Partnership Profession Form

What is the Partnership Profession

The partnership profession refers to the legal and operational framework that governs partnerships in a business context. This includes various types of partnerships, such as general partnerships, limited partnerships, and limited liability partnerships. Each type has distinct characteristics and implications for liability, management, and taxation. Understanding these nuances is crucial for individuals and businesses seeking to establish or engage in partnerships.

Key Elements of the Partnership Profession

Several key elements define the partnership profession, including:

- Partnership Agreement: A written document outlining the roles, responsibilities, and profit-sharing arrangements among partners.

- Liability: The extent to which partners are personally liable for the debts and obligations of the partnership.

- Taxation: Partnerships typically enjoy pass-through taxation, meaning profits and losses are reported on partners' individual tax returns.

- Management Structure: Defines how decisions are made and how the partnership is managed, which can vary based on the type of partnership.

Steps to Complete the Partnership Profession

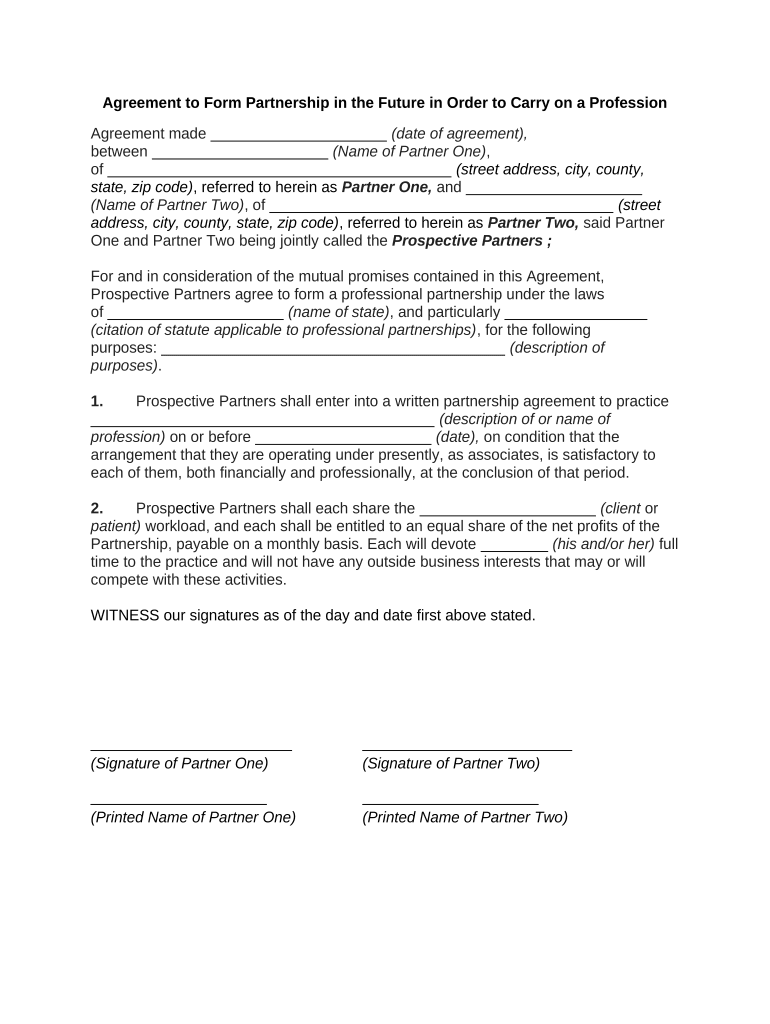

Completing the partnership profession involves several important steps:

- Determine the type of partnership that best suits your business needs.

- Draft a comprehensive partnership agreement that includes all essential terms.

- Register the partnership with the appropriate state authorities, if necessary.

- Obtain any required licenses or permits based on your business activities.

- Set up a system for managing finances and record-keeping.

Legal Use of the Partnership Profession

The legal use of the partnership profession is governed by state laws and regulations. Each state may have specific requirements regarding the formation, operation, and dissolution of partnerships. It is essential to comply with these regulations to ensure that the partnership is recognized legally and to protect the interests of all partners involved.

Examples of Using the Partnership Profession

Partnerships can be utilized in various scenarios, including:

- Professional Services: Accountants, lawyers, and consultants often form partnerships to combine expertise and resources.

- Small Businesses: Friends or family members may enter into a partnership to start a local business.

- Joint Ventures: Companies may partner for specific projects or initiatives to leverage each other's strengths.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for partnerships, including how to report income and expenses. Partnerships must file Form 1065, U.S. Return of Partnership Income, to report their financial activities. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits for tax purposes.

Quick guide on how to complete partnership profession

Complete Partnership Profession effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Partnership Profession on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Partnership Profession with ease

- Obtain Partnership Profession and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Partnership Profession and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the partnership profession and how can airSlate SignNow help?

The partnership profession involves collaborative business relationships where professionals work together to achieve common goals. airSlate SignNow simplifies document signing and management in these partnerships, ensuring that agreements are executed swiftly and securely. Our platform allows seamless collaboration, making it an ideal tool for those in the partnership profession.

-

What are the pricing options for airSlate SignNow in the partnership profession?

airSlate SignNow offers flexible pricing plans tailored for various needs within the partnership profession. We understand that partnerships require cost-effective solutions, so our plans cater to different budgets while providing essential features. Review our pricing page to find a plan that aligns with your partnership goals.

-

What features does airSlate SignNow provide for professionals in the partnership profession?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking that are beneficial for professionals in the partnership profession. These tools streamline the document signing process, ensuring that all your partnership agreements are handled efficiently and effectively. Enhanced workflow automation also saves time and reduces errors.

-

How can airSlate SignNow enhance collaboration in the partnership profession?

AirSlate SignNow enhances collaboration in the partnership profession by allowing multiple signers to engage with documents simultaneously. This feature minimizes delays, ensuring that all parties in a partnership can review and sign documents quickly. The platform's notification system keeps everyone updated on document statuses, fostering better communication.

-

Are there integrations available with airSlate SignNow for partnership professionals?

Yes, airSlate SignNow offers numerous integrations with popular applications that professionals in the partnership profession may already use. These integrations make it easy to incorporate eSigning into your existing workflows. You can connect with customer management, accounting software, and more for a seamless experience.

-

How secure is the signing process on airSlate SignNow for the partnership profession?

Security is our top priority, especially for sensitive documents in the partnership profession. airSlate SignNow uses advanced encryption and authentication measures to ensure that your documents are secure during the signing process. Our compliance with industry standards provides peace of mind for all partners involved.

-

Can I manage multiple partnerships using airSlate SignNow?

Absolutely! airSlate SignNow is designed to handle multiple partnerships efficiently. You can create, send, and manage numerous documents for various partners simultaneously, making it a versatile tool for professionals juggling multiple relationships within the partnership profession.

Get more for Partnership Profession

- Jesse white secretary of state form

- Illinois reduced license get form

- Illinois vietnam veteran license plates form

- Drivers licensestate id card illinois secretary of state form

- Northwestern plates form

- Sekretarza stanu illinois illinois secretary of state form

- Il inability card form

- Expedited title service cyberdrive illinois form

Find out other Partnership Profession

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document