Exemption Letter for Essential Businesses Ca Form

What is the exemption letter for essential businesses in California?

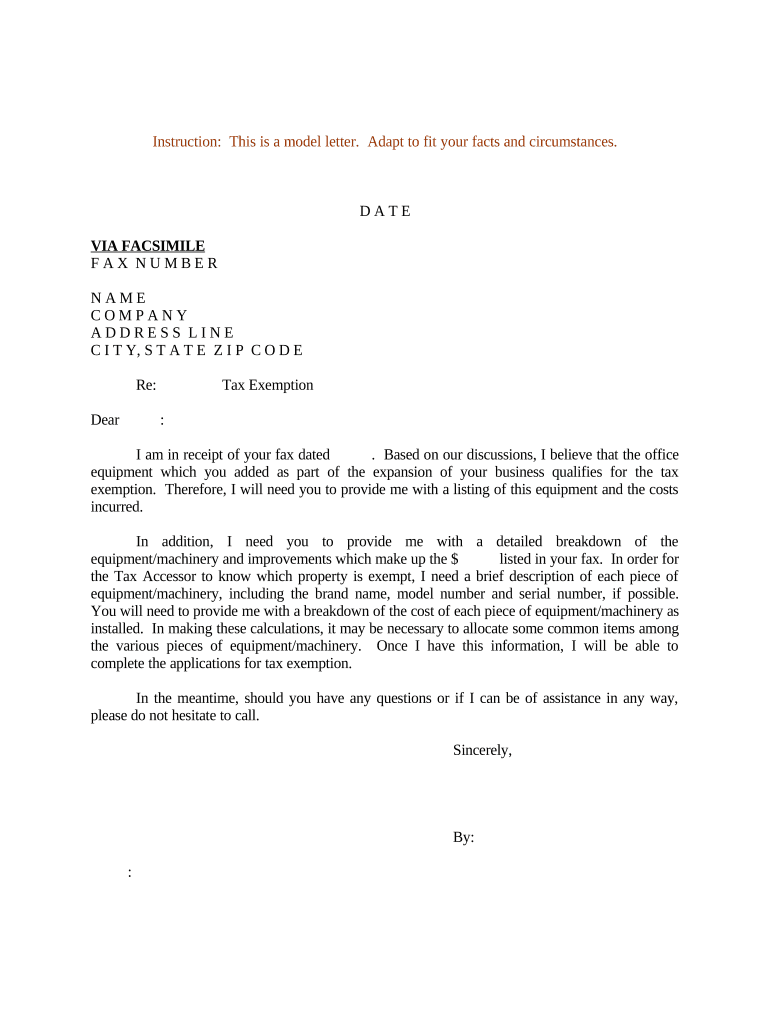

The exemption letter for essential businesses in California serves as a formal document that allows certain businesses to operate during emergencies, such as public health crises. This letter is particularly vital for businesses that provide essential services, ensuring they can continue functioning while adhering to state regulations. The letter typically outlines the nature of the business, the services provided, and the justification for being classified as essential. Understanding this classification is crucial for compliance with local laws and maintaining operational continuity.

Key elements of the exemption letter for essential businesses in California

When drafting an exemption letter for essential businesses in California, several key elements must be included to ensure its validity and effectiveness:

- Business Information: Include the full name, address, and contact information of the business.

- Nature of Services: Clearly describe the services provided and how they qualify as essential under state guidelines.

- Justification: Provide a rationale for why the business should be considered essential, referencing relevant state orders or guidelines.

- Signature: The letter should be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Steps to complete the exemption letter for essential businesses in California

Completing the exemption letter involves several straightforward steps:

- Gather Information: Collect all necessary business details, including ownership, services offered, and applicable state guidelines.

- Draft the Letter: Write the letter using clear and concise language, ensuring all key elements are included.

- Review for Accuracy: Double-check the details for accuracy and compliance with state regulations.

- Obtain Signatures: Ensure that the letter is signed by an authorized individual within the business.

- Distribute as Necessary: Provide copies of the letter to relevant authorities or stakeholders as required.

Legal use of the exemption letter for essential businesses in California

The legal use of the exemption letter is critical for ensuring that businesses can operate without facing penalties or shutdowns. The letter must comply with state laws and guidelines regarding essential services. It serves as a protective measure, allowing businesses to demonstrate their eligibility to operate during emergencies. Businesses should keep a copy of the letter on hand and be prepared to present it to law enforcement or regulatory agencies if requested.

Eligibility criteria for the exemption letter for essential businesses in California

To qualify for the exemption letter, businesses must meet specific eligibility criteria, which may include:

- Service Type: The business must provide services deemed essential, such as healthcare, food supply, or emergency services.

- Compliance with Regulations: The business must adhere to all local and state regulations regarding health and safety.

- Operational Necessity: The services provided must be necessary for the community's well-being during emergencies.

Who issues the exemption letter for essential businesses in California?

The exemption letter is typically issued by the business itself, as there is no centralized authority responsible for providing these letters. However, businesses may need to reference state or local government guidelines that outline essential services. In some cases, local health departments or regulatory agencies may provide additional documentation or guidance to support the exemption letter.

Quick guide on how to complete exemption letter for essential businesses ca

Complete Exemption Letter For Essential Businesses Ca effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Exemption Letter For Essential Businesses Ca on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Exemption Letter For Essential Businesses Ca without hassle

- Locate Exemption Letter For Essential Businesses Ca and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device. Edit and eSign Exemption Letter For Essential Businesses Ca and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter tax office?

A sample letter tax office is a template used to communicate with tax authorities. It helps individuals and businesses convey specific information or requests effectively. Using a well-structured letter can facilitate smoother interactions with the tax office.

-

How can airSlate SignNow assist with preparing a sample letter tax office?

airSlate SignNow offers templates and tools to create a professional sample letter tax office quickly. Its user-friendly interface allows you to customize the letter to meet your specific needs. With eSigning capabilities, you can finalize your document efficiently.

-

Are there any costs associated with using airSlate SignNow for the sample letter tax office?

Yes, airSlate SignNow operates on a subscription model, offering various pricing tiers. Each tier comes with different features including the ability to prepare and eSign a sample letter tax office. Be sure to check their website for detailed pricing and features.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides extensive features such as document templates, eSignature capabilities, and cloud storage. These tools make it easy to manage a sample letter tax office and other important documents. Additionally, you can track the status of documents in real-time.

-

Is airSlate SignNow secure for sending a sample letter tax office?

Absolutely! airSlate SignNow implements top-notch security measures, including encryption and secure access controls. This ensures that your sample letter tax office and other sensitive documents are protected throughout the entire process.

-

Can I integrate airSlate SignNow with other applications for preparing a sample letter tax office?

Yes, airSlate SignNow supports various integrations with commonly used applications like Google Drive, Dropbox, and others. This integration simplifies retrieving and saving your sample letter tax office directly from your preferred platforms, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for a sample letter tax office?

Using airSlate SignNow for a sample letter tax office enhances efficiency and reduces paper clutter. It allows for quick drafting, sending, and eSigning, streamlining the entire process. Additionally, it aids in document safety and provides a professional appearance.

Get more for Exemption Letter For Essential Businesses Ca

- Monthly state revenue watch home comptrollertexasgov form

- New jersey tax forms 2020 printable state nj 1040 form

- P 142op form

- Dtf form 95 447952394

- Bc appl both form

- 05 164 2021 texas franchise tax annual report extension request 05 164 2021 texas franchise tax annual report extension request form

- 05 169 texas franchise tax 2021 e z computation annual report form

- 50 132 property owners notice of protest texas comptroller form

Find out other Exemption Letter For Essential Businesses Ca

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure