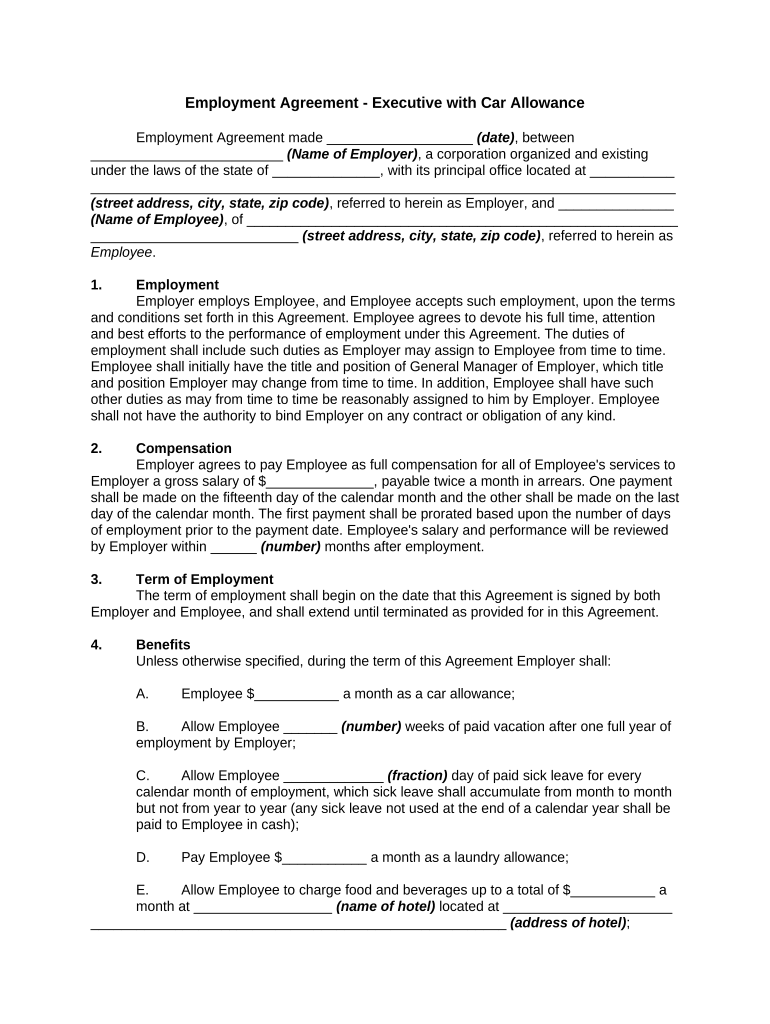

Agreement Car Allowance Form

What is the car allowance policy?

A car allowance policy outlines the framework for compensating employees who use their personal vehicles for work-related activities. This policy typically defines the amount employees will receive, the conditions under which the allowance is granted, and the responsibilities of both the employer and employee. It serves to clarify expectations and ensure compliance with tax regulations. Understanding this policy is crucial for both employers and employees to manage vehicle-related expenses effectively.

Key elements of the car allowance policy

Essential components of a car allowance policy include:

- Eligibility Criteria: Defines who qualifies for the allowance, such as full-time employees or those in specific job roles.

- Allowance Amount: Specifies the monthly or annual amount provided to employees, which may vary based on job responsibilities or vehicle type.

- Usage Guidelines: Outlines acceptable uses of the vehicle, including business travel and commuting.

- Tax Implications: Addresses how the allowance will be treated for tax purposes, ensuring compliance with IRS guidelines.

- Reporting Requirements: Details any documentation employees must provide to justify the allowance, such as mileage logs or expense reports.

Steps to complete the car allowance policy template

To effectively implement a car allowance policy, follow these steps:

- Define Eligibility: Determine which employees will be eligible for the allowance based on their roles and responsibilities.

- Set Allowance Amount: Establish a fair and competitive allowance amount that reflects the costs associated with vehicle use.

- Draft the Policy: Create a written policy that includes all key elements, ensuring clarity and compliance with relevant laws.

- Communicate the Policy: Share the policy with eligible employees, ensuring they understand the guidelines and requirements.

- Monitor and Review: Regularly assess the policy's effectiveness and make adjustments as necessary based on employee feedback and changing regulations.

Legal use of the car allowance policy

For a car allowance policy to be legally binding, it must comply with federal and state regulations. This includes adherence to IRS guidelines regarding taxable income and proper documentation of vehicle use. Employers should ensure the policy is clearly communicated and that employees understand their obligations. Regular reviews and updates to the policy can help maintain compliance with evolving laws and regulations.

Examples of using the car allowance policy

Practical examples of car allowance policy applications include:

- An employee who travels frequently for client meetings may receive a higher allowance to cover increased fuel and maintenance costs.

- Companies may offer different allowance amounts based on geographic location, recognizing variations in cost of living and vehicle expenses.

- Employers might require employees to submit monthly mileage reports to ensure transparency and accountability in vehicle use.

IRS Guidelines

The IRS provides specific guidelines regarding car allowances, classifying them as either taxable or non-taxable income. Employers must report allowances that exceed the standard mileage rate as taxable income. It is essential for businesses to stay informed about these guidelines to avoid penalties and ensure compliance. Regular training and updates for HR personnel can help maintain adherence to IRS requirements.

Quick guide on how to complete agreement car allowance

Complete Agreement Car Allowance effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a fantastic eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Agreement Car Allowance on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Agreement Car Allowance without hassle

- Obtain Agreement Car Allowance and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from your preferred device. Modify and electronically sign Agreement Car Allowance while ensuring excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a car allowance policy template?

A car allowance policy template is a pre-designed document that outlines the terms and conditions under which an employer provides a vehicle allowance to employees. This template helps ensure compliance and clarity by defining the eligible expenses, reimbursement processes, and tax implications associated with vehicle allowances.

-

How can I customize the car allowance policy template?

You can easily customize the car allowance policy template by modifying sections to fit your organization's specific needs. Whether you want to include different allowance amounts, mileage reimbursements, or eligibility criteria, our platform allows you to edit the template directly for a tailored fit.

-

Is the car allowance policy template legally compliant?

Yes, the car allowance policy template is designed to comply with applicable laws and regulations, but it's important for businesses to review it with legal counsel. This ensures that the template meets local employment laws and tax regulations, protecting both the employer and employees.

-

What are the benefits of using a car allowance policy template?

Using a car allowance policy template streamlines the creation of consistent policies across your organization. It saves time and reduces the risk of legal issues by providing a solid framework that addresses common scenarios, while also delivering clear communication of benefits to employees.

-

Can I integrate the car allowance policy template with other tools?

Yes, the car allowance policy template can be easily integrated with various HR and payroll systems for seamless functionality. Our platform supports integrations that make tracking allowances and compliance straightforward, ensuring that all employee documentation is managed efficiently.

-

What formats are available for the car allowance policy template?

The car allowance policy template is available in multiple formats, including Word, PDF, and online formats. These options allow you to choose the best format that suits your workflow and ensures easy distribution to employees and stakeholders.

-

How much does the car allowance policy template cost?

The cost of the car allowance policy template can vary based on the specific package you choose on our platform. We offer competitive pricing options that cater to businesses of all sizes, providing a cost-effective solution for creating and managing policies efficiently.

Get more for Agreement Car Allowance

Find out other Agreement Car Allowance

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure