Exemption Applications Form

What is the exemption application?

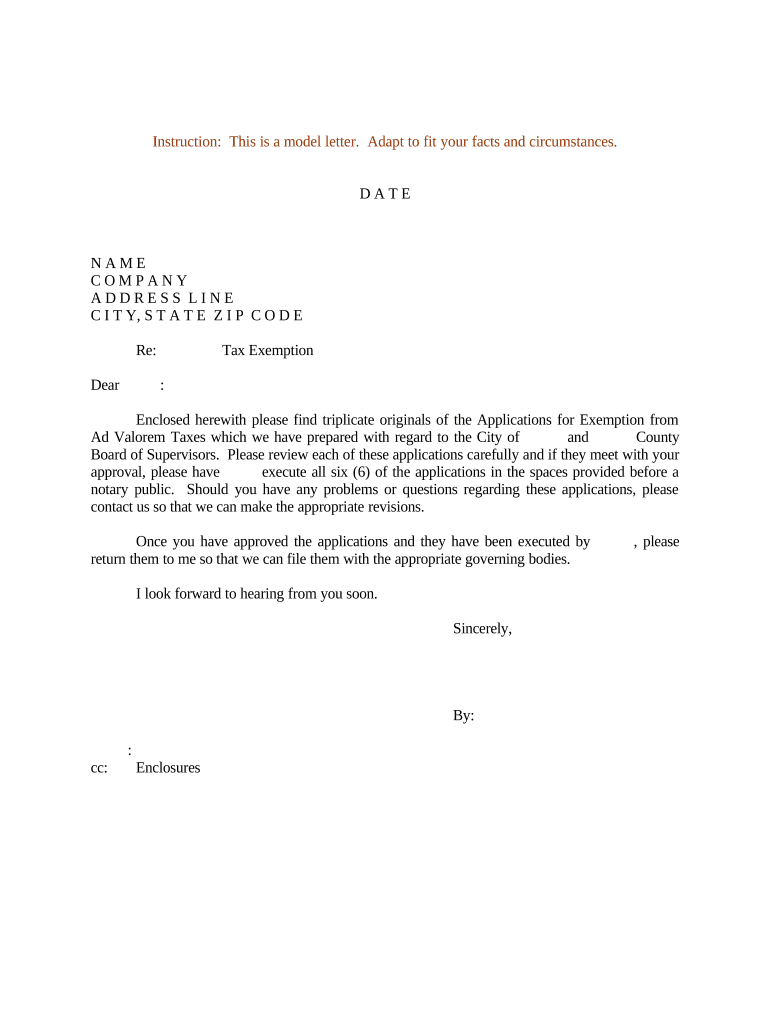

An exemption application is a formal request submitted to a governing body, often used to seek relief from certain tax obligations or regulations. In the United States, these applications can pertain to various areas, including tax exemptions for non-profit organizations, property tax exemptions, and specific exemptions related to business operations. Understanding the purpose and requirements of these applications is essential for individuals and organizations seeking to navigate the complexities of tax law and compliance.

Steps to complete the exemption application

Completing an exemption application involves several key steps to ensure accuracy and compliance. Follow these general steps:

- Gather necessary documentation: Collect all relevant documents that support your request, such as financial statements, proof of eligibility, and identification.

- Fill out the application form: Carefully complete the exemption application form, ensuring all information is accurate and complete.

- Review the application: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the application: Send the completed application along with any required supporting documents to the appropriate agency, either online, by mail, or in person.

- Follow up: After submission, monitor the status of your application and respond promptly to any requests for additional information.

Legal use of the exemption application

Exemption applications must adhere to specific legal requirements to be considered valid. In the U.S., these applications are governed by various laws and regulations, including the Internal Revenue Code for tax-related exemptions. It is crucial to ensure that the application complies with all relevant legal frameworks, as this can affect its acceptance and the potential benefits granted. Utilizing a reliable e-signature solution can enhance the legal standing of your application, providing a secure way to submit documents while maintaining compliance with eSignature laws.

Eligibility criteria for exemption applications

Eligibility criteria for exemption applications vary depending on the type of exemption being sought. Common factors include:

- Type of organization or entity: Non-profit organizations often qualify for tax exemptions, while businesses may need to meet specific criteria based on their structure.

- Purpose of the exemption: The application must demonstrate that the requested exemption serves a valid public purpose or meets specific regulatory standards.

- Financial status: Many applications require proof of financial need or the ability to meet certain revenue thresholds.

Understanding these criteria is essential for preparing a successful application and ensuring compliance with applicable laws.

Required documents for exemption applications

When submitting an exemption application, certain documents are typically required to support your request. These may include:

- Completed application form: Ensure that all sections are filled out accurately.

- Proof of eligibility: This may include tax identification numbers, incorporation documents, or financial statements.

- Supporting documentation: Additional materials that demonstrate the purpose of the exemption, such as mission statements or project descriptions.

Providing comprehensive and accurate documentation can significantly enhance the likelihood of approval for your exemption application.

Form submission methods for exemption applications

Exemption applications can typically be submitted through various methods, depending on the agency and type of exemption. Common submission methods include:

- Online submission: Many agencies offer digital platforms for submitting applications, which can streamline the process and reduce processing times.

- Mail: Traditional mail submission is still an option for those who prefer physical documentation.

- In-person submission: Some agencies allow applicants to submit forms directly at their offices, providing an opportunity for immediate feedback.

Choosing the appropriate submission method can depend on personal preference, urgency, and specific agency requirements.

Quick guide on how to complete exemption applications

Complete Exemption Applications effortlessly on any device

Online document management has gained popularity with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Exemption Applications on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Exemption Applications with ease

- Obtain Exemption Applications and click Get Form to initiate the process.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors requiring new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Exemption Applications and ensure effective communication at each stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are exemption applications and how can airSlate SignNow help?

Exemption applications are official requests that allow individuals or businesses to be excluded from certain legal requirements or obligations. airSlate SignNow simplifies this process by enabling users to easily create, send, and eSign exemption applications, ensuring a faster and more efficient workflow.

-

What features does airSlate SignNow offer for exemption applications?

airSlate SignNow provides a range of features for managing exemption applications, including customizable templates, automated workflows, and secure eSigning. These features help streamline the document management process, making it easier to track submissions and ensure compliance.

-

How does pricing work for airSlate SignNow regarding exemption applications?

Pricing for airSlate SignNow is flexible and based on usage, making it a cost-effective solution for businesses needing to manage exemption applications. Various plans are available, allowing organizations to choose the best fit for their needs based on document volume and required features.

-

Can airSlate SignNow integrate with other software for managing exemption applications?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, such as CRM systems and project management tools, which enhances the management of exemption applications. This connectivity allows users to centralize their processes and increase overall efficiency.

-

What benefits does airSlate SignNow provide for handling exemption applications?

The primary benefits of using airSlate SignNow for exemption applications include improved efficiency, reduced paperwork, and enhanced compliance. It enables businesses to quickly get documents signed and stored securely, ultimately saving time and resources.

-

Is airSlate SignNow secure for sending exemption applications?

Absolutely. airSlate SignNow takes security very seriously, employing industry-leading encryption standards to protect sensitive information in exemption applications. This ensures that all electronic signatures and documents remain confidential and tamper-proof.

-

Can I track the status of my exemption applications in airSlate SignNow?

Yes, users can easily track the status of exemption applications within airSlate SignNow. The platform provides real-time updates on document progress, allowing businesses to stay informed on where each application stands in the signing process.

Get more for Exemption Applications

Find out other Exemption Applications

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast