Partnership Banking Withdrawal Form

What is the partnership banking withdrawal?

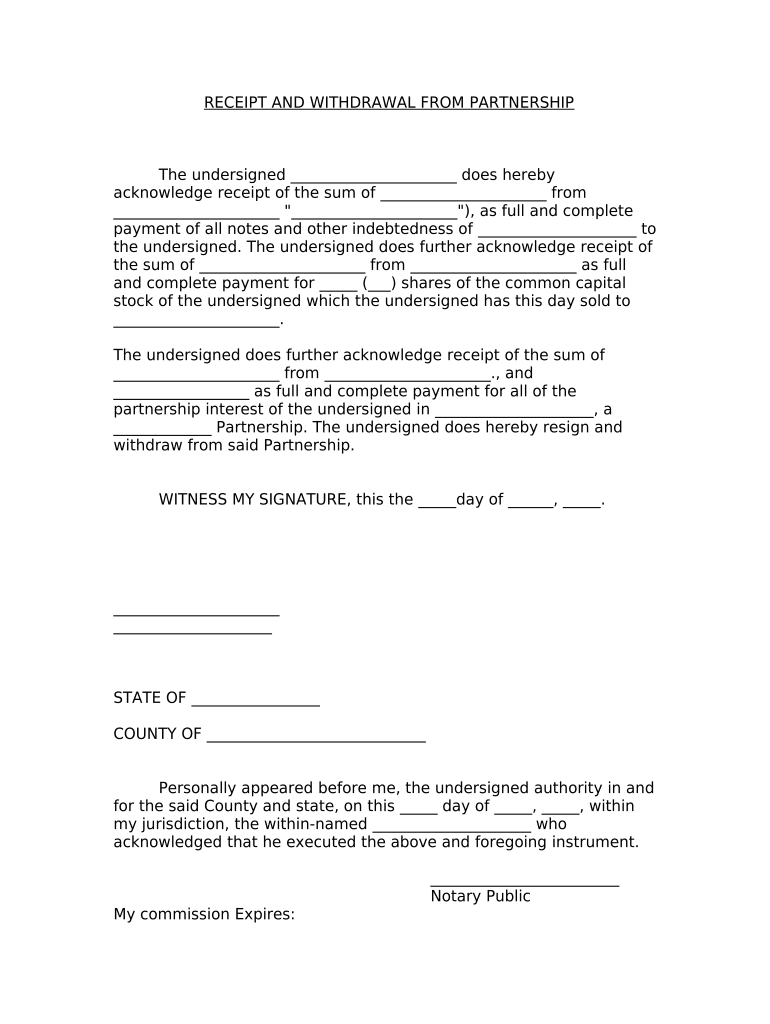

The partnership banking withdrawal refers to the formal process by which a partner in a partnership can withdraw their financial interest from the partnership. This process typically involves completing a specific withdrawal partnership agreement, which outlines the terms and conditions under which the withdrawal will occur. The agreement should detail the distribution of assets, any outstanding liabilities, and the timeline for the withdrawal. Understanding this process is essential for ensuring that all legal and financial obligations are met, protecting both the withdrawing partner and the remaining partners.

Steps to complete the partnership banking withdrawal

Completing a partnership banking withdrawal involves several key steps to ensure that the process is legally compliant and smooth. The following steps are generally recommended:

- Review the partnership agreement: Check the existing partnership agreement for any specific provisions regarding withdrawals.

- Draft a withdrawal partnership agreement: Create a written agreement that outlines the terms of the withdrawal, including asset distribution and liabilities.

- Obtain necessary approvals: Ensure that all remaining partners consent to the withdrawal as per the partnership agreement.

- Complete required forms: Fill out any necessary forms, including the partnership banking withdrawal form, ensuring all information is accurate.

- Submit the withdrawal form: Submit the completed form to the appropriate banking institution or regulatory body as required.

- Finalize financial transactions: Execute any financial transactions related to the withdrawal, such as transferring funds or assets.

Legal use of the partnership banking withdrawal

The legal use of the partnership banking withdrawal is governed by both state and federal laws, which can vary significantly. It is crucial to ensure that the withdrawal partnership agreement complies with relevant legal standards, including those outlined in the Uniform Partnership Act. This compliance helps protect the interests of all partners involved and ensures that the withdrawal is recognized as valid by legal entities. Additionally, adhering to eSignature laws can enhance the legitimacy of the documents involved in the withdrawal process.

Key elements of the partnership banking withdrawal

Several key elements must be included in a partnership banking withdrawal agreement to ensure its effectiveness and legality:

- Identification of partners: Clearly identify all partners involved in the agreement.

- Withdrawal terms: Specify the conditions under which the withdrawal will take place, including any notice periods.

- Asset distribution: Outline how the partnership's assets will be divided among partners, including the withdrawing partner.

- Liability assumptions: Address how any outstanding liabilities will be handled post-withdrawal.

- Signatures: Ensure that all partners sign the agreement, validating their consent to the terms.

Required documents for the partnership banking withdrawal

When initiating a partnership banking withdrawal, several documents are typically required to ensure compliance and facilitate the process:

- Partnership agreement: The original partnership agreement that outlines the terms of the partnership.

- Withdrawal partnership agreement: A new document detailing the specific terms of the withdrawal.

- Financial statements: Recent financial statements of the partnership to assess asset distribution.

- Tax documents: Relevant tax documents that may affect the withdrawal process.

- Identification: Valid identification for all partners involved to verify their identities.

Examples of using the partnership banking withdrawal

Understanding how the partnership banking withdrawal operates in practice can provide valuable insights. For instance, if a partner in a law firm decides to leave, they would initiate a withdrawal partnership agreement that specifies how their share of clients and profits will be handled. Another example could involve a real estate partnership where one partner wishes to exit. The withdrawal agreement would detail the sale of that partner's share of properties and how the proceeds will be divided among the remaining partners. These examples illustrate the practical application of the withdrawal process in various business contexts.

Quick guide on how to complete partnership banking withdrawal

Effortlessly prepare Partnership Banking Withdrawal on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Partnership Banking Withdrawal on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Partnership Banking Withdrawal without hassle

- Obtain Partnership Banking Withdrawal and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign function, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose your method of submitting the form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any selected device. Edit and eSign Partnership Banking Withdrawal to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a withdrawal partnership in airSlate SignNow?

A withdrawal partnership in airSlate SignNow refers to the collaborative approach we provide to manage and streamline document signing and eSigning processes. This feature allows businesses to facilitate transactions seamlessly while ensuring compliance and security in every step of document handling.

-

How does a withdrawal partnership benefit my business?

The withdrawal partnership offers numerous benefits, including enhanced efficiency in document workflows, improved turnaround times, and reduced costs associated with manual processes. By leveraging our automated solutions, your business can focus more on strategic activities while ensuring smooth transactions.

-

What pricing options are available for withdrawal partnership services?

Our pricing for the withdrawal partnership services is designed to be cost-effective, catering to a variety of business needs. You can choose from different subscription models based on your document volume, number of users, or specific feature requirements, ensuring you find the best fit for your organization.

-

Does airSlate SignNow support integrations for withdrawal partnership?

Yes, airSlate SignNow supports various integrations that enhance the functionality of your withdrawal partnership. You can integrate with popular platforms and software tools, allowing for a more streamlined experience and better alignment with your existing workflows.

-

Can I customize the withdrawal partnership documents?

Absolutely! airSlate SignNow allows you to customize your withdrawal partnership documents to align with your brand or specific requirements. You can add logos, adjust layouts, and include personalized fields, ensuring your documents reflect your business's unique identity.

-

Is there a trial period for the withdrawal partnership features?

Yes, airSlate SignNow offers a free trial to let you experience the withdrawal partnership features firsthand. This trial allows prospective customers to explore the functionalities and benefits of our solutions before committing to a subscription.

-

How secure is the withdrawal partnership process?

The withdrawal partnership process in airSlate SignNow is built with top-notch security protocols to protect your data. We implement encryption, multi-factor authentication, and compliance with regulations, ensuring that your sensitive information remains safe throughout the document signing process.

Get more for Partnership Banking Withdrawal

- Br illinois form

- Illinois secretary of state 6966720 form

- History of illinois dui laws illinois secretary of state form

- Waiver of fees for disaster victims illinois secretary of state form

- Il governmental form

- Letter consignment form

- Illinois disclosure living form

- Illinois veterans history project veteranamp39s fact sheet form

Find out other Partnership Banking Withdrawal

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now