Mortgage Note Form

What is the Mortgage Note

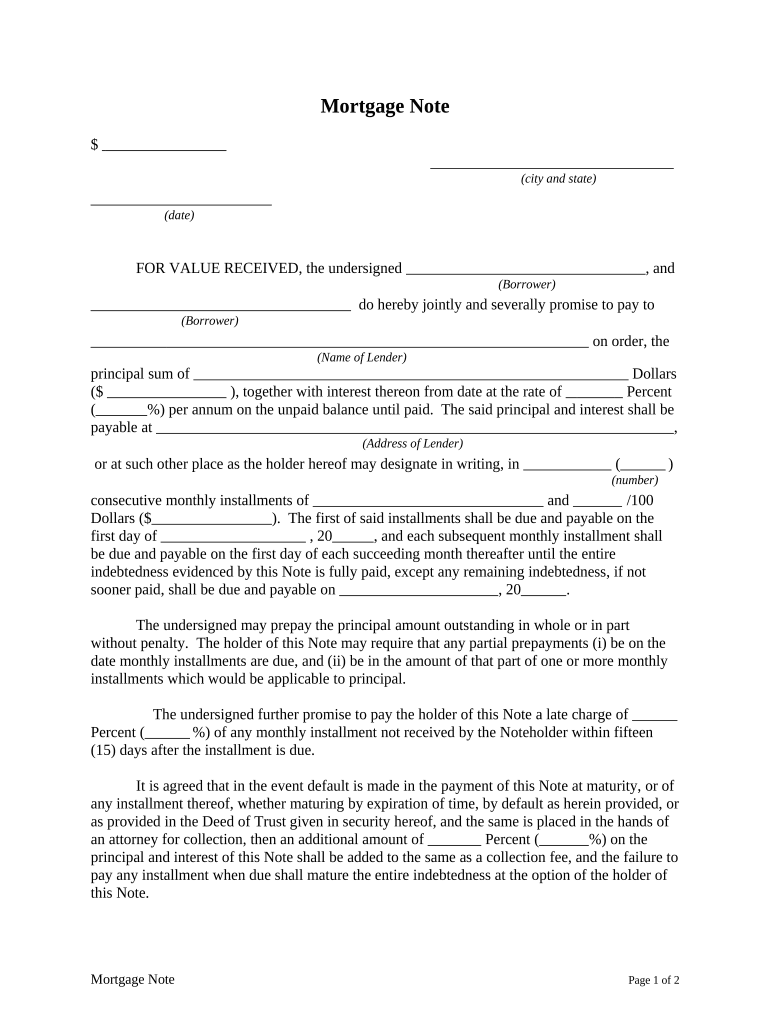

A mortgage note is a legal document that outlines the terms of a loan secured by real estate. It serves as a promise to repay the borrowed amount, detailing the loan amount, interest rate, repayment schedule, and the consequences of default. The mortgage note is crucial in real estate transactions as it provides lenders with a legal claim to the property if the borrower fails to meet their obligations.

Key elements of the Mortgage Note

Understanding the key elements of a mortgage note is essential for both borrowers and lenders. These elements include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The percentage charged on the borrowed amount, which can be fixed or variable.

- Repayment Terms: The schedule for repayment, including the frequency of payments and the loan duration.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to make payments.

- Property Description: A detailed description of the property being financed.

Steps to complete the Mortgage Note

Completing a mortgage note involves several important steps to ensure accuracy and legality:

- Gather Information: Collect all necessary details, including personal identification, property information, and financial details.

- Fill Out the Form: Complete the mortgage note form with accurate information, ensuring all fields are filled out correctly.

- Review the Document: Carefully review the completed mortgage note for any errors or omissions.

- Sign the Document: Both the borrower and lender must sign the mortgage note, which can be done electronically for convenience.

- Store the Document: Keep a copy of the signed mortgage note in a secure location for future reference.

Legal use of the Mortgage Note

The legal use of a mortgage note is governed by various laws and regulations. In the United States, mortgage notes must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to be considered valid when signed electronically. These laws ensure that electronic signatures carry the same weight as traditional handwritten signatures, provided that certain conditions are met.

How to obtain the Mortgage Note

Obtaining a mortgage note typically occurs during the loan application process. Borrowers can request a mortgage note from their lender, which will provide the necessary documentation once the loan is approved. It is important to ensure that the note is complete and accurate before signing. Additionally, borrowers may consult with a legal professional to understand the implications of the mortgage note fully.

Digital vs. Paper Version

Both digital and paper versions of the mortgage note are legally valid, but each has its advantages. Digital mortgage notes offer convenience, allowing for faster processing and easier storage. They can be signed electronically, streamlining the transaction process. On the other hand, paper versions provide a tangible document that some borrowers may prefer for record-keeping. Regardless of the format, it is essential to ensure that the document complies with relevant legal requirements.

Quick guide on how to complete mortgage note 497332286

Effortlessly Prepare Mortgage Note on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Handle Mortgage Note on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Mortgage Note with Ease

- Locate Mortgage Note and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your preferred delivery method for your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, endless form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Mortgage Note and guarantee excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mortgage Note?

A Mortgage Note is a legal document that outlines the terms of a loan used to purchase real estate. It establishes the borrower's obligation to repay the lender and includes details such as the loan amount, interest rate, and payment schedule. Understanding a Mortgage Note is crucial for both borrowers and lenders to ensure compliance with the loan agreement.

-

How does airSlate SignNow facilitate the signing of Mortgage Notes?

airSlate SignNow provides a seamless platform for electronically signing Mortgage Notes, ensuring a quick and secure process. Users can upload their Mortgage Note documents, customize them for their needs, and send them out for signatures. The solution simplifies document management and speeds up the closing process signNowly.

-

What are the costs associated with using airSlate SignNow for Mortgage Notes?

airSlate SignNow offers various pricing plans that cater to different business needs, including plans specifically tailored for handling Mortgage Notes. The cost-effective solution ensures businesses can manage their documentation without breaking the bank. Pricing varies based on features, number of users, and additional options for bulk signing.

-

Can I integrate airSlate SignNow with other software for managing Mortgage Notes?

Yes, airSlate SignNow offers integrations with numerous software applications, allowing for streamlined management of Mortgage Notes. This enhances productivity by connecting your preferred CRM, document management, or financial software. Users can easily automate workflows and ensure all necessary data is accessible from a single platform.

-

What are the benefits of using airSlate SignNow for Mortgage Notes?

Using airSlate SignNow for Mortgage Notes provides multiple benefits, including increased efficiency, enhanced security, and reduced paperwork. The platform allows for real-time updates and tracking, which keeps all parties informed throughout the mortgage process. Additionally, eSigning eliminates delays associated with physical paperwork.

-

Is airSlate SignNow compliant with regulations related to Mortgage Notes?

Yes, airSlate SignNow complies with all relevant electronic signature laws and regulations, ensuring that your Mortgage Notes are legally binding. The platform adheres to industry standards for security and privacy, which helps protect sensitive information during the signing process. This compliance gives users peace of mind when handling important documents.

-

How can airSlate SignNow help in accelerating the Mortgage Note signing process?

airSlate SignNow streamlines the Mortgage Note signing process by enabling quick eSigning, reducing the time to close on real estate transactions. Automated reminders and notifications keep signers engaged, ensuring that documents are signed promptly. This efficiency not only speeds up the process but also enhances the overall customer experience.

Get more for Mortgage Note

- Exercise caution when using free wifi or public computers as these are not secure form

- Work study employer information form

- Confidential travel history form all university of st

- Form ithaca college

- Food stamps eligibility snap program eligibility help form

- I changed my last name right before graduation general form

- University of rhode island purchase card application form

- 2020 21 verification worksheet householdnumber in college form

Find out other Mortgage Note

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document