California S Exencion 2017

What is the California S Exencion

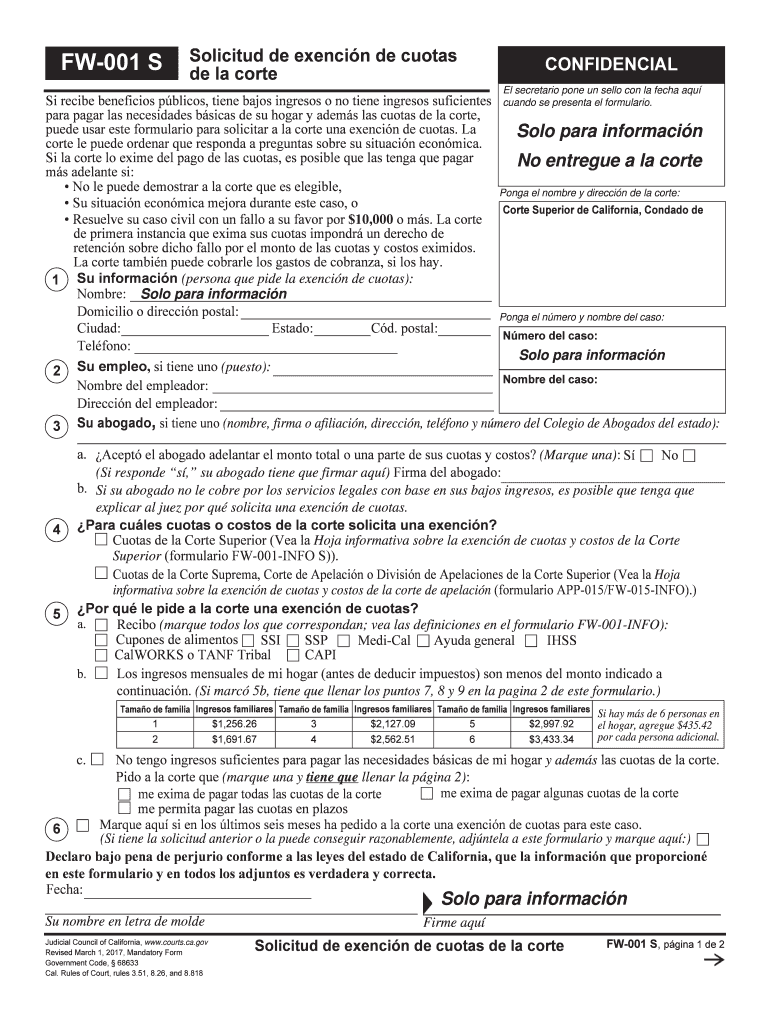

The California S Exencion is a specific form designed to provide tax relief for eligible individuals and businesses within the state. This exemption allows taxpayers to reduce their taxable income, thereby lowering their overall tax liability. The form is particularly relevant for those who meet certain income thresholds or qualify under specific criteria set by the California Franchise Tax Board. Understanding the purpose and implications of the California S Exencion is crucial for effective tax planning and compliance.

How to use the California S Exencion

Using the California S Exencion involves several key steps. First, determine if you meet the eligibility criteria, which may include income limits and other qualifications. Once eligibility is confirmed, you can obtain the form from the California Franchise Tax Board's website or through authorized tax preparation services. After filling out the form accurately, it must be submitted along with your tax return. Ensure that all required documentation is included to avoid delays in processing.

Steps to complete the California S Exencion

Completing the California S Exencion requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including income statements and any relevant tax records.

- Download the California S Exencion form from the California Franchise Tax Board's website.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the form along with your tax return, either electronically or by mail, based on your filing preference.

Eligibility Criteria

To qualify for the California S Exencion, taxpayers must meet specific eligibility criteria established by the California Franchise Tax Board. These criteria typically include income limits that vary based on filing status, as well as residency requirements. Additionally, certain exemptions may apply based on the nature of the taxpayer's income or business activities. It is essential to review these criteria carefully to ensure compliance and maximize potential tax benefits.

Required Documents

When applying for the California S Exencion, several documents are required to support your application. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous year’s tax return for reference.

- Any additional documentation that verifies eligibility, such as proof of residency or business registration.

Having these documents ready will streamline the application process and help ensure that your submission is complete.

Legal use of the California S Exencion

The California S Exencion must be used in accordance with state tax laws and regulations. It is essential to ensure that all information provided on the form is truthful and accurate to avoid potential legal consequences. Misuse of the exemption may lead to penalties, including fines or disqualification from future exemptions. Taxpayers should consult with a tax professional if they have questions about the legal implications of using this form.

Quick guide on how to complete california s exencion

Manage California S Exencion effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle California S Exencion on any device with airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to adjust and eSign California S Exencion seamlessly

- Find California S Exencion and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign California S Exencion to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california s exencion

Create this form in 5 minutes!

How to create an eSignature for the california s exencion

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 001s form, and how can it be used with airSlate SignNow?

The 001s form is a customizable document that can be created and edited using airSlate SignNow's user-friendly platform. Businesses can utilize the 001s form for various purposes, from contracts to agreements, ensuring a smooth, efficient signing process.

-

How much does it cost to use airSlate SignNow for the 001s form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including access to the 001s form. You can choose from several tiers starting with a free trial and scale up to premium features based on your requirements.

-

What features does airSlate SignNow provide for the 001s form?

With airSlate SignNow, the 001s form comes with features like custom branding, in-person signing, and real-time tracking. These features enhance the document management experience, making it easier to handle and monitor the signing process.

-

Can I integrate the 001s form with other applications?

Yes, airSlate SignNow allows seamless integration of the 001s form with popular applications like Google Drive, Salesforce, and Dropbox. This integration enhances your workflow by centralizing document management and storage.

-

What are the benefits of using airSlate SignNow for the 001s form?

Using airSlate SignNow for the 001s form offers numerous benefits, including increased efficiency, reduced turnaround time, and improved security. It allows businesses to streamline their document processes while ensuring compliance with e-signature regulations.

-

Is it easy to create a 001s form on airSlate SignNow?

Absolutely! Creating a 001s form on airSlate SignNow is simple and intuitive. Users can easily drag and drop fields into the document, customize it to their needs, and prepare it for signing with minimal effort.

-

Can I track the status of my 001s form send-outs?

Yes, airSlate SignNow provides real-time tracking for the 001s form. You’ll receive notifications when a document is viewed, signed, or completed, helping you stay informed about your document's status at all times.

Get more for California S Exencion

- Report of death form nassau county nassaucountyny

- Eppa1 form

- Mail to department of taxation village of holgate form

- Eco bank form loan filling

- Data center access authorization form csub

- Dhsu purchase requisition form pdf

- Archery badge workbook form

- Student behavior incident reporting procedure the form

Find out other California S Exencion

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors