Incorporator Form

What is the sole incorporator?

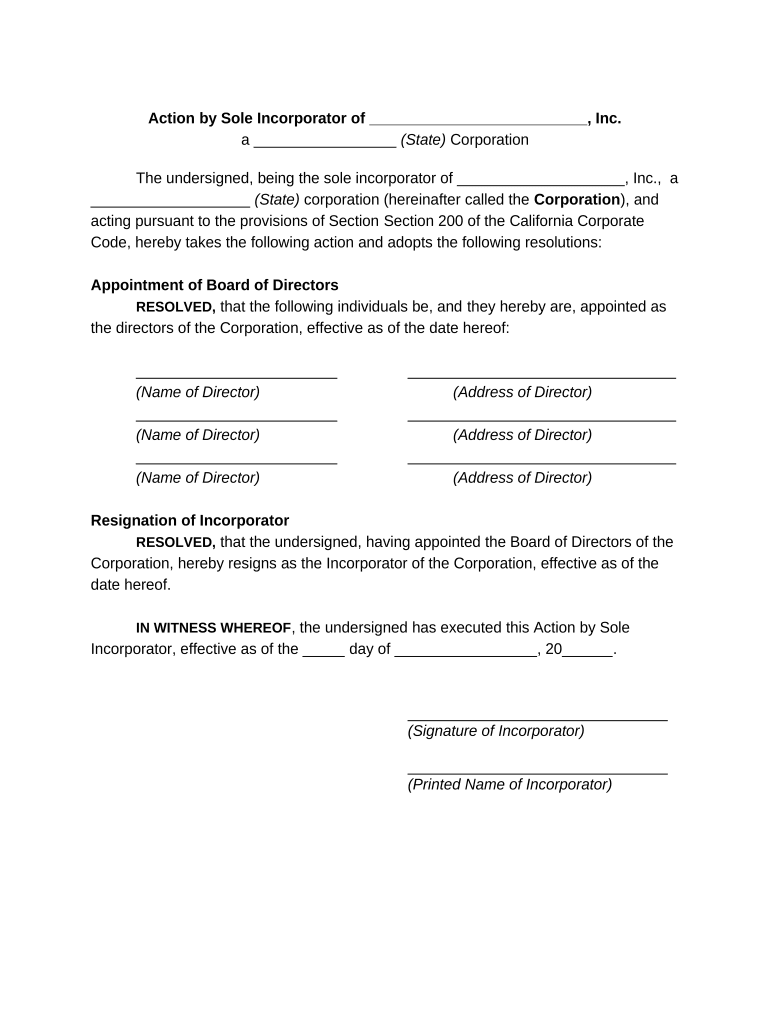

The sole incorporator is an individual responsible for establishing a corporation by filing the necessary documents with the state. This person initiates the incorporation process and often serves as the initial point of contact for legal and administrative matters. The sole incorporator may be the owner or a designated representative, and their role is crucial in ensuring that all legal requirements for forming a corporation are met.

Steps to complete the sole incorporator form

Completing the sole incorporator form involves several key steps that ensure compliance with state regulations. First, gather necessary information, including the corporation's name, address, and purpose. Next, fill out the incorporator statement accurately, providing details about the sole incorporator, such as their name and address. After completing the form, review it for accuracy and ensure all required signatures are included. Finally, submit the form to the appropriate state agency, either online or by mail, along with any required filing fees.

Legal use of the sole incorporator

The sole incorporator plays a vital role in the legal establishment of a corporation. Their signature on the incorporation documents signifies consent and acknowledgment of the corporation's formation. To ensure the legal validity of the incorporation, the sole incorporator must adhere to state-specific laws governing corporate formation. This includes understanding the legal implications of their role and ensuring compliance with all relevant regulations.

Key elements of the sole incorporator

Several key elements define the role of the sole incorporator. These include:

- Name and address: The incorporator's full legal name and residential address are required for identification.

- Corporation details: Information about the corporation, such as its name, purpose, and structure, must be clearly stated.

- Compliance with state laws: The incorporator must ensure that the incorporation process aligns with specific state requirements.

- Filing fees: Payment of any necessary fees is essential for the incorporation to be processed.

State-specific rules for the sole incorporator

Each state in the U.S. has its own regulations regarding the role and responsibilities of the sole incorporator. These rules may dictate the information required on the incorporation form, the filing process, and any additional documentation needed. It is important for the sole incorporator to familiarize themselves with their state’s specific requirements to ensure a smooth incorporation process.

How to obtain the sole incorporator form

The sole incorporator form can typically be obtained from the website of the state agency responsible for business registrations. Many states offer downloadable forms that can be filled out electronically or printed for manual completion. Additionally, some states provide online filing options, allowing the sole incorporator to submit the necessary documents directly through a secure portal.

Quick guide on how to complete incorporator

Complete Incorporator effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle Incorporator on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

How to edit and eSign Incorporator with ease

- Find Incorporator and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of submitting your form: via email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any preferred device. Edit and eSign Incorporator to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sole incorporator and how does it work?

A sole incorporator is an individual who forms a corporation without the need for additional partners or directors. This role allows one person to complete the necessary paperwork and legal requirements to establish a business entity. By using airSlate SignNow, a sole incorporator can efficiently eSign documents and streamline the incorporation process.

-

What are the benefits of being a sole incorporator?

Being a sole incorporator provides full control over the business decisions and eliminates the need to consult with other partners. It offers flexibility in management and allows for simpler tax filings. Additionally, airSlate SignNow enables a sole incorporator to manage all essential documents securely and conveniently.

-

How does airSlate SignNow facilitate the work of a sole incorporator?

airSlate SignNow simplifies the document management process for a sole incorporator by providing a user-friendly platform to send, eSign, and track documents. It reduces the time spent on administrative tasks, allowing the sole incorporator to focus on the growth of the business. Plus, it is cost-effective, making it an ideal tool for individual entrepreneurs.

-

What features does airSlate SignNow offer to support sole incorporators?

AirSlate SignNow offers various features tailored for sole incorporators, including customizable templates, in-app signing, and real-time tracking of document status. These features enhance efficiency and ensure that the incorporation process is completed accurately and promptly. With airSlate SignNow, a sole incorporator can manage everything from one platform.

-

Is airSlate SignNow suitable for small businesses with a sole incorporator?

Yes, airSlate SignNow is highly suitable for small businesses managed by a sole incorporator. Its affordable pricing and intuitive interface make it an excellent choice for individuals doing business on their own. The platform's tools are designed to help sole incorporators navigate essential legal processes effortlessly.

-

Can a sole incorporator integrate airSlate SignNow with other tools?

Absolutely! AirSlate SignNow offers seamless integrations with various business tools such as Google Workspace, Salesforce, and Microsoft apps. These integrations allow a sole incorporator to enhance workflow efficiency and maintain a cohesive business environment while managing their documents.

-

What are the pricing options for a sole incorporator using airSlate SignNow?

AirSlate SignNow provides flexible pricing plans that cater to sole incorporators, ensuring affordability regardless of the budget. Users can choose from monthly or annual subscriptions, with options that include essential features suited for document signing and management. Investing in airSlate SignNow is a cost-effective solution for sole incorporators streamlining their business processes.

Get more for Incorporator

- Physicians medical evaluation for assisted living form

- Alton c crews middle school retest plan snappages form

- Aflac claim forms cancer continuing to print

- Request for review form blue cross blue shield of georgia

- Hawaii open door form

- Hawaii food permit form

- Hawaii insurance fraud form

- Financial assistance application the queens health systems form

Find out other Incorporator

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple