Change Ownership Property Form

What is the change of ownership document?

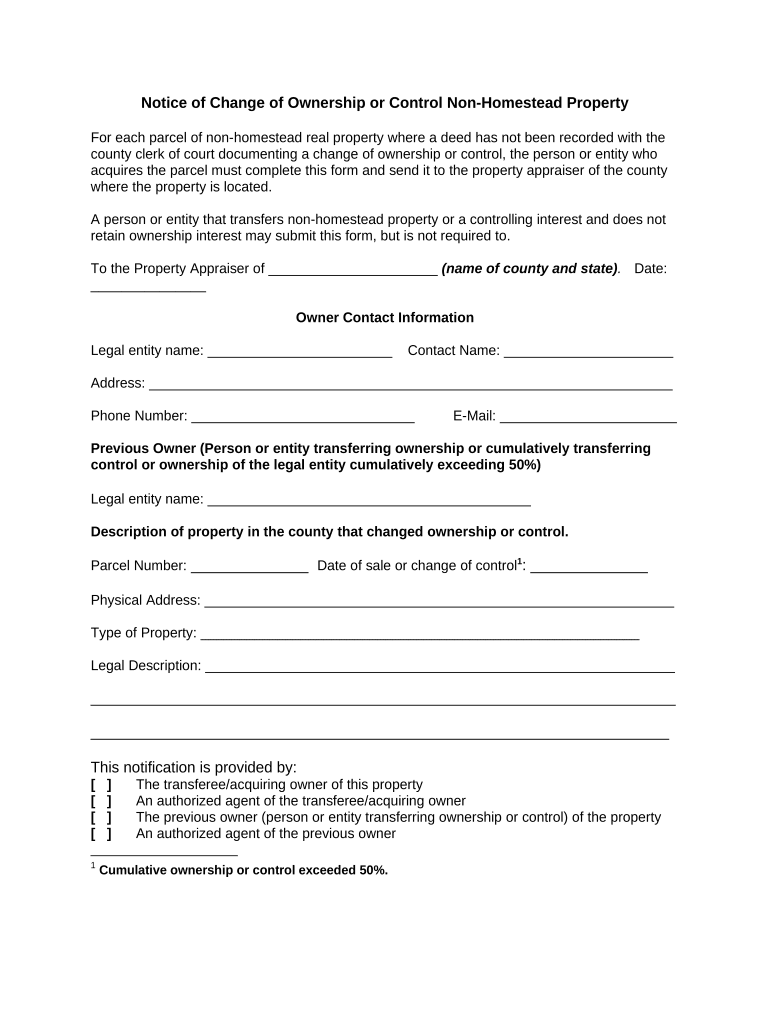

The change of ownership document is a legal form used to transfer ownership of property or assets from one party to another. This document is essential in various contexts, including real estate transactions, vehicle transfers, and business ownership changes. It serves as a formal record that indicates who the new owner is and outlines the terms of the transfer. In the United States, this document must comply with state-specific laws and regulations to be considered valid.

Steps to complete the change of ownership document

Completing a change of ownership document typically involves several key steps:

- Gather necessary information about the property or asset being transferred.

- Identify the current owner and the new owner, including their full names and contact details.

- Clearly describe the property or asset, including any relevant identification numbers, such as a vehicle identification number (VIN) for cars or a legal description for real estate.

- Include any terms or conditions related to the transfer, such as payment details or contingencies.

- Sign the document in the presence of a notary public if required by state law.

- Submit the completed document to the appropriate government agency or entity, such as a county recorder’s office or the Department of Motor Vehicles (DMV).

Legal use of the change of ownership document

The legal use of a change of ownership document is crucial for ensuring the validity of the transfer. This document must meet specific legal requirements, which can vary by state. Generally, it should include the signatures of both the current and new owners, and in some cases, it may need to be notarized. Compliance with local laws is essential to avoid disputes regarding ownership and to ensure that the transfer is recognized by relevant authorities.

Required documents for the change of ownership

When preparing a change of ownership document, several supporting documents may be required, including:

- Proof of identity for both the current and new owners.

- Original title or deed for the property or asset being transferred.

- Any existing liens or encumbrances on the property, if applicable.

- Purchase agreement or bill of sale, if the transfer involves a sale.

Form submission methods

Submitting a change of ownership document can typically be done through various methods, depending on the type of property and state regulations. Common submission methods include:

- Online submission through state or local government websites.

- Mailing the completed document to the appropriate agency.

- In-person submission at designated offices, such as the county recorder's office or DMV.

State-specific rules for the change of ownership

Each state in the U.S. has its own regulations regarding change of ownership documents. These rules can dictate the required forms, submission processes, and legal requirements for the transfer. It is important for individuals to familiarize themselves with their state’s specific guidelines to ensure compliance and avoid potential issues during the transfer process.

Quick guide on how to complete change ownership property

Prepare Change Ownership Property effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers a flawless eco-friendly substitute for traditional printed and signed papers, as you can locate the right form and safely archive it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Change Ownership Property on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Change Ownership Property without hassle

- Locate Change Ownership Property and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Change Ownership Property and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a change of ownership document?

A change of ownership document is a legal form used to transfer ownership rights from one party to another. With airSlate SignNow, you can easily create and eSign this document, ensuring all parties are in agreement and that the transfer is legally recognized.

-

How can airSlate SignNow help with creating a change of ownership document?

airSlate SignNow provides a user-friendly platform that simplifies the process of creating a change of ownership document. You can customize templates, add necessary fields, and securely invite other parties to eSign, making the process efficient and straightforward.

-

What features does airSlate SignNow offer for managing change of ownership documents?

With airSlate SignNow, you gain access to features like document templates, real-time tracking, and automated reminders. These tools help ensure your change of ownership document is completed promptly and accurately, reducing potential delays in ownership transfer.

-

Is airSlate SignNow affordable for businesses needing a change of ownership document?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes. Our pricing plans are designed to accommodate various needs, and the ability to eSign change of ownership documents can save you time and resources that would otherwise be spent on traditional paper processes.

-

Can I integrate airSlate SignNow with other platforms for handling change of ownership documents?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, including CRM and project management tools. This allows you to manage your change of ownership documents directly within your existing workflows, enhancing efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for change of ownership documents?

Using airSlate SignNow for change of ownership documents provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our electronic signatures are legally binding, ensuring that your document holds up in any legal context.

-

How secure is my change of ownership document with airSlate SignNow?

Your security is a top priority at airSlate SignNow. We use advanced encryption and comply with industry standards to protect your change of ownership document, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Change Ownership Property

- Beginning driver experience log nrs 483 form

- Temporary visitor drivers license tvdl quick guide form

- Illinois secretary of state polish edition form

- Vehicle inspection form houston county probate court

- Form trs78 direct deposit request form trs78 direct deposit request

- Illinois emergency management agency cert application for form

- Mv 50 retailmv 50w wholesale order form vs 1141 419

- Reminders for tax year 2018 form

Find out other Change Ownership Property

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online