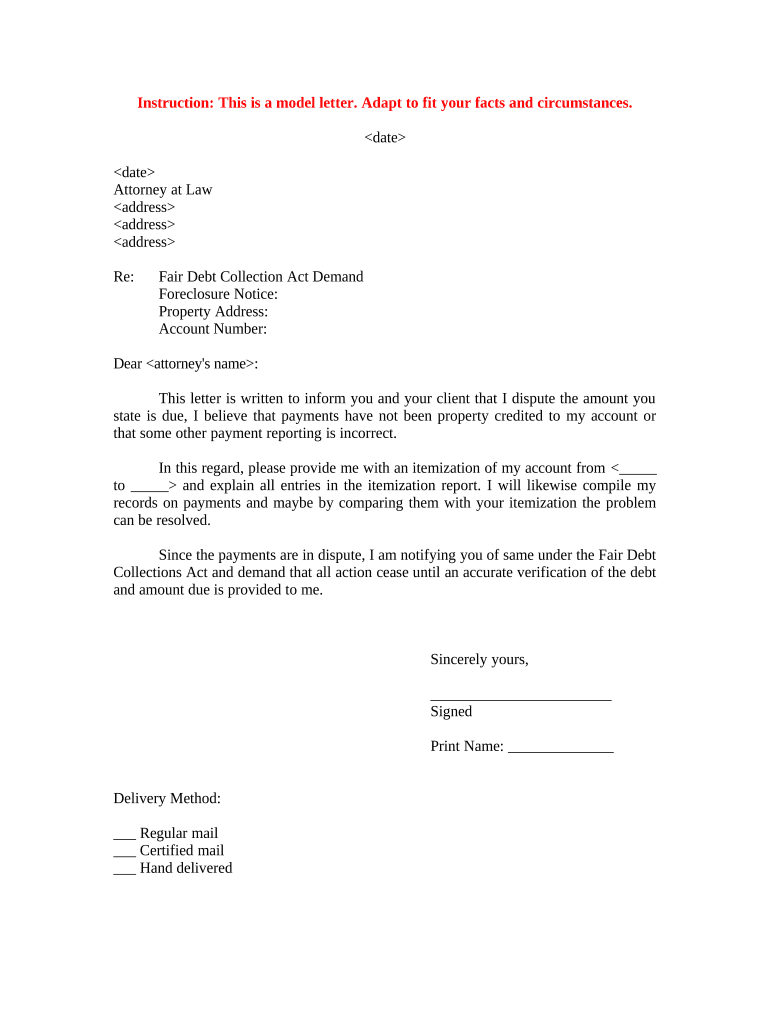

Foreclosure Dispute Form

What is the foreclosure dispute?

A foreclosure dispute arises when a property owner contests the legal process of foreclosure initiated by a lender. This can occur for various reasons, such as a disagreement over the amount owed, claims of improper procedures, or the assertion that the homeowner has been wrongfully targeted. Understanding the nature of the dispute is crucial for homeowners facing potential foreclosure, as it can impact their rights and options moving forward.

Steps to complete the foreclosure dispute

Completing a foreclosure dispute involves several key steps to ensure that the process is handled correctly and effectively. First, gather all relevant documents, including the mortgage agreement, payment history, and any correspondence with the lender. Next, clearly outline the reasons for the dispute, citing specific issues such as payment discrepancies or procedural errors. After preparing your case, submit a formal letter dispute form to the lender, detailing your claims and including supporting documentation. It is also advisable to consult with a foreclosure attorney to review your case and provide guidance throughout the process.

Legal use of the foreclosure dispute

The legal use of a foreclosure dispute is essential for homeowners to protect their rights. By formally disputing a foreclosure, homeowners can potentially halt the process while their claims are investigated. This legal avenue allows for a review of the lender's actions and may lead to a resolution that could include loan modifications or repayment plans. It is important to ensure that the dispute is filed according to state-specific laws and regulations to maintain its validity.

Key elements of the foreclosure dispute

Several key elements are critical to a successful foreclosure dispute. These include a clear statement of the dispute, supporting evidence such as payment records and correspondence, and adherence to any state-specific requirements. Additionally, the dispute should outline the desired outcome, whether it be a loan modification, reinstatement of the mortgage, or other remedies. Understanding these elements can help homeowners effectively communicate their position and strengthen their case.

Required documents

When filing a foreclosure dispute, specific documents are necessary to support your claims. These typically include:

- The original mortgage agreement

- Payment history and records

- Any notices received from the lender regarding foreclosure

- Correspondence between you and the lender

- Any documentation related to hardship or financial difficulties

Having these documents organized and readily available can facilitate the dispute process and enhance the credibility of your claims.

Who issues the form?

The form used for a foreclosure dispute is typically issued by the lender or financial institution that holds the mortgage. Homeowners may also find templates or sample forms through legal aid organizations or foreclosure attorneys. It is essential to use the correct form and ensure that it complies with any state-specific requirements to avoid delays or complications in the dispute process.

Quick guide on how to complete foreclosure dispute

Effortlessly prepare Foreclosure Dispute on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Foreclosure Dispute on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related activity today.

How to modify and eSign Foreclosure Dispute effortlessly

- Obtain Foreclosure Dispute and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Foreclosure Dispute to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a foreclosure dispute and how can airSlate SignNow assist in resolving it?

A foreclosure dispute involves disagreements between lenders and borrowers regarding the foreclosure process. airSlate SignNow empowers users to efficiently eSign and manage all related documents, ensuring everything is in order and legally binding. Our platform simplifies communication and document sharing, helping to speed up the resolution of any foreclosure dispute.

-

How much does airSlate SignNow cost when dealing with foreclosure disputes?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes addressing foreclosure disputes. With cost-effective solutions, users can choose a plan that fits their needs without compromising on features. This way, you can focus on resolving your foreclosure dispute efficiently and affordably.

-

What features does airSlate SignNow provide for managing foreclosure disputes?

airSlate SignNow includes features like eSignature capabilities, document templates, and real-time collaboration tools tailored for foreclosure disputes. Users can easily create, edit, and share necessary documents, streamlining the process. These features not only save time but also help in mitigating risks associated with foreclosure disputes.

-

Can airSlate SignNow integrate with other tools for foreclosure dispute management?

Yes, airSlate SignNow offers integration with various tools and applications that enhance foreclosure dispute management. Whether it's connecting with CRM software or cloud storage services, our platform ensures seamless workflows. These integrations simplify data sharing and improve overall efficiency in handling foreclosure disputes.

-

How does airSlate SignNow ensure the security of documents related to foreclosure disputes?

Security is a top priority for airSlate SignNow, especially with sensitive documents involved in foreclosure disputes. Our platform employs advanced encryption, secure access controls, and audit trails to protect your documents. This ensures that all parties involved in the foreclosure dispute can share and sign documents safely.

-

Is there a trial period for airSlate SignNow for users dealing with foreclosure disputes?

Yes, airSlate SignNow offers a free trial period that allows users to explore our features in the context of foreclosure disputes. This gives you the opportunity to test our eSigning capabilities and document management tools without any financial commitment. You can assess how well our solution meets your needs in resolving foreclosure disputes.

-

What benefits does eSigning provide in foreclosure disputes?

eSigning offers countless benefits in foreclosure disputes, including speed, convenience, and transparency. It reduces the time taken to execute agreements and allows all parties to sign documents from anywhere at any time. Additionally, airSlate SignNow provides a clear record of all signatures, which is vital in resolving foreclosure disputes effectively.

Get more for Foreclosure Dispute

- In the tax appeal court of the state of hawaiamp39i hawaiigov form

- State of hawaiamp39i circuit court of the exhibit list courts state hi form

- Hawaii notice attend kids form

- Pdf version hawaii state judiciary courts state hi form

- Application for use of judiciary facilities hawaii state courts state hi form

- In the tax appeal court of the state of hawaiamp39i hawaiigov 6969037 form

- Arbitration award hawaii state judiciary courts state hi form

- Sex offender addendum form

Find out other Foreclosure Dispute

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney