Share Revenue Form

What is the Share Revenue

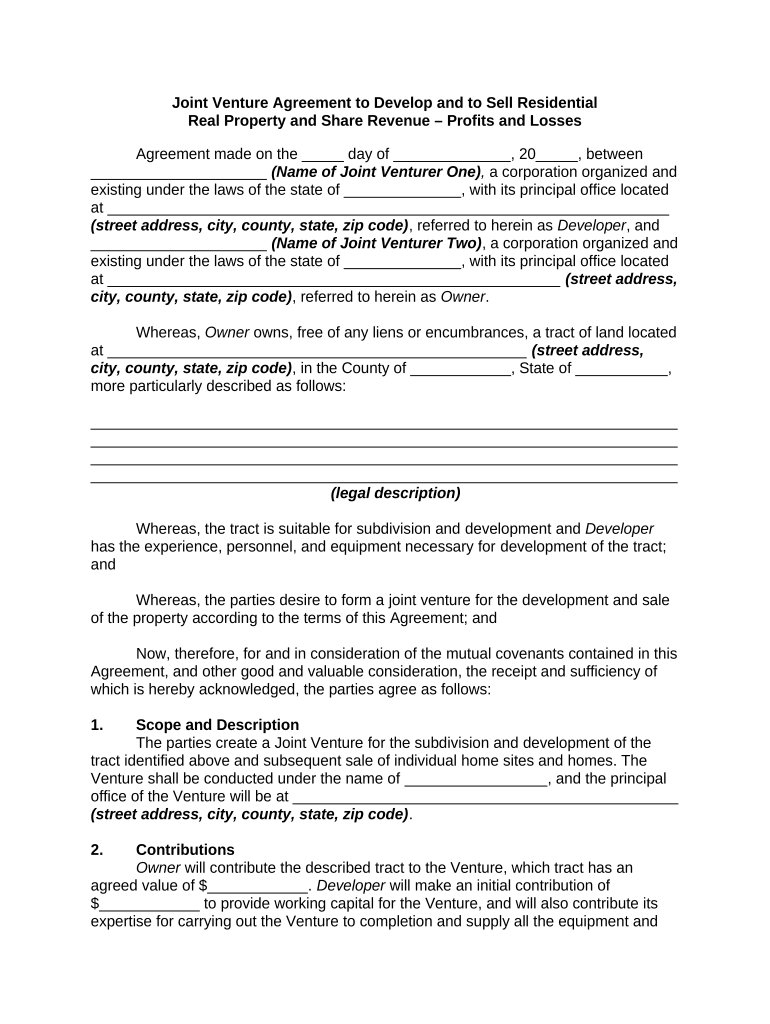

The share revenue form is a crucial document used by businesses to outline the distribution of revenue among partners or stakeholders. This form serves to formalize the agreements made regarding how profits will be shared, ensuring transparency and accountability. It is particularly important for partnerships and corporations, where multiple parties have a vested interest in the financial outcomes of the business. By clearly defining the terms of revenue sharing, the share revenue form helps prevent disputes and fosters a collaborative environment.

How to use the Share Revenue

Using the share revenue form involves several key steps. First, gather all necessary information about the parties involved, including their roles and contributions to the business. Next, fill out the form with details about the revenue-sharing agreement, specifying percentages or amounts each party will receive. Ensure that all parties review the completed form for accuracy and clarity. Once everyone agrees on the terms, signatures should be obtained to validate the document. Utilizing electronic signature solutions like signNow can streamline this process, making it efficient and secure.

Steps to complete the Share Revenue

Completing the share revenue form involves a systematic approach. Begin by identifying all stakeholders who will share in the revenue. Next, outline the revenue-sharing structure by determining the percentage or fixed amount each party will receive. It is essential to include any conditions that may affect these distributions, such as performance metrics or timeframes. After drafting the agreement, review it with all stakeholders to ensure mutual understanding and agreement. Finally, obtain signatures from all parties involved, which can be facilitated through an electronic signing platform to enhance security and compliance.

Legal use of the Share Revenue

The legal use of the share revenue form is governed by various regulations that ensure its validity and enforceability. To be legally binding, the form must be completed accurately and signed by all parties involved. Compliance with federal and state laws, such as the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (ESIGN), is essential when using electronic signatures. These laws provide a framework that recognizes electronic signatures as valid, provided certain criteria are met. It is advisable to consult legal counsel to ensure that the form complies with all applicable laws.

Key elements of the Share Revenue

Several key elements must be included in the share revenue form to ensure its effectiveness. These elements typically include:

- Parties Involved: Names and roles of all stakeholders.

- Revenue Distribution: Clear percentages or amounts allocated to each party.

- Conditions: Any specific conditions that affect revenue sharing.

- Effective Date: The date when the agreement takes effect.

- Signatures: Signatures of all parties to validate the agreement.

Examples of using the Share Revenue

Examples of using the share revenue form can vary based on the business structure and agreements in place. For instance, in a partnership, the form may specify that profits are shared equally among partners unless otherwise agreed. In a corporation, the form might detail how dividends are distributed to shareholders based on their ownership percentage. Additionally, startups may use the form to outline revenue sharing with investors, ensuring that all parties understand their returns based on the agreed terms.

Quick guide on how to complete share revenue

Effortlessly Prepare Share Revenue on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without any delays. Manage Share Revenue on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

Easily Modify and Electronically Sign Share Revenue

- Locate Share Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Share Revenue, ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to share revenue with airSlate SignNow?

Sharing revenue with airSlate SignNow typically involves collaborating with us to increase your earnings while utilizing our eSigning solutions. By partnering with us, you can generate income through referrals and enhance your business offerings.

-

How can I earn by sharing revenue through airSlate SignNow?

You can earn by sharing revenue with airSlate SignNow through our affiliate program. By referring customers to our platform, you will receive a percentage of the revenue generated from their use of our eSigning solution.

-

What pricing options does airSlate SignNow offer?

airSlate SignNow provides flexible pricing plans designed for businesses of all sizes. Whether you are looking to share revenue through an affiliate partnership or want to use our services directly, we offer competitive pricing to suit your needs.

-

What features does airSlate SignNow provide that can help share revenue?

Our platform includes features such as custom branding, secure eSigning, and integration with various applications, making it easy to enhance value for your customers. These features help you share revenue effectively with new clients by offering them an optimized digital signing experience.

-

Is airSlate SignNow easy to integrate into my existing systems?

Yes, airSlate SignNow is designed for seamless integration with many popular applications and platforms. This ease of integration allows you to quickly adapt and maximize the opportunities to share revenue with your customers without disrupting your current systems.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly streamline your document management and eSigning processes, ultimately improving efficiency and customer satisfaction. Additionally, you can leverage these benefits to share revenue by offering faster turnaround times to your clients.

-

Can I track the performance of my shared revenue efforts with airSlate SignNow?

Yes, airSlate SignNow provides analytics tools that enable you to track your referrals and shared revenue performance. This data helps you refine your marketing strategies and maximize your earnings through effective partnerships.

Get more for Share Revenue

- Instructions for 941p me mainegov form

- Maine revenue services filing for maine income tax form

- 99 16941p0 form 941p me 01 01 2019 12 31 2019 schedule

- Maine revenue services formsin alphabetical order forms

- Maine revenue services forms real estate withholding

- 1900100 00 00 00 00 00 00 00 00 00 00 00 mainegov form

- Maine revenue services forms individual mainegov

- Federal extension is in effect form

Find out other Share Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors