Gift Agreement with Institution Form

What is the Gift Agreement With Institution

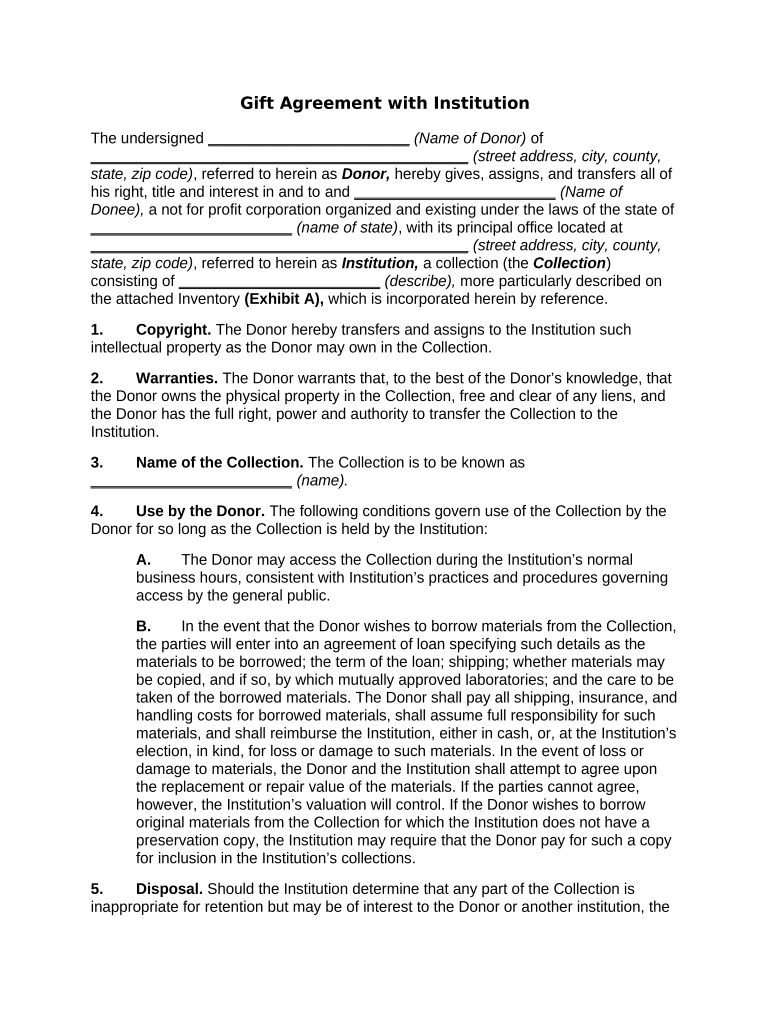

The Gift Agreement With Institution is a formal document that outlines the terms and conditions under which a donor provides a gift to an institution, such as a university or non-profit organization. This agreement typically specifies the purpose of the gift, the amount, and any conditions attached to its use. It serves to protect both the donor's intentions and the institution's obligations, ensuring clarity and mutual understanding.

How to use the Gift Agreement With Institution

To effectively use the Gift Agreement With Institution, both the donor and the institution should review the document thoroughly. It is important to ensure that all parties understand the terms, including any stipulations regarding the use of funds or resources. Once agreed upon, the document should be signed electronically or in person, depending on the preferences of the parties involved. Utilizing a platform like signNow can facilitate this process, providing a secure and efficient way to manage signatures and document storage.

Steps to complete the Gift Agreement With Institution

Completing the Gift Agreement With Institution involves several key steps:

- Draft the Agreement: Outline the terms of the gift, including the donor’s name, the institution’s name, the gift amount, and any specific conditions.

- Review the Agreement: Both parties should carefully review the document to ensure all details are accurate and satisfactory.

- Sign the Agreement: Use an electronic signature tool to sign the document, ensuring compliance with legal standards.

- Store the Agreement: Keep a copy of the signed agreement for both the donor and the institution for future reference.

Key elements of the Gift Agreement With Institution

Several critical elements should be included in the Gift Agreement With Institution to ensure its effectiveness:

- Donor Information: Full name and contact details of the donor.

- Institution Information: Name and address of the institution receiving the gift.

- Gift Description: A clear description of the gift, including its purpose and any restrictions.

- Acceptance Clause: A statement indicating that the institution accepts the gift under the specified terms.

- Signatures: Signatures from both the donor and an authorized representative of the institution.

Legal use of the Gift Agreement With Institution

The legal use of the Gift Agreement With Institution is crucial for ensuring that both parties adhere to the agreed-upon terms. This document can be enforceable in a court of law, provided it meets the necessary legal requirements, such as clarity of terms and mutual consent. It is advisable for both parties to consult legal counsel to ensure that the agreement complies with relevant laws and regulations, particularly those concerning charitable donations and tax implications.

Quick guide on how to complete gift agreement with institution

Effortlessly Prepare Gift Agreement With Institution on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle Gift Agreement With Institution on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Gift Agreement With Institution with Ease

- Obtain Gift Agreement With Institution and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Gift Agreement With Institution and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Gift Agreement With Institution?

A Gift Agreement With Institution is a legal document that outlines the terms and conditions under which a donor contributes funds or assets to an institution. This agreement ensures clarity and mutual understanding between the donor and the recipient institution, facilitating a smooth donation process.

-

How can airSlate SignNow help with creating a Gift Agreement With Institution?

airSlate SignNow allows you to easily create and customize a Gift Agreement With Institution using our intuitive platform. Users can draft their agreements, add necessary fields, and ensure all parties can eSign documents effortlessly, streamlining the entire process.

-

What features does airSlate SignNow offer for Gift Agreements?

airSlate SignNow offers several features for managing a Gift Agreement With Institution, including templates, automated workflows, and secure e-signatures. These features help simplify the creation, distribution, and signing process while maintaining a high level of security and compliance.

-

Is airSlate SignNow cost-effective for managing Gift Agreements?

Yes, airSlate SignNow is a cost-effective solution for managing Gift Agreements With Institution. Our pricing plans cater to organizations of all sizes, allowing users to handle all aspects of document signing and management without breaking the bank.

-

Can I integrate airSlate SignNow with other platforms while managing Gift Agreements?

Absolutely! airSlate SignNow provides seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This facilitates the easy importation and exportation of documents related to the Gift Agreement With Institution, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for my Gift Agreement With Institution?

Using airSlate SignNow for your Gift Agreement With Institution ensures a faster, more secure, and efficient eSigning experience. With features like real-time tracking and automated notifications, you can keep all parties updated and signNowly reduce the time spent on traditional paperwork.

-

How secure is airSlate SignNow for signing Gift Agreements?

airSlate SignNow employs state-of-the-art security measures to protect your Gift Agreement With Institution. Our platform uses encryption, secure access controls, and complies with major regulations, ensuring that your documents are safe throughout the entire signing process.

Get more for Gift Agreement With Institution

- Montana introduction family law form

- Alaska certified payroll form fill in 2008

- 10 hour shift waiver form alaska

- Alaska pamphlet 300 form

- Minimum wage exemption for handicapped persons alaska labor alaska form

- Pamphlet 400 form

- Title 36 complaint form alaska department of labor and workforce labor alaska

- Pdf labor alaska search form

Find out other Gift Agreement With Institution

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast