Collection Notice Form

What is the Collection Notice

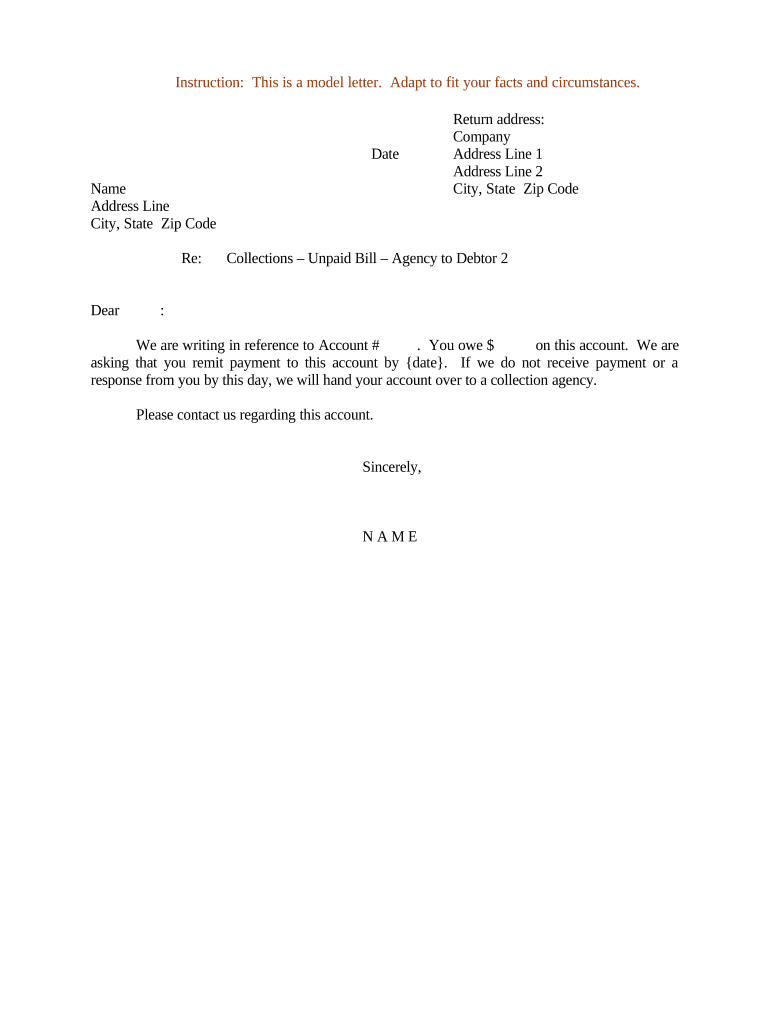

A collection notice is a formal communication sent by a creditor to inform a debtor about an outstanding balance. This document serves as a reminder of the unpaid debt and typically includes details such as the amount owed, the due date, and the consequences of failing to pay. In the United States, collection notices must comply with the Fair Debt Collection Practices Act (FDCPA), which protects consumers from abusive practices. Understanding the purpose of a collection notice is crucial for both creditors and debtors to ensure compliance with legal standards and maintain transparent communication.

How to Use the Collection Notice

Using a collection notice effectively involves several key steps. First, ensure that the notice clearly states the amount owed and any applicable fees. Next, include a deadline for payment to encourage prompt action. It is also important to provide contact information for the debtor to discuss the debt or arrange payment plans. When sending the notice, consider using certified mail or electronic delivery methods to ensure that the debtor receives it. This documentation can serve as proof of communication if further action is necessary.

Key Elements of the Collection Notice

A well-structured collection notice should include several essential elements to be effective. These elements are:

- Creditor Information: Name and contact details of the creditor or collection agency.

- Debtor Information: Name and address of the debtor.

- Account Information: Reference number or account number associated with the debt.

- Amount Owed: Total balance due, including any interest or fees.

- Payment Instructions: Clear directions on how to make the payment.

- Legal Disclaimers: Any required legal language regarding the debt collection process.

Steps to Complete the Collection Notice

Completing a collection notice involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary information about the debt, including amounts and due dates.

- Draft the notice using clear and concise language.

- Include all key elements, ensuring that legal disclaimers are present.

- Review the document for accuracy and compliance with relevant laws.

- Send the notice to the debtor using a reliable delivery method.

Legal Use of the Collection Notice

The legal use of a collection notice is governed by federal and state laws. Under the FDCPA, creditors must adhere to specific guidelines when communicating with debtors. This includes providing accurate information, avoiding harassment, and respecting the debtor's rights. Failure to comply with these regulations can result in legal consequences for the creditor. It is essential for businesses to understand these laws to ensure that their collection practices are both effective and lawful.

Examples of Using the Collection Notice

Examples of collection notices can vary based on the type of debt and the relationship between the creditor and debtor. For instance, a friendly collection letter may be used for a long-term customer who has fallen behind on payments. In contrast, a more formal collection notice may be appropriate for a new client. Each example should reflect the tone and urgency of the situation while maintaining compliance with legal standards. Customizing the notice to fit the context can enhance the likelihood of a positive response from the debtor.

Quick guide on how to complete collection notice

Effortlessly Prepare Collection Notice on Any Device

Managing documents online has gained signNow traction among enterprises and individuals. It serves as an ideal eco-friendly substitute for traditional paper and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Handle Collection Notice on any device with the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

The simplest method to modify and electronically sign Collection Notice effortlessly

- Find Collection Notice and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically supplies for such tasks.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Collection Notice to ensure excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a consumer collection notice disclaimer?

A consumer collection notice disclaimer is a legal statement used to inform consumers about potential debt collection actions. This disclaimer helps ensure compliance with consumer protection laws and informs individuals of their rights when receiving collection notices.

-

How does airSlate SignNow help with consumer collection notice disclaimers?

airSlate SignNow provides an efficient platform for businesses to manage and send consumer collection notice disclaimers electronically. This ensures that documents are signed, sealed, and delivered promptly, reducing the risk of non-compliance with legal requirements.

-

What are the pricing options available for airSlate SignNow when using consumer collection notice disclaimers?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from budget-friendly options for small businesses. Each plan includes features for managing documents, including the ability to create and send consumer collection notice disclaimers at an affordable rate.

-

Are there any features specifically for handling consumer collection notice disclaimers?

Yes, airSlate SignNow includes features designed to streamline the creation and distribution of consumer collection notice disclaimers. Users can customize templates, track document status, and ensure secure electronic signatures, all of which enhance compliance and efficiency.

-

Can I integrate airSlate SignNow with other applications for managing consumer collection notice disclaimers?

Absolutely! airSlate SignNow supports integration with numerous applications, including CRM systems and accounting software. This allows users to seamlessly manage their consumer collection notice disclaimers alongside other business processes within their existing workflows.

-

What benefits does using airSlate SignNow provide for sending consumer collection notice disclaimers?

Using airSlate SignNow for sending consumer collection notice disclaimers ensures faster delivery and greater accountability. The platform's electronic signature capabilities also enhance the legitimacy of the documents, providing peace of mind that your notices are compliant and legally binding.

-

Is airSlate SignNow secure for sending consumer collection notice disclaimers?

Yes, airSlate SignNow prioritizes security and compliance, especially when handling sensitive documents like consumer collection notice disclaimers. The platform employs advanced encryption methods and adheres to industry-standard security protocols to protect your documents and consumer information.

Get more for Collection Notice

Find out other Collection Notice

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later