Depreciation Worksheet Form

What is the Depreciation Worksheet

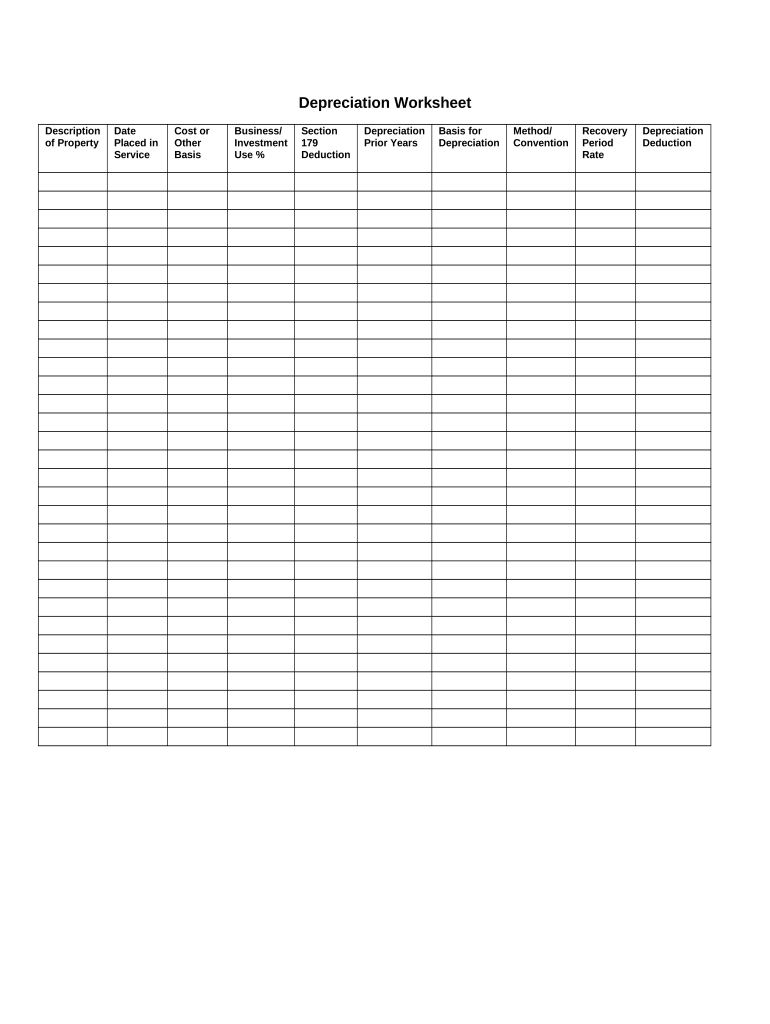

The depreciation worksheet is a vital tool used for calculating the depreciation of assets over time. This form helps individuals and businesses track the value of their assets, ensuring compliance with tax regulations. By detailing the depreciation method, asset cost, useful life, and accumulated depreciation, the worksheet provides a comprehensive overview of an asset's financial status. It is particularly important for tax reporting, as accurate depreciation calculations can significantly impact taxable income.

How to use the Depreciation Worksheet

Using the depreciation worksheet involves several key steps. First, gather all necessary information about the asset, including its purchase price, date of acquisition, and expected useful life. Next, select the appropriate depreciation method, such as straight-line or declining balance. Fill in the worksheet by entering the asset details and calculating annual depreciation based on the chosen method. Regular updates to the worksheet are essential to reflect any changes in asset value or useful life, ensuring accurate financial reporting.

Steps to complete the Depreciation Worksheet

Completing the depreciation worksheet requires a systematic approach:

- Identify the asset and its purchase details.

- Determine the useful life of the asset based on IRS guidelines.

- Select a depreciation method that aligns with your financial strategy.

- Calculate the annual depreciation expense using the chosen method.

- Record the accumulated depreciation over the years.

- Review the worksheet for accuracy and compliance with tax regulations.

Key elements of the Depreciation Worksheet

Several key elements are essential for an effective depreciation worksheet. These include:

- Asset Description: A clear identification of the asset being depreciated.

- Cost Basis: The initial purchase price of the asset, including any additional costs incurred.

- Depreciation Method: The chosen method for calculating depreciation, such as straight-line or declining balance.

- Useful Life: The estimated period over which the asset will be used.

- Annual Depreciation Expense: The calculated amount to be deducted each year.

- Accumulated Depreciation: The total depreciation taken on the asset up to the current date.

IRS Guidelines

The IRS provides specific guidelines regarding the use of depreciation worksheets. These guidelines outline acceptable methods for calculating depreciation, including the Modified Accelerated Cost Recovery System (MACRS). It is crucial to adhere to these regulations to ensure compliance and avoid potential penalties. Additionally, the IRS specifies record-keeping requirements, emphasizing the importance of maintaining accurate documentation for all assets.

Legal use of the Depreciation Worksheet

The legal use of the depreciation worksheet is paramount for both individuals and businesses. Properly completed worksheets can serve as essential documentation during audits or tax reviews. To ensure legal validity, the worksheet must be filled out accurately, reflecting true asset values and depreciation calculations. Utilizing electronic solutions, such as signNow, can enhance the legal standing of the worksheet by providing secure signatures and compliance with eSignature laws.

Quick guide on how to complete depreciation worksheet 497332630

Manage Depreciation Worksheet effortlessly on any device

Digital document handling has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Depreciation Worksheet on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Depreciation Worksheet without hassle

- Locate Depreciation Worksheet and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with features specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Depreciation Worksheet and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a depreciation worksheet and how can it benefit my business?

A depreciation worksheet is a vital tool for calculating the depreciation of assets over time. By using a depreciation worksheet, your business can track asset values and plan for tax obligations accurately. This helps optimize your financial management and ensures compliance with accounting standards.

-

How does airSlate SignNow incorporate a depreciation worksheet in its services?

AirSlate SignNow offers features that streamline the creation and management of a depreciation worksheet within your documents. This integration allows users to eSign and collaborate on financial documents that include depreciation calculations effortlessly. The ability to handle such worksheets digitally enhances accuracy and saves time.

-

Is there a cost associated with using airSlate SignNow for creating a depreciation worksheet?

Yes, airSlate SignNow offers various pricing plans that include features for creating a depreciation worksheet. The pricing is designed to be cost-effective, ensuring that businesses of all sizes can benefit from its capabilities. You can choose a plan that best fits your needs and budget.

-

Can I integrate airSlate SignNow with my existing accounting software for depreciation tracking?

Absolutely! AirSlate SignNow integrates seamlessly with many popular accounting software platforms. This allows you to manage your depreciation worksheet alongside your other financial documents, ensuring that all your data is consistent and accessible.

-

What are the key features of airSlate SignNow that support creating a depreciation worksheet?

Key features of airSlate SignNow include customizable templates, automated calculations, and secure eSignature options. These features allow you to create a depreciation worksheet that meets your specific needs while ensuring that all calculations are accurate and legally binding. The platform’s user-friendly interface makes it easy to use.

-

How does using a depreciation worksheet improve financial reporting?

Utilizing a depreciation worksheet enhances the accuracy of your financial reporting by providing clear documentation of asset values over time. This is crucial for audits and financial analysis. By having a precise depreciation worksheet, your business can make informed decisions based on real asset performance.

-

Can I access my depreciation worksheet from anywhere with airSlate SignNow?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your depreciation worksheet from anywhere at any time. This flexibility is essential for businesses on the go, enabling you to manage your documents and make updates as needed. It's designed for modern workflows.

Get more for Depreciation Worksheet

Find out other Depreciation Worksheet

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation