Notice Check Form

What is the Notice Check

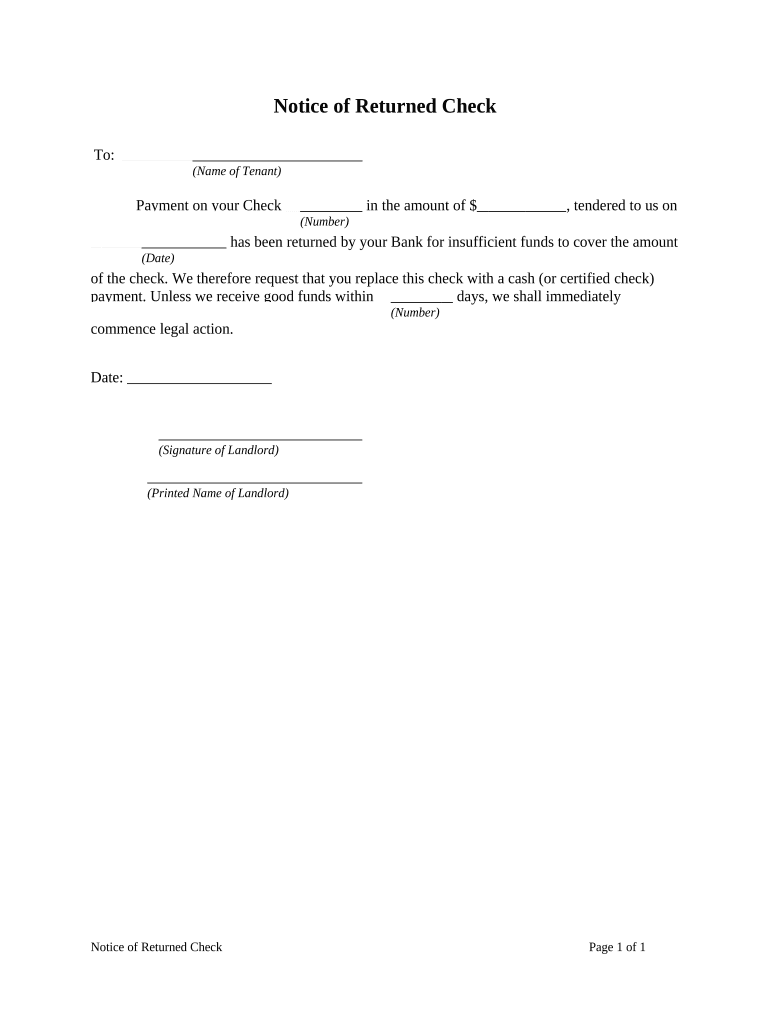

The notice check is a formal document issued when a check is returned due to insufficient funds or other reasons, such as a closed account. This document serves as a notification to the issuer of the check, informing them that the payment could not be processed. It is crucial for both the payee and the issuer to understand the implications of a notice check, as it can affect financial records and relationships.

How to Use the Notice Check

Using the notice check involves several steps. First, the payee must receive the notice indicating that their check has been returned. Next, they should review the details provided in the notice, including the reason for the return. After understanding the situation, the payee may need to contact the issuer to resolve the issue, which could involve arranging for a new payment method or discussing the circumstances surrounding the returned check.

Steps to Complete the Notice Check

Completing a notice check involves a systematic approach to ensure all necessary information is accurately recorded. Follow these steps:

- Gather all relevant information, including the original check details and the notice received.

- Clearly state the reason for the notice check, as indicated in the returned check form.

- Include any necessary documentation that supports your claim or request for payment.

- Ensure that all parties involved are informed about the notice check and its implications.

Legal Use of the Notice Check

The notice check must be used in compliance with relevant legal standards. In the United States, it is important to follow state-specific regulations regarding the handling of returned checks. This includes adhering to the Fair Debt Collection Practices Act and other applicable laws. Proper use of the notice check can help protect the rights of both the payee and the issuer, ensuring that all actions taken are legally sound.

Key Elements of the Notice Check

Several key elements must be included in a notice check to ensure its validity and effectiveness:

- The date of issuance of the notice.

- The name and contact information of the payee.

- The name and contact information of the issuer of the check.

- The amount of the original check and the reason for its return.

- Any relevant transaction or check numbers.

Examples of Using the Notice Check

Examples of using a notice check can vary based on different scenarios. For instance, if a business receives a notice check due to a bounced payment from a client, they may use the document to formally notify the client of the issue and request a new payment. Similarly, an individual might use the notice check to address a returned personal check with a friend or family member, ensuring transparency and clarity in their financial dealings.

Quick guide on how to complete notice check

Effortlessly prepare Notice Check on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without hindrances. Manage Notice Check on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

The easiest way to modify and electronically sign Notice Check without any hassle

- Locate Notice Check and click Get Form to commence.

- Utilize the tools provided to submit your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Modify and eSign Notice Check to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a notice check, and how does it work with airSlate SignNow?

A notice check is a formal notification that can be sent electronically using airSlate SignNow. It allows businesses to inform relevant parties of important updates or changes while ensuring that the document is securely signed and stored.

-

How can airSlate SignNow streamline the notice check process?

airSlate SignNow simplifies the notice check process by providing an efficient platform for document sharing and eSigning. With customizable templates and a user-friendly interface, businesses can send notice checks without hassle, reducing delays and ensuring compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals, small businesses, and enterprises. Each plan includes features to facilitate the notice check process, ensuring you only pay for what you use.

-

What features can I expect when using airSlate SignNow for notice checks?

When using airSlate SignNow for notice checks, you'll have access to features like document templates, unlimited eSigning, and integration with popular productivity tools. These features are designed to help you manage your notice checks more efficiently and effectively.

-

Is airSlate SignNow secure for sending notice checks?

Yes, airSlate SignNow prioritizes security, employing industry-standard encryption and compliance with regulations such as GDPR and HIPAA. This means your notice checks are securely transmitted and stored, providing peace of mind for sensitive documents.

-

Can I integrate other tools with airSlate SignNow for notice checks?

Absolutely! airSlate SignNow offers seamless integrations with various applications like Google Drive, Zapier, and Microsoft Office. This capability allows you to enhance your workflows and streamline the notice check process further.

-

What benefits does airSlate SignNow provide for automated notice checks?

Using airSlate SignNow for automated notice checks can save you time and resources by eliminating manual processes. Automation improves efficiency, reduces errors, and allows you to focus on core business activities while still managing necessary notifications.

Get more for Notice Check

- Operations bureaupenalty waiver form

- Do not mail to department of revenue services drs form

- Form ct 706709 ext instructions section 1 gift tax

- Fillable online strawberry marin rental agreement waiver form

- 2019 california form 3523 research credit 2019 california form 3523 research credit

- 2019 form 541 california fiduciary income tax return 2019 form 541 california fiduciary income tax return

- 2019 3885 corporation depreciation and amortization 2019 3885 corporation depreciation and amortization form

- 2019 california form 3885 l depreciation and amortization 2019 california form 3885 l depreciation and amortization

Find out other Notice Check

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement