Ct Proceedings Withholding 2017-2026

What is the Ct Proceedings Withholding

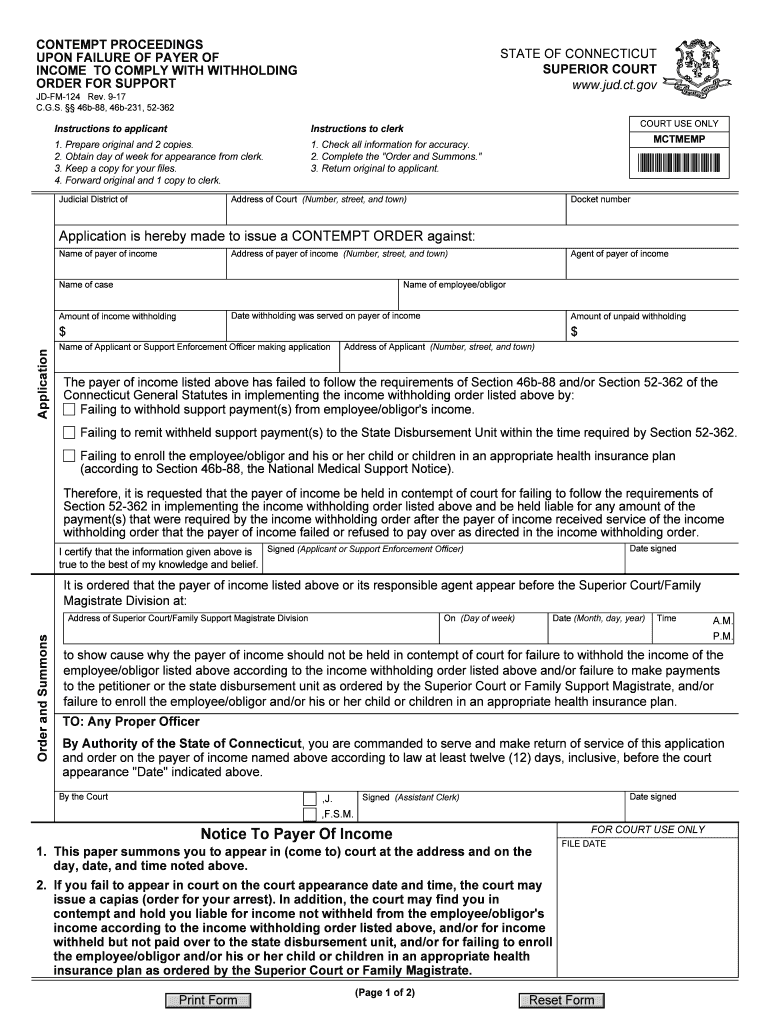

The Ct Proceedings Withholding is a legal mechanism utilized in Connecticut to manage the withholding of income for individuals involved in court proceedings. This form is primarily used in cases where a payer is required to withhold a portion of their income to fulfill obligations such as child support or alimony. The withholding ensures that payments are made consistently and in compliance with court orders, thereby supporting the financial stability of dependents.

How to use the Ct Proceedings Withholding

Using the Ct Proceedings Withholding involves several steps to ensure compliance with legal requirements. First, the payer must complete the appropriate form, detailing the necessary information regarding their income and the amount to be withheld. Once filled out, the form should be submitted to the relevant court or agency overseeing the case. It is crucial to keep records of all submissions and communications related to the withholding to maintain transparency and accountability.

Steps to complete the Ct Proceedings Withholding

Completing the Ct Proceedings Withholding requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, such as proof of income and any existing court orders.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate court or agency, either online or by mail.

- Retain copies of the submitted form and any correspondence for your records.

Legal use of the Ct Proceedings Withholding

The legal use of the Ct Proceedings Withholding is governed by state laws and regulations. It is essential for the payer to understand their obligations under the law, including the specific amounts that must be withheld and the timelines for payments. Failure to comply with these legal requirements can result in penalties, including additional court actions or fines.

Required Documents

To effectively complete the Ct Proceedings Withholding, certain documents are required. These may include:

- Proof of income, such as pay stubs or tax returns.

- Any existing court orders related to the withholding.

- Identification documents to verify the payer's identity.

Form Submission Methods

The Ct Proceedings Withholding can be submitted through various methods, depending on the preferences of the payer and the requirements of the court. Common submission methods include:

- Online submission through designated court portals.

- Mailing the completed form to the appropriate court address.

- In-person submission at the court clerk's office.

Penalties for Non-Compliance

Non-compliance with the Ct Proceedings Withholding can lead to serious consequences. Payers who fail to withhold the required amounts or do not submit the form as mandated may face legal repercussions. These can include fines, wage garnishments, or additional court orders to enforce compliance. Understanding the importance of adhering to the withholding requirements is crucial for avoiding these penalties.

Quick guide on how to complete ct proceedings withholding

Effortlessly Prepare Ct Proceedings Withholding on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents quickly and without delays. Manage Ct Proceedings Withholding on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Ct Proceedings Withholding effortlessly

- Locate Ct Proceedings Withholding and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in several clicks from any device you choose. Edit and electronically sign Ct Proceedings Withholding and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct proceedings withholding

Create this form in 5 minutes!

How to create an eSignature for the ct proceedings withholding

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a payer summons get?

A payer summons get is a legal document that requests payment from a payer for services rendered. Understanding how the payer summons get function can help streamline your document management process.

-

How does airSlate SignNow simplify the payer summons get process?

airSlate SignNow allows you to create, send, and eSign payer summons get effortlessly. With intuitive features, you can ensure every document is securely managed and signed in compliance with legal standards.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to businesses of all sizes. By selecting a plan, you can easily handle multiple payer summons get without breaking the bank, ensuring a cost-effective solution.

-

Can I integrate airSlate SignNow with other applications for payer summons get management?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your payer summons get workflow. This allows you to connect with popular platforms and automate processes efficiently.

-

What security features does airSlate SignNow provide for payer summons get?

airSlate SignNow prioritizes security by utilizing advanced encryption methods to protect your payer summons get. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

How can airSlate SignNow improve the efficiency of handling payer summons get?

By using airSlate SignNow, businesses can dramatically speed up the handling of payer summons get. The platform automates workflows, reducing the time spent on document management and enhancing overall productivity.

-

Is there a mobile application for managing payer summons get?

Yes, airSlate SignNow offers a mobile application that allows you to manage payer summons get on the go. With the mobile app, you can send and eSign documents from anywhere, making it convenient for busy professionals.

Get more for Ct Proceedings Withholding

- Cor 14 3 386489326 form

- Uwplatteville continuing education registration and data form

- Inflatanation waiver form

- Name change of 412408676 form

- Room reservation form pdf university registrar tulane university

- Dealer license nc form

- 29 salaries from overtime during emergency situat form

- Fossil record worksheet pdf form

Find out other Ct Proceedings Withholding

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile